Get the free DONATION POLICY & PROCEDURES - Books-A-Million, Inc.

Show details

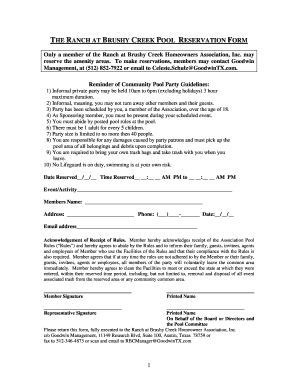

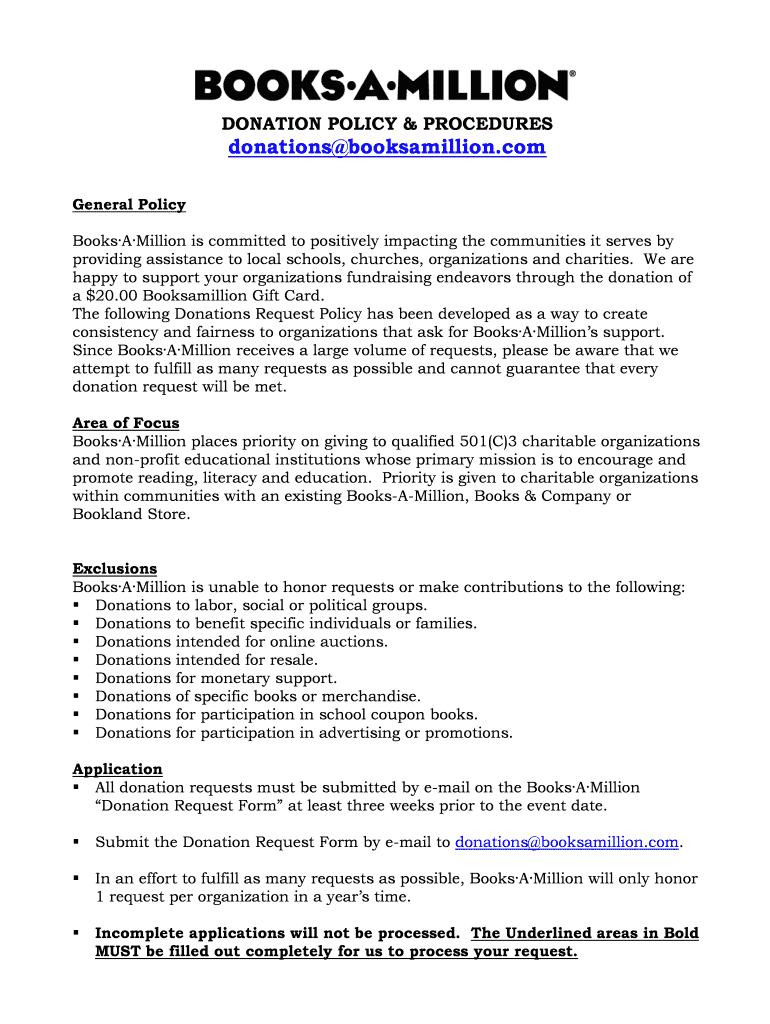

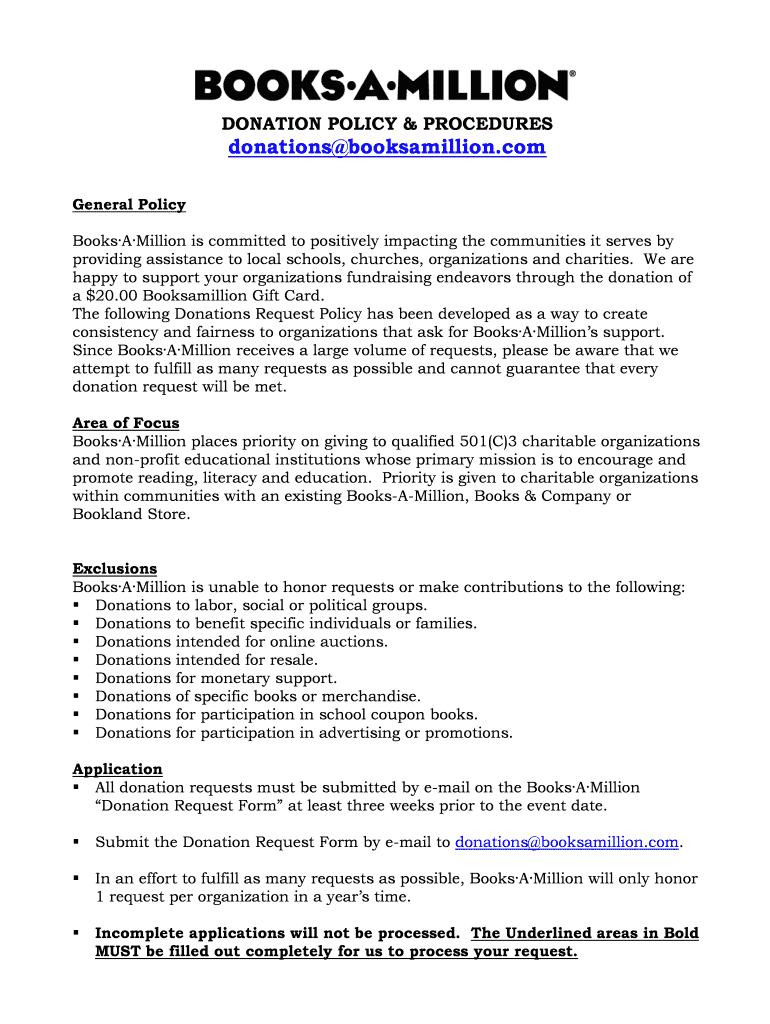

DONATION POLICY & PROCEDURES donations booksamillion.com General Policy Books-A-Million is committed to positively impacting the communities it serves by providing assistance to local schools, churches,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donation policy amp procedures

Edit your donation policy amp procedures form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donation policy amp procedures form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit donation policy amp procedures online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit donation policy amp procedures. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donation policy amp procedures

How to fill out donation policy & procedures:

01

Begin by identifying the purpose of your donation policy and procedures. Determine what types of donations your organization accepts and the guidelines for accepting them.

02

Outline the process for accepting donations. This can include specifying whether donations can be made in person, online, or through other means. Also, establish the documentation required for receiving donations and the individuals responsible for handling them.

03

Define the criteria for accepting donations. Determine what types of donations are acceptable and which ones your organization cannot accept. This can include specifying acceptable monetary amounts, types of goods, or restrictions based on legal or ethical considerations.

04

Establish guidelines for acknowledging and recognizing donors. Determine how your organization will express appreciation for donations, such as sending thank-you letters, providing tax receipts, or recognizing donors publicly.

05

Create procedures for tracking and recording donations. Develop a system for accurately documenting and accounting for all donations received. This can include maintaining records of donor information, donation amounts, purpose of the donation, and any restrictions or special instructions provided by the donor.

06

Include guidelines for handling and managing donated funds or goods. Determine how your organization will handle financial contributions, such as banking procedures, investment policies, and ensuring funds are used appropriately. If applicable, establish protocols for storing and distributing donated goods.

Who needs donation policy & procedures?

01

Nonprofit organizations: Nonprofits often rely on donations to support their programs and operations. Having clear policies and procedures ensures that donations are handled ethically and responsibly.

02

Charitable institutions: Charitable institutions, such as schools, hospitals, and social welfare organizations, may also benefit from having donation policies and procedures in place. This helps them establish guidelines for accepting donations and ensures transparency in how funds or goods are utilized.

03

For-profit businesses: Some for-profit businesses may have corporate social responsibility programs or establish foundations to support charitable causes. In such cases, having donation policies and procedures can help ensure that these contributions are handled appropriately and align with the company's mission and values.

In conclusion, filling out donation policy & procedures involves defining guidelines for accepting donations, establishing criteria, acknowledging donors, tracking donations, and handling funds or goods. This process is important for nonprofit organizations, charitable institutions, and even for-profit businesses with philanthropic initiatives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit donation policy amp procedures from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including donation policy amp procedures. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I complete donation policy amp procedures online?

Easy online donation policy amp procedures completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit donation policy amp procedures online?

The editing procedure is simple with pdfFiller. Open your donation policy amp procedures in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

What is donation policy amp procedures?

The donation policy and procedures refer to the rules and guidelines that govern the process of accepting donations and how they are managed within an organization.

Who is required to file donation policy amp procedures?

Nonprofit organizations and charities are typically required to have and file donation policies and procedures.

How to fill out donation policy amp procedures?

To fill out donation policy and procedures, organizations should outline their process for accepting donations, managing funds, and ensuring compliance with legal requirements.

What is the purpose of donation policy amp procedures?

The purpose of donation policy and procedures is to establish clear guidelines for accepting, managing, and reporting donations to ensure transparency and accountability.

What information must be reported on donation policy amp procedures?

Information that must be reported on donation policy and procedures includes the process for accepting donations, how funds are allocated and used, and any legal requirements for reporting donations.

Fill out your donation policy amp procedures online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donation Policy Amp Procedures is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.