Get the free Credit Card on File Authorization Form Patient Information

Get, Create, Make and Sign credit card on file

How to edit credit card on file online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card on file

How to fill out credit card on file

Who needs credit card on file?

The Ultimate Guide to Credit Card on File Forms

Understanding credit card on file

A credit card on file form is a document that allows businesses to securely store a customer's credit card information for future transactions. This form is essential for ensuring smooth recurring billing, particularly in industries like subscription services, healthcare, and hospitality. By utilizing a credit card on file approach, businesses can provide convenience to their customers while enhancing their operational efficiency.

The importance of maintaining a credit card on file goes beyond ease of transactions; it also serves a critical role in risk management. Processing payments without re-entering details reduces the chances of errors and chargebacks, making it a win-win for both parties.

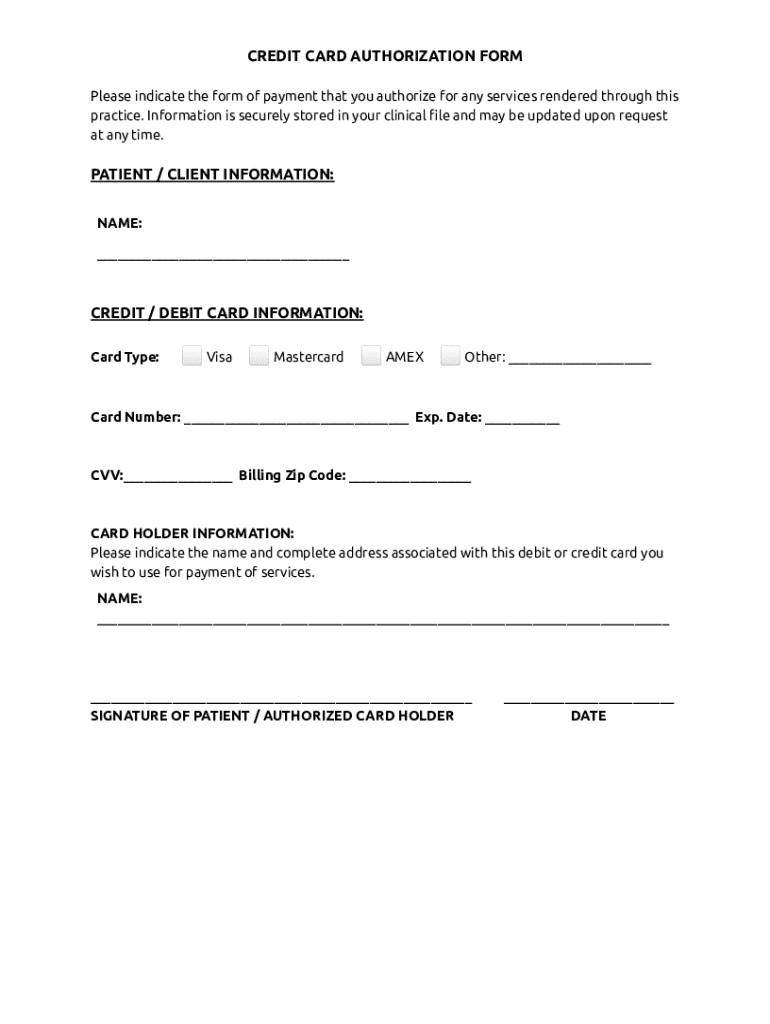

Key components of a credit card on file form

To effectively use a credit card on file form, it's essential to gather comprehensive information. This includes customer details like their name, address, and contact information, as well as credit card specifics such as card number, expiration date, and billing address. Collecting accurate data mitigates errors and instills consumer confidence in transactions.

Additional elements like CVV information, while sensitive, are critical for transaction authorization. Authorization statements included in the form clarify the customer's consent for storing their payment details. Furthermore, it's important to specify an expiration date for how long card information will be retained, ensuring compliance and trust.

How to successfully collect and manage credit card information

Securing sensitive data is paramount when collecting credit card information. Employ strong data encryption techniques to protect information both in transit and at rest. Additionally, compliance with Payment Card Industry (PCI) standards is non-negotiable for businesses handling credit card information, ensuring that all stakeholders follow best practices.

Obtaining explicit consent is vital. Ensure customers are well-informed about how their data will be used and stored, establishing transparency from the outset. Using pdfFiller, you can streamline this consent process by securely storing and managing forms, allowing customers easy access to their information whenever necessary.

Utilizing the credit card on file form effectively

Creating and customizing a credit card on file form is straightforward with pdfFiller. Start by leveraging existing templates to tailor the document to your business requirements. The platform's user-friendly tools allow for easy adjustments, ensuring that the forms align with your branding and compliance needs.

Integrating e-signatures into the process adds a layer of convenience and security. By allowing customers to electronically sign the form, you simplify the authorization process while maintaining legal validity. E-signatures embody a contemporary approach that not only enhances the user experience but also fortifies your compliance stance.

Common questions and concerns

Many people wonder if using a credit card on file form is mandatory. While it's not legally required, it is beneficial for businesses that manage recurring payments or services. Customers typically appreciate the convenience it offers, which can increase retention rates.

When it comes to the retention of signed forms, businesses should establish a clear policy. Generally, retaining signed forms for one to two years is advisable, but always check legal guidelines relevant to your industry. If customers wish to change or delete their card information, promptly accommodating such requests is crucial for maintaining trust and satisfaction.

Case studies and examples

Consider the case of a popular subscription service that successfully leveraged credit card on file forms to increase their customer retention rates. By utilizing automated billing through stored card information, they eliminated friction in their payment process. Consequently, customers appreciated the hassle-free experience and were more likely to engage continuously.

On the flip side, another business faced challenges when a data breach compromised their stored credit card information. This incident highlighted the importance of robust storage protocols and data security measures. By adopting a platform like pdfFiller, they not only safeguarded information but also improved their overall customer trust and satisfaction.

Best tools and resources

When it comes to managing credit card on file forms, pdfFiller stands out for its ease of use compared to traditional methods. Its cloud-based platform allows for streamlined editing, signing, and document management from virtually anywhere. This level of accessibility ensures that business teams can collaborate without being bogged down by paperwork.

Moreover, maintaining customer data security is a team effort. It's crucial to communicate best practices for safety to ensure customer confidence. Utilize tools provided by pdfFiller to create comprehensive and secure forms that not only protect data but also facilitate smooth customer interactions.

Related topics of interest

Integrating a credit card on file form with business operations can optimize payment processing and streamline commerce solutions. Handling recurring billing effectively through these forms enhances customer satisfaction and loyalty. Exploring alternatives to credit cards, such as digital wallets or bank transfers, may be beneficial for companies looking to enhance security and convenience in customer transactions.

As digital payment technologies evolve, staying updated with the latest trends will ensure that your business remains competitive. Understanding customer preferences for various payment methods will help tailor your offerings to their needs, thus enriching the customer experience and boosting retention.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit card on file without leaving Google Drive?

How can I send credit card on file to be eSigned by others?

How do I edit credit card on file on an Android device?

What is credit card on file?

Who is required to file credit card on file?

How to fill out credit card on file?

What is the purpose of credit card on file?

What information must be reported on credit card on file?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.