Get the free CREDIT CARD AUTHORISATION/ NEW ACCOUNT FORM

Get, Create, Make and Sign credit card authorisation new

How to edit credit card authorisation new online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card authorisation new

How to fill out credit card authorisation new

Who needs credit card authorisation new?

Credit Card Authorization New Form: A Comprehensive Guide

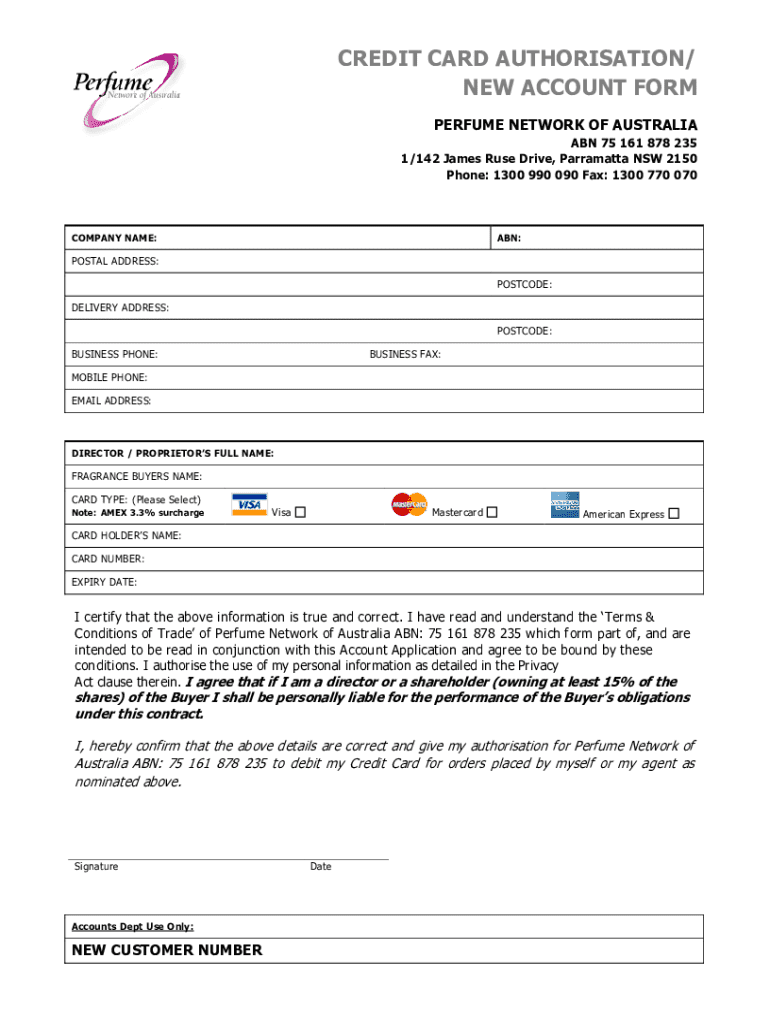

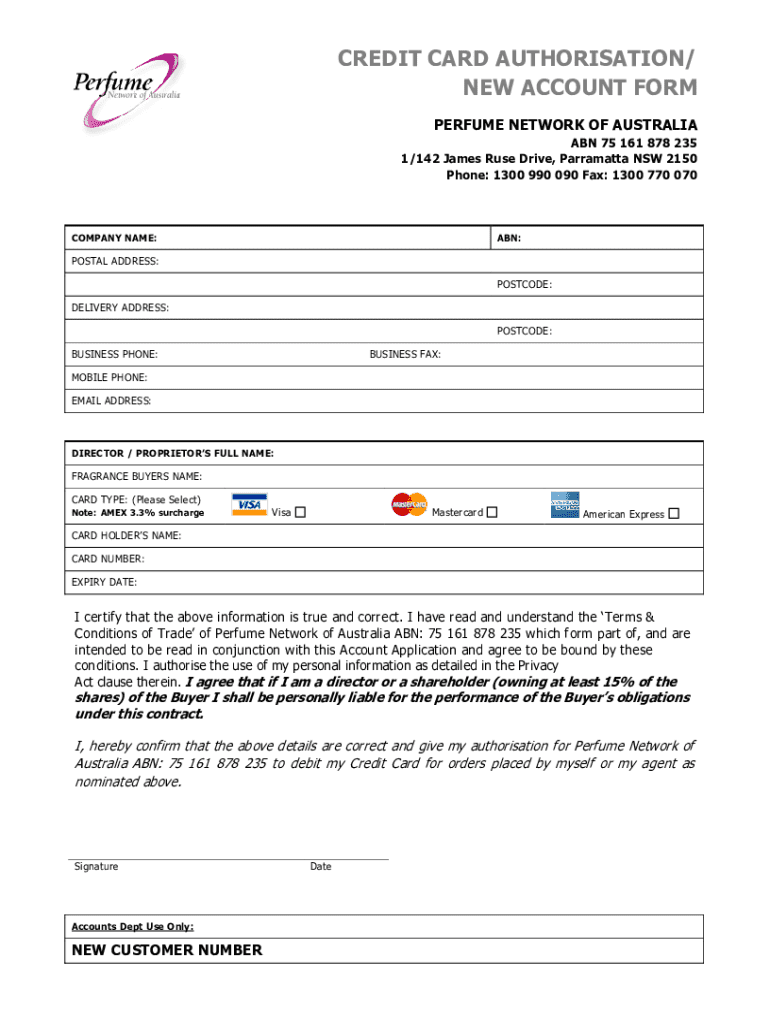

Understanding credit card authorization forms

A credit card authorization form is a document used by businesses and service providers to obtain permission from a customer to charge their credit card for a specific amount. Its primary purpose is to prevent unauthorized transactions and ensure that payments are secure and legitimate. The use of credit card authorization forms offers numerous benefits including enhanced security and compliance with industry standards, significantly reducing the risk of fraud for both merchants and consumers.

Individuals, businesses, and service providers who handle credit card transactions need a credit card authorization form. This includes companies that operate on a subscription basis, those providing services that require upfront payment, and even individuals who wish to store their customer’s credit card details for repeated services.

Why you should use a credit card authorization form

Using a credit card authorization form is a proactive measure against chargeback abuse, which occurs when customers dispute valid charges, causing financial loss for businesses. According to industry statistics, chargebacks can cost merchants up to 1.5% of their total revenue each year. This is where a solid authorization process becomes indispensable.

From a legal perspective, while it may not be mandated, utilizing an authorization form is highly advisable as it provides a layer of protection against potential disputes. Moreover, it helps foster customer trust. When customers see that a business prioritizes security and transparency, they are more likely to engage and maintain a long-term relationship.

Components of a credit card authorization form

A well-structured credit card authorization form includes several essential elements. First, it gathers necessary personal and payment information such as the cardholder's name, card number, expiration date, and billing address. Second, it contains consent statements that clearly indicate the authorization of charges along with a space for the cardholder's signature.

You might have common questions as you draft your form. For instance, you may wonder why there isn't a space for the CVV number. While it's essential for online transactions, many merchants prefer not to collect it for security reasons. Another common query relates to 'card on file' practices, which refers to securely storing a credit card’s information for future transactions.

Steps to create a credit card authorization form

Creating a credit card authorization form begins with choosing the right template. Many online platforms offer customizable templates that align with your business requirements. Once you’ve selected a suitable option, fill in the necessary fields carefully, ensuring accuracy and clarity.

If you’re creating this form for business purposes, you'll want to include additional instructions on what the customer should expect. For personal use, be mindful of the sensitive information you are collecting and ensure that the form is secure. Utilizing interactive tools like pdfFiller enhances your experience, allowing you to edit, sign, and store the document seamlessly.

Best practices for using credit card authorization forms

Once you’ve obtained and signed credit card authorization forms, the next step is to ensure their safe storage. It is generally recommended to keep signed forms for at least a year or as per your local regulations, especially if disputes arise.

When it comes to security, employ robust measures such as encryption and secure filing systems to protect sensitive information. Compliance with industry standards such as PCI DSS should also guide your practices, ensuring that you are meeting all necessary security protocols.

Frequently asked questions (FAQ)

Navigating credit card authorization forms can present challenges for first-time users. Common concerns include understanding the legal implications of the forms and what to do in case of a failed transaction. Many users also encounter issues related to missing or incomplete information. To troubleshoot these issues, check for clear instructions on the form or consult a professional for guidance.

Downloadable resources

To streamline your process, pdfFiller offers downloadable templates for credit card authorization forms. These templates can be customized to fit your specific needs, ensuring compliance and user-friendliness. Accessing these templates enables you to effectively manage your financial transactions while maintaining a thorough document trail.

In addition to templates, pdfFiller also provides tools to help you manage your completed forms, enhancing your overall experience. Knowing how to leverage these resources can significantly simplify your documentation process.

Related topics worth exploring

The topic of credit card authorization opens up various avenues for further exploration. Understanding how to take card payments over the phone is crucial for businesses that handle remote transactions. Additionally, delving into card-not-present (CNP) transactions can uncover cost implications that may affect your business model. Consider investigating how to set up payment links for seamless transactions, which can further simplify the payment process.

Community engagement

We encourage you to share your experiences with our credit card authorization forms. Your input can assist in refining our offerings and providing better solutions for everyone. Additionally, let us know what features you would like to see in our future templates, which can enhance the overall user experience.

Keep learning with pdfFiller

Stay informed with the latest tips and essential offers through the pdfFiller platform. By signing up, you will gain access to a curated library of resources designed to elevate your document management experience. Embracing these learning opportunities can substantially benefit your personal and professional growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit card authorisation new without leaving Google Drive?

How can I send credit card authorisation new for eSignature?

How do I complete credit card authorisation new on an iOS device?

What is credit card authorisation new?

Who is required to file credit card authorisation new?

How to fill out credit card authorisation new?

What is the purpose of credit card authorisation new?

What information must be reported on credit card authorisation new?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.