Get the free Renter Insurance - Let's Insure - letsinsure

Show details

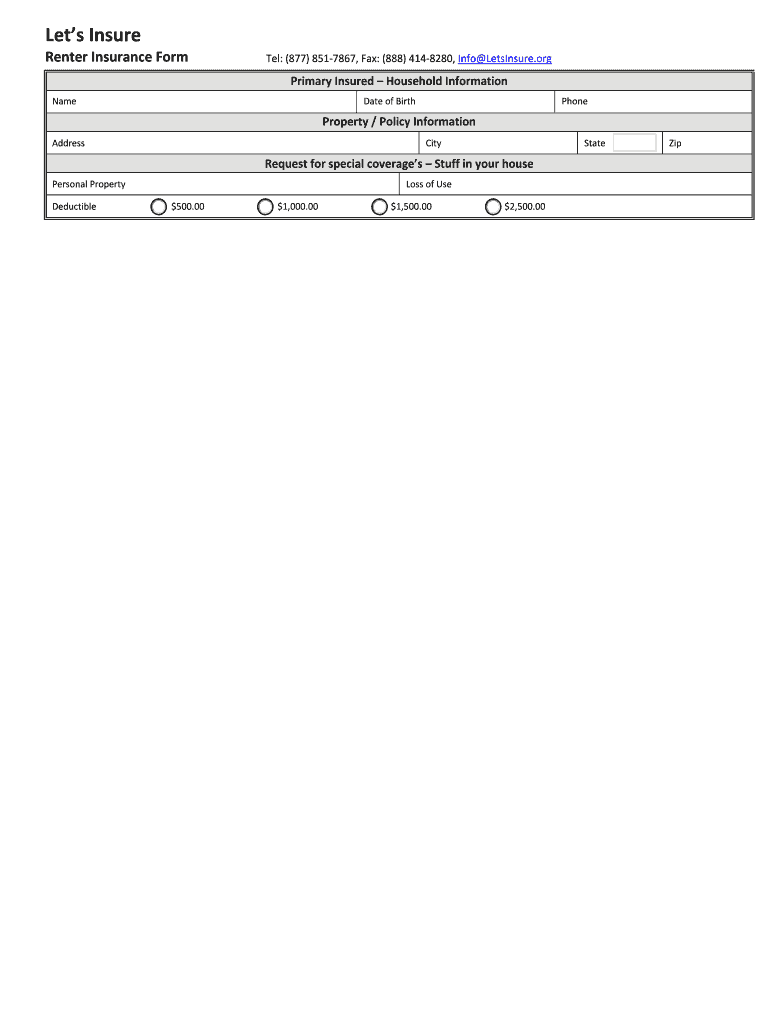

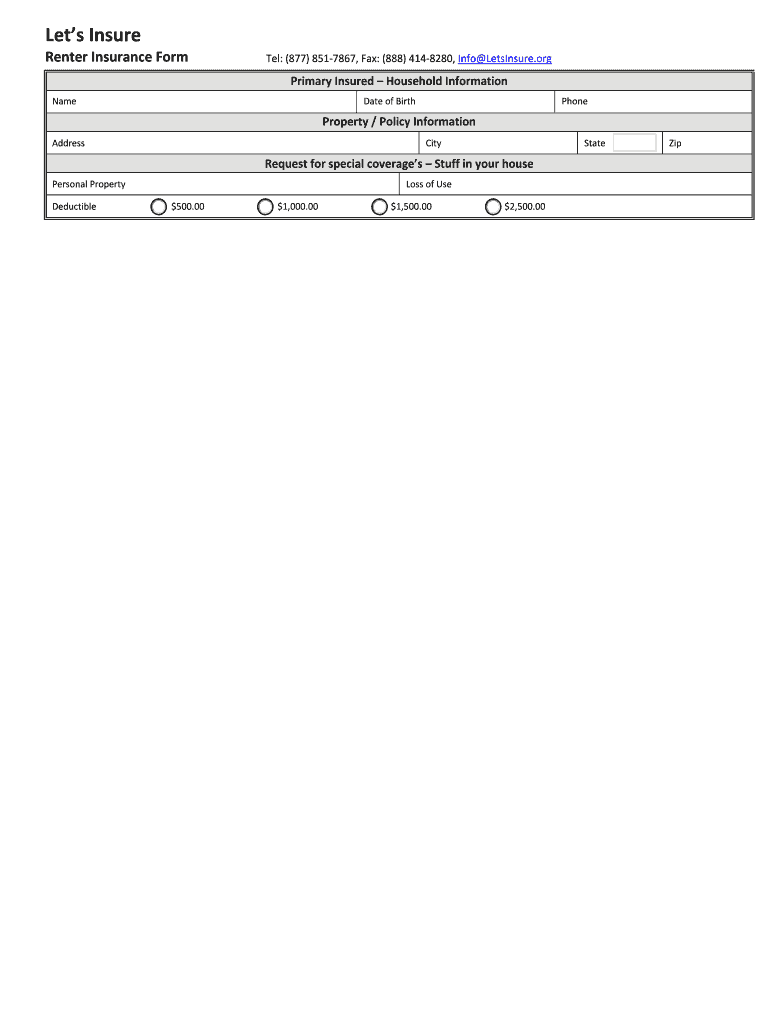

Let s Insure Renter Insurance Form Tel: (877) 851-7867, Fax: (888) 414-8280, Info Leisure.org Primary Insured Household Information Name Date of Birth Phone Property / Policy Information Address City

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign renter insurance - let39s

Edit your renter insurance - let39s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your renter insurance - let39s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing renter insurance - let39s online

To use the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit renter insurance - let39s. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out renter insurance - let39s

How to fill out renter insurance - letamp39s?

01

Gather necessary information: Before filling out renter insurance, gather all the necessary information such as your personal details, contact information, property details, and any additional coverage options you would like to include.

02

Understand your coverage needs: Assess your belongings and determine the amount of coverage you need. Consider the value of your personal belongings, as well as any additional structures or improvements you want to insure.

03

Research insurance providers: Look for reputable insurance providers that offer renter insurance. Compare different companies, their coverage options, deductibles, premiums, and customer reviews to make an informed decision.

04

Contact insurance provider: Once you have chosen an insurance provider, contact them either by phone or through their website. Follow the instructions provided to start the application process.

05

Provide accurate information: Fill out the application form accurately and truthfully. Provide all the required details, including your name, address, date of birth, and any other information the insurance provider may ask for.

06

Select coverage options: Choose the coverage options that best suit your needs. This may include personal property coverage, liability coverage, medical payments coverage, or additional living expenses coverage.

07

Review the policy language: Carefully review the terms and conditions of the policy, including coverage limits, exclusions, and any additional endorsements. Make sure you understand what is covered and what is not.

08

Pay the premium: Once you are satisfied with the coverage and terms, pay the premium amount as instructed by the insurance provider. This may be a one-time payment or monthly installments, depending on the provider.

Who needs renter insurance - letamp39s?

01

Renters: Anyone who is living in a rented property, such as apartments, condos, or houses, should consider getting renter insurance. It provides financial protection against damages, theft, or liability claims.

02

Students: Students living in dorms or off-campus housing should also get renter insurance. It helps protect their personal belongings, electronics, and other items from theft or damage.

03

Young professionals: Individuals who have recently started their careers and are renting a place should also consider renter insurance. It offers peace of mind and financial protection in case of unforeseen events.

04

Military personnel: Military personnel who live in rented housing or apartments can benefit from renter insurance. It provides coverage for their personal belongings and protects against liability claims.

05

People with valuable possessions: If you own expensive electronics, jewelry, artwork, or other valuable possessions, renter insurance can help protect them from theft or damage.

06

Those who want liability coverage: Renter insurance also includes liability coverage, which protects you in case someone gets injured on your property and files a lawsuit against you. It helps cover legal expenses and medical costs.

In conclusion, anyone living in a rental property, regardless of their age or occupation, should consider getting renter insurance to protect their belongings and provide liability coverage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send renter insurance - let39s for eSignature?

When you're ready to share your renter insurance - let39s, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find renter insurance - let39s?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific renter insurance - let39s and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How can I fill out renter insurance - let39s on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your renter insurance - let39s. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is renter insurance - let39s?

Renter insurance, also known as tenant insurance, is a type of insurance policy that provides coverage for a renter's personal property and liability in a rented property.

Who is required to file renter insurance - let39s?

Renter insurance is typically not required by law, but landlords may require tenants to have a renter insurance policy as part of the lease agreement.

How to fill out renter insurance - let39s?

To fill out a renter insurance policy, you will need to provide information about the property you are renting, your personal belongings, and any additional coverage options you may want.

What is the purpose of renter insurance - let39s?

The purpose of renter insurance is to protect a renter's personal property and provide liability coverage in case of accidents or damages that occur within the rented property.

What information must be reported on renter insurance - let39s?

Information that must be reported on renter insurance typically includes a list of personal belongings, the value of those belongings, and any additional coverage options chosen.

Fill out your renter insurance - let39s online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Renter Insurance - let39s is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.