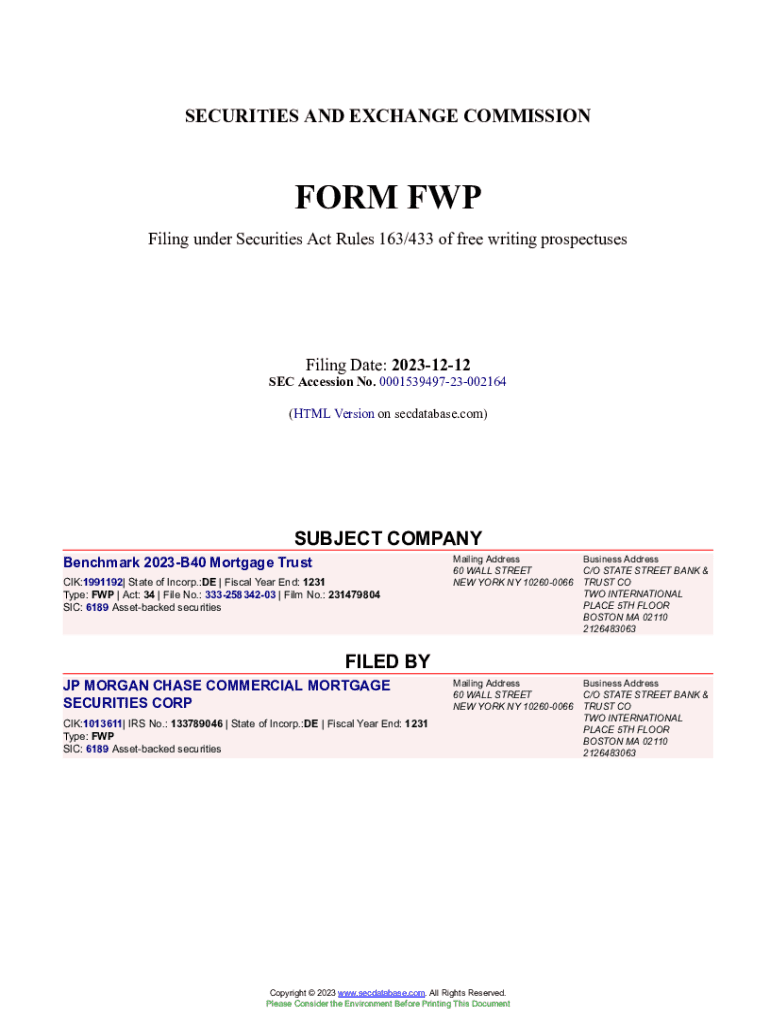

Get the free Benchmark 2023-B40 Mortgage Trust Form FWP Filed 2023-12-12. Accession Number

Show details

SECURITIES AND EXCHANGE COMMISSIONFORM FWP Filing under Securities Act Rules 163/433 of free writing prospectusesFiling Date: 20231212SEC Accession No. 000153949723002164 (HTML Version on secdatabase.com)SUBJECT COMPANY Benchmark 2023B40 Mortgage Trust CIK:1991192| State of Incorp.:DE | Fiscal Year End: 1231 Type: FWP | Act: 34 | File No.: 33325834203 | Film No.: 231479804 SIC: 6189 Assetbacked securitiesMailing Address 60 WALL STREET NEW YORK NY 102600066Business Address C/O

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign benchmark 2023-b40 mortgage trust

Edit your benchmark 2023-b40 mortgage trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your benchmark 2023-b40 mortgage trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit benchmark 2023-b40 mortgage trust online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit benchmark 2023-b40 mortgage trust. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

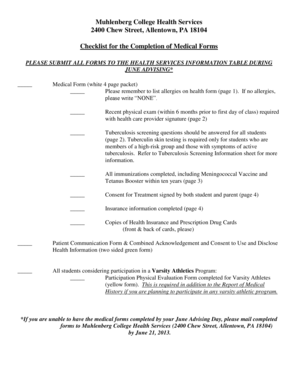

How to fill out benchmark 2023-b40 mortgage trust

How to fill out benchmark 2023-b40 mortgage trust

01

Gather necessary financial documents, including income statements, credit reports, and property details.

02

Visit the official Benchmark 2023-B40 mortgage trust website or consult your lender to download the application form.

03

Carefully read through the instructions provided with the application to understand the requirements.

04

Fill out the application form accurately with required information such as personal details, financial history, and property information.

05

Provide supporting documents as specified in the instructions, ensuring all copies are clear and legible.

06

Review the completed application for any errors or omissions before submission.

07

Submit the application and supporting documents per the guidelines provided, either online or via mail.

Who needs benchmark 2023-b40 mortgage trust?

01

Individuals looking to purchase a home or refinance their existing mortgage with favorable rates.

02

Borrowers with varying credit profiles who may benefit from the specific offerings of the Benchmark 2023-B40 mortgage trust.

03

Real estate investors seeking financing options for property acquisitions or improvements.

04

First-time homebuyers who require accessible financing solutions tailored to their needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send benchmark 2023-b40 mortgage trust for eSignature?

Once you are ready to share your benchmark 2023-b40 mortgage trust, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make edits in benchmark 2023-b40 mortgage trust without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing benchmark 2023-b40 mortgage trust and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I complete benchmark 2023-b40 mortgage trust on an Android device?

On an Android device, use the pdfFiller mobile app to finish your benchmark 2023-b40 mortgage trust. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is benchmark 2023-b40 mortgage trust?

The benchmark 2023-b40 mortgage trust is a financial instrument or entity that represents a collection of mortgage-backed securities, designed to serve as a standard for evaluating mortgage markets and investment performance.

Who is required to file benchmark 2023-b40 mortgage trust?

Entities involved in the issuance or trading of mortgage-backed securities, such as financial institutions, mortgage originators, and entities managing mortgage portfolios, are typically required to file information related to the benchmark 2023-b40 mortgage trust.

How to fill out benchmark 2023-b40 mortgage trust?

To fill out the benchmark 2023-b40 mortgage trust form, stakeholders must provide detailed information regarding mortgage originations, loan characteristics, borrower data, and compliance with regulatory requirements, following the specific guidelines provided in the filing instructions.

What is the purpose of benchmark 2023-b40 mortgage trust?

The purpose of the benchmark 2023-b40 mortgage trust is to provide a standardized reference for the performance and risk assessment of mortgage-backed securities, helping investors make informed decisions and ensure transparency in the mortgage market.

What information must be reported on benchmark 2023-b40 mortgage trust?

Required information for the benchmark 2023-b40 mortgage trust includes data on loan types, borrower credit profiles, loan-to-value ratios, interest rates, default rates, and any other relevant metrics that help in assessing the mortgage portfolio's performance.

Fill out your benchmark 2023-b40 mortgage trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Benchmark 2023-b40 Mortgage Trust is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.