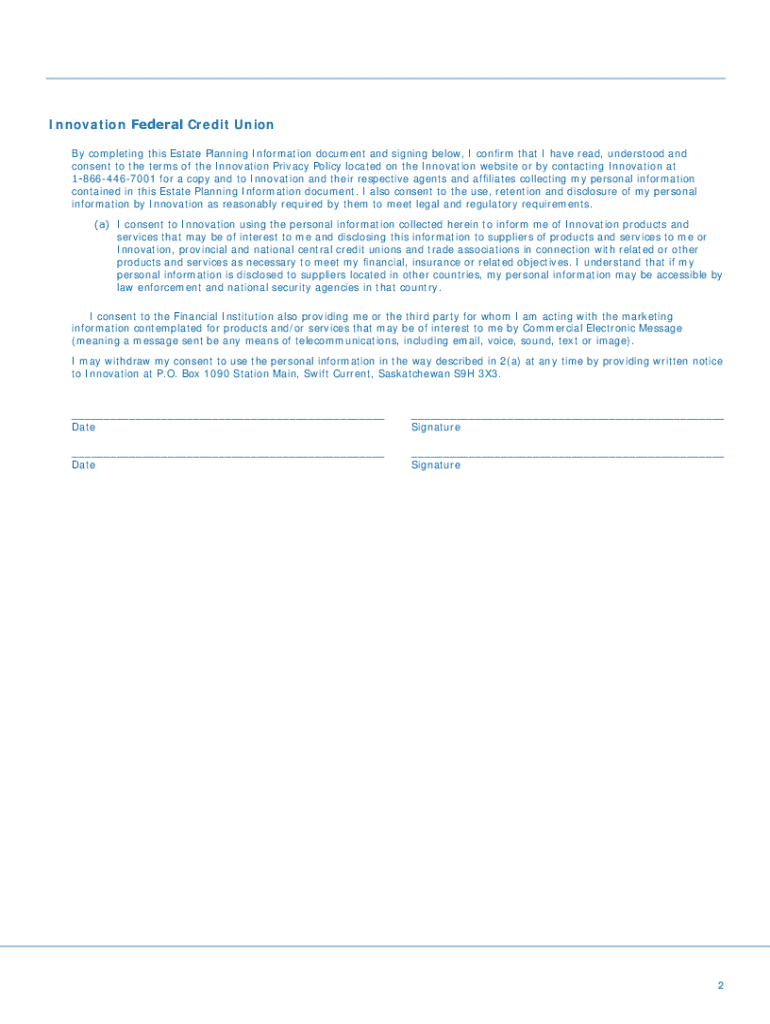

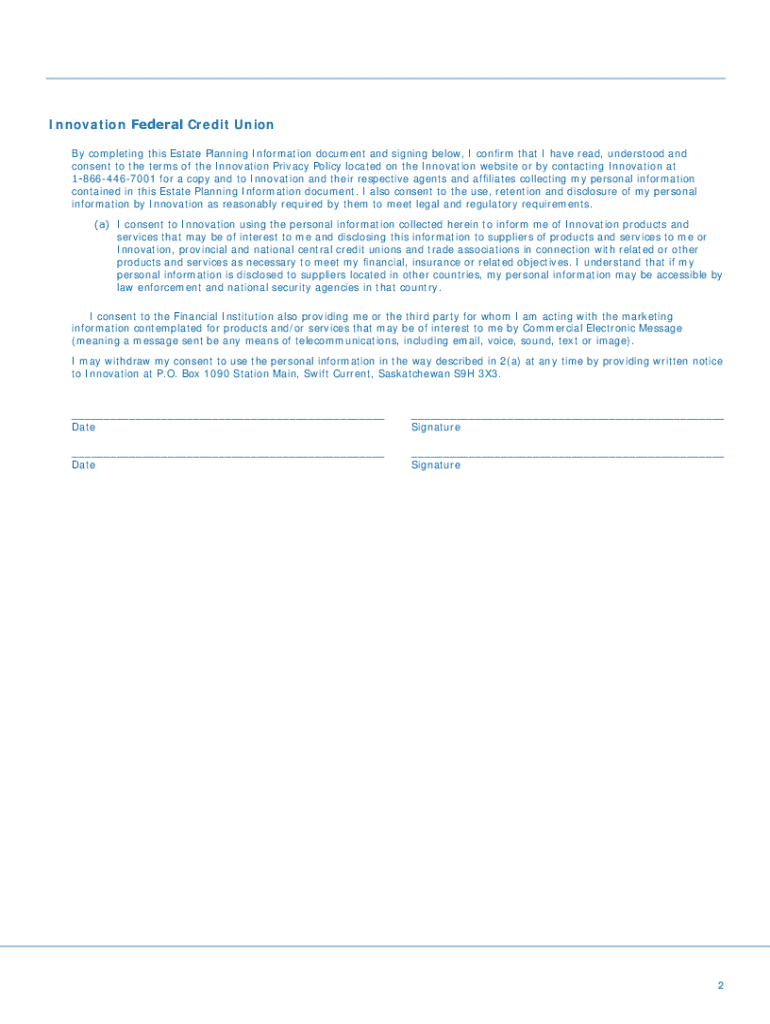

Get the free 18664467001

Get, Create, Make and Sign 18664467001 form

Editing 18664467001 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 18664467001 form

How to fill out 7 estate planning essentials

Who needs 7 estate planning essentials?

7 Estate Planning Essentials Form: A Comprehensive Guide

Understanding estate planning essentials

Estate planning is a critical process that allows individuals to define how their assets will be managed and distributed after their death. It encompasses a series of legal documents that outline your wishes regarding your estate—everything from property and finances to healthcare decisions. Without a well-structured plan, families may face significant challenges, including expensive legal battles, confusion, and emotional stress during an already difficult time.

Having a robust estate plan ensures that your wishes are honored and can help minimize the burden on your loved ones. This guide outlines the 7 estate planning essentials that everyone should consider, offering both clarity and actionable insights. By actively engaging in estate planning, you control your legacy and protect those you love.

Last Will and Testament: Establishing your final wishes

A Last Will and Testament is vital for expressing your final wishes regarding the distribution of your assets, naming guardians for minor children, and appointing executors to manage your estate. Key components include details about your beneficiaries, specific bequests, and pertinent information on how debts will be handled.

To create a will using pdfFiller, simply access their platform and start with a customizable template. Fill out your details, make sure to include important information, and eSign your document for validation. Review it thoroughly to ensure it aligns with your wishes. Don't forget that it’s essential to revisit and update your will regularly, especially after major life changes such as marriage, divorce, or the birth of a child.

Living Trust: Managing your assets during and after life

A living trust is a powerful tool that helps you manage your assets both during your lifetime and after your passing. It allows you to place your assets into a trust, and you can designate how they should be distributed without going through probate, offering more privacy and expedience.

To set up a trust with pdfFiller, take advantage of their user-friendly templates. You can customize your trust document according to your specific requirements. Once you've filled it out, utilize pdfFiller's eSigning feature to ensure it’s legally binding. Remember to transfer your assets into the trust correctly, as failing to do so can render it ineffective.

Durable Power of Attorney: Ensuring your wishes are followed

A Durable Power of Attorney (DPOA) grants someone you trust the authority to manage your financial and legal affairs should you become incapacitated. This document is essential for ensuring that your interests are protected without the need for court intervention.

When selecting your agent, choose someone responsible and trustworthy. Consider their ability to navigate your financial situation and advocate for your best interests. To create a DPOA form via pdfFiller, simply select the appropriate template, fill in your details, and leverage the eSigning feature for instant authentication.

Health care power of attorney: Directing medical decisions

A Health Care Power of Attorney allows you to designate someone to make medical decisions on your behalf if you are unable to do so. This essential document ensures your medical treatment aligns with your personal values and desires.

When naming your agent, consider their willingness to advocate for your medical preferences in potentially challenging situations. Use pdfFiller to create a Health Care Power of Attorney document, ensuring you input all necessary healthcare preferences to guide your agent effectively. Once completed, eSign to finalize the document, making it legally binding.

Advance health care directive: Outlining your medical preferences

An Advance Health Care Directive (Living Will) specifies your medical preferences in scenarios where you cannot communicate, such as terminal illnesses or severe injuries. This directive serves to clarify your wishes to both your family and healthcare professionals.

When drafting your directive, include key elements like resuscitation preferences, life-support wishes, and organ donation decisions. You can complete this document using pdfFiller’s customizable templates. Ensure you save the document securely and share copies with relevant parties for immediate access.

Beneficiary designations: Keeping your assets in the right hands

Beneficiary designations are crucial to ensure that specific assets like insurance policies, retirement accounts, and bank accounts are passed on to your intended heirs without going through probate. Properly naming beneficiaries keeps your assets out of public records and can accelerate the process of asset transfer.

To update your beneficiary information, contact your financial institutions, and fill out the relevant forms. Many account managers provide easy access to digital platforms where you can update this information swiftly. Remember, reviewing your beneficiary designations regularly, especially after major life events, is essential.

Guardianship designations: Protecting your minor children

Guardianship designations are perhaps the most important estate planning documents for parents of minor children. This provision allows you to designate a trusted individual who will raise your children in the event that you are unable to do so. It’s essential to discuss this responsibility with the chosen guardian ahead of time.

Using pdfFiller, you can easily prepare guardianship documents. By filling out a template and detailing your choice of guardian, you ensure that your wishes are respected. Remember to discuss your wishes openly with the selected person and keep them informed about your decisions.

Additional considerations for complete estate planning

Beyond the foundational documents, various other factors should be considered during estate planning. Tax implications can significantly affect the transfer of your assets, so consult with professionals to optimize your strategy. Engaging with estate planning attorneys or financial advisors can provide significant value, ensuring you are aware of local laws and regulations that may apply.

Common estate planning mistakes include failing to update your documents after life changes or neglecting to communicate your plans to family members. Regularly revisiting your plan and involving trusted professionals can help you avoid these pitfalls and ensure your estate plan is comprehensive and effective.

The takeaway: Taking action with your estate planning

Starting your estate planning journey can seem daunting, but taking actionable steps toward securing your legacy is invaluable. Begin with the 7 estate planning essentials form, tailoring it to your unique needs and preferences. Regular reviews—at least every few years or after significant life events—are crucial to maintaining an effective estate plan.

Utilize pdfFiller’s cloud-based platform for ongoing document management, ensuring every form you create is easily accessible. Regular updates and reviews safeguard your intentions and provide peace of mind, knowing your wishes will be honored.

FAQs on estate planning essentials

Navigating estate planning can prompt various questions. Here are some frequently asked questions to consider:

Related topics for further exploration

The estate planning landscape is broad and complex. Consider exploring the following related topics to deepen your understanding:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 18664467001 form?

How can I edit 18664467001 form on a smartphone?

How do I fill out 18664467001 form on an Android device?

What is 7 estate planning essentials?

Who is required to file 7 estate planning essentials?

How to fill out 7 estate planning essentials?

What is the purpose of 7 estate planning essentials?

What information must be reported on 7 estate planning essentials?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.