Get the free Canada securities lending panel

Get, Create, Make and Sign canada securities lending panel

How to edit canada securities lending panel online

Uncompromising security for your PDF editing and eSignature needs

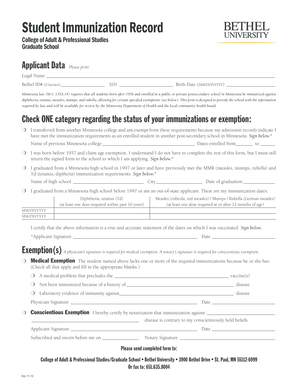

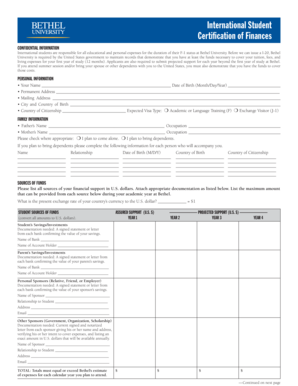

How to fill out canada securities lending panel

How to fill out canada securities lending panel

Who needs canada securities lending panel?

Navigating the Canada Securities Lending Panel Form: A Comprehensive Guide

Overview of the Canada Securities Lending Panel Form

The Canada Securities Lending Panel Form is a vital document that facilitates the securities lending process in Canada. This form provides a structured way for institutional investors, lenders, and borrowers to engage in transactions whereby securities are temporarily transferred between parties. Understanding this form is crucial for anyone involved in securities lending, as it ensures compliance with regulatory requirements while protecting all stakeholders' interests.

The significance of this form extends beyond mere compliance; it acts as a formal record of the lending transaction, detailing essential information about the securities, the parties involved, and the terms of the loan. Its correct completion is pivotal in managing risks and minimizing disputes.

Applicability

The Canada Securities Lending Panel Form is primarily used by institutional investors, financial institutions, and any organizations involved in borrowing or lending securities. In particular, asset managers, pension funds, hedge funds, and banks are obligated to use this form when they establish securities lending agreements. This ensures transparency and compliance with the regulations set forth by the Canadian Securities Administrators (CSA) and other regulatory bodies.

Understanding the securities lending framework in Canada

Canada's securities lending framework is governed by a detailed set of regulations designed to protect market integrity and promote responsible lending practices. Key regulatory bodies, such as the Canadian Securities Administrators (CSA), implement these regulations, ensuring that all transactions are conducted transparently and with adequate safeguards in place.

Within this framework, various parties play crucial roles: institutional investors often act as lenders, looking to earn additional returns on their portfolios, while borrowers—usually hedge funds or investment firms—seek to augment their short positions or enhance liquidity. Each party must understand their responsibilities and the legal implications of the securities lending transaction to prevent potential conflicts or disputes.

Key components of the Canada Securities Lending Panel Form

The Canada Securities Lending Panel Form is structured to capture essential information about the securities lending transaction. Key components include:

Step-by-step instructions for completing the Canada Securities Lending Panel Form

Completing the Canada Securities Lending Panel Form requires careful preparation and attention to detail. Here’s how to do it effectively:

Common mistakes can often lead to delays in processing or even legal complications. Ensure all fields are filled completely and accurately. Double-check all borrower information, issuer details, and securities specifications for any typos or missing information.

Editing and reviewing the Canada Securities Lending Panel Form

Once you have completed the initial draft of the Canada Securities Lending Panel Form, editing and review become crucial. Using pdfFiller tools empowers users to modify the form seamlessly.

The interactive tools available on pdfFiller not only allow you to make changes but also enable collaborative review. Team members can provide feedback directly on the form, ensuring everyone agrees on the content before submission. This collaboration features commenting options and real-time editing, facilitating communication whether your team works remotely or in person.

Signing and submitting the Canada Securities Lending Panel Form

After finalizing the Canada Securities Lending Panel Form, the next step is electronic signing. pdfFiller provides easy-to-use electronic signature options that comply with legal requirements, making the signing process quick and secure.

Submission guidelines must be followed meticulously. Depending on the nature of the transaction, you may need to submit the form to different regulatory bodies. Be aware of submission deadlines to avoid penalties or issues with compliance. Always keep records of submissions for reference.

Managing and storing the Canada Securities Lending Panel Form

Once submitted, it’s vital to manage and store the Canada Securities Lending Panel Form securely. pdfFiller offers cloud-based document management that simplifies the organization and retrieval process.

Utilizing cloud storage solutions ensures that sensitive information remains protected and is readily accessible when needed. Implementing security practices such as regular password changes, two-factor authentication, and controlled access can help safeguard your documents against unauthorized access.

Frequently asked questions (FAQs)

Users often have several common queries regarding the Canada Securities Lending Panel Form. Addressing these inquiries can save time and enhance understanding. For example:

User testimonials and experiences

Many users have found pdfFiller instrumental in managing their Canada Securities Lending Panel Form process. Testimonials depict how simple it is to navigate the platform and collaborate seamlessly.

'I was amazed at how easy it was to fill out and submit the securities lending form with pdfFiller. The collaborative features helped us finalize details quickly,' shared one satisfied user.

Connect with specialized support

When facing challenges with the Canada Securities Lending Panel Form, accessing specialized support is crucial. pdfFiller offers robust customer support that guides users through potential issues and answers any queries regarding form completion or submission.

For further assistance, users can reach out via the customer support portal on the pdfFiller website, where detailed resources and contact details for direct communication are available. This accessibility promotes a smoother and more efficient document management process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send canada securities lending panel to be eSigned by others?

How can I edit canada securities lending panel on a smartphone?

How do I complete canada securities lending panel on an iOS device?

What is canada securities lending panel?

Who is required to file canada securities lending panel?

How to fill out canada securities lending panel?

What is the purpose of canada securities lending panel?

What information must be reported on canada securities lending panel?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.