Get the free Nebraska County Treasurer's Manual : Registration

Get, Create, Make and Sign nebraska county treasurer039s manual

How to edit nebraska county treasurer039s manual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska county treasurer039s manual

How to fill out nebraska county treasurer039s manual

Who needs nebraska county treasurer039s manual?

Nebraska County Treasurer's Manual Form: A Comprehensive Guide

Overview of the Nebraska County Treasurer's Manual Form

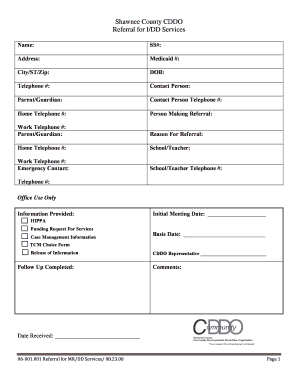

The Nebraska County Treasurer's Manual Form serves as an essential resource for officials in the treasurer's office, offering guidelines and standard procedures for managing property taxes, assessments, and other financial obligations. This manual not only facilitates the efficient operation of treasurers' offices across Nebraska but also ensures compliance with state laws. The forms included range from tax payment applications to property valuation statements, each designed to encapsulate specific information necessary for local financial management.

Adhering to local guidelines in the manual is crucial for avoiding legal repercussions. Accurate submission of these forms ensures compliance with Nebraska state regulations, which helps maintain the integrity of the financial records and governmental processes. Consequently, understanding how to use the Nebraska County Treasurer's Manual Form is essential for both treasurer’s office personnel and residents alike.

Key components of the Nebraska County Treasurer's Manual

The Nebraska County Treasurer's Manual encompasses various types of forms tailored for specific functions within the treasurer's office. Among these are tax payment forms, property valuation forms, and special assessment forms, each fulfilling a distinct purpose in financial management. For instance, tax payment forms are utilized for the collection of property taxes, while property valuation forms are essential for assessing the value of real estate for taxation purposes.

A detailed examination of the most commonly used forms reveals their complexity and the nuances in their completion. Form A, the Property Tax Statement, requires fields such as property location, owner's name, and assessed value. Meanwhile, Form B, the Tax Refund Application, includes specific instructions that guide individuals on how to submit claims accurately. Accessing updated forms is vital, and users should regularly check the official state website for the most recent versions to ensure compliance.

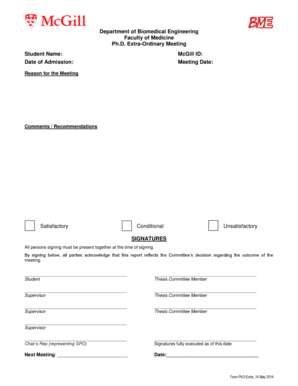

Step-by-step guide to filling out the Nebraska County Treasurer's Manual forms

Locating the correct form is the first step in using the Nebraska County Treasurer's Manual effectively. Platforms such as pdfFiller make it easy to navigate through various forms. Users can search for specific documents by entering keywords or filtering by category, ensuring that they find the appropriate form for their needs.

Completing each section of these forms can be straightforward if users follow clear instructions. For example, Form A requires careful entry in sections including property description and taxpayer information. By using example entries in the guide, individuals can gain clarity on what information to input. However, common mistakes often occur in this step; for instance, incorrect property descriptions or missing signatures can delay processing. To minimize errors, double-checking each entry against the form’s instructions is vital.

Editing and customizing your forms

Using pdfFiller's editing tools allows users to enhance their forms with annotations and comments, ensuring that notes or clarifying remarks are included where needed. This enables better communication among team members in the treasurer’s office. Version control is also available, allowing users to track changes made to the documents, which is especially beneficial for maintaining accurate records.

When it comes to storing documentation, adopting best practices for digital storage is critical. Utilizing cloud storage offers several benefits, including easy access from anywhere, which is particularly advantageous in a mobile work environment. Storing forms in organized folders can further enhance retrieval efficiency. This method ensures that all relevant documents are at your fingertips when needed.

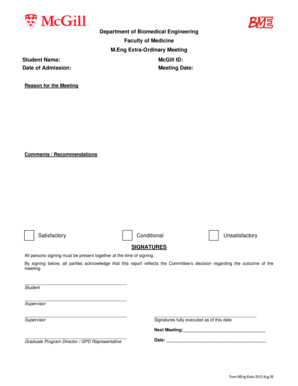

eSigning and collaborating on treasurer's forms

The process of electronic signing, or eSigning, has gained traction across Nebraska due to its efficiency and legal standing. Electronic signatures are recognized by law, making them a valid alternative to traditional signatures. Users can complete the eSigning process seamlessly through pdfFiller, which outlines steps for securely signing forms electronically.

Moreover, collaborating on forms with team members becomes easier with tools that allow real-time edits and sharing. Treasure office employees can work together, ensuring that documents are reviewed and approved swiftly. Utilizing collaboration features can lead to reduced processing times and increased accuracy in document management.

Managing your completed documentation

After completing the necessary forms, organizing them effectively is crucial for operational efficiency. Implementing strategies such as categorizing documents based on their purpose or associated projects can streamline retrieval. Utilizing folders within the pdfFiller platform offers a structured approach to document management, enhancing overall productivity.

In addition, the ability to retrieve past forms efficiently is essential for historical accuracy. Users can employ search functionalities within pdfFiller, allowing them to find archived documents quickly. The importance of maintaining backups cannot be overstated, as they protect against data loss and ensure that critical forms remain accessible.

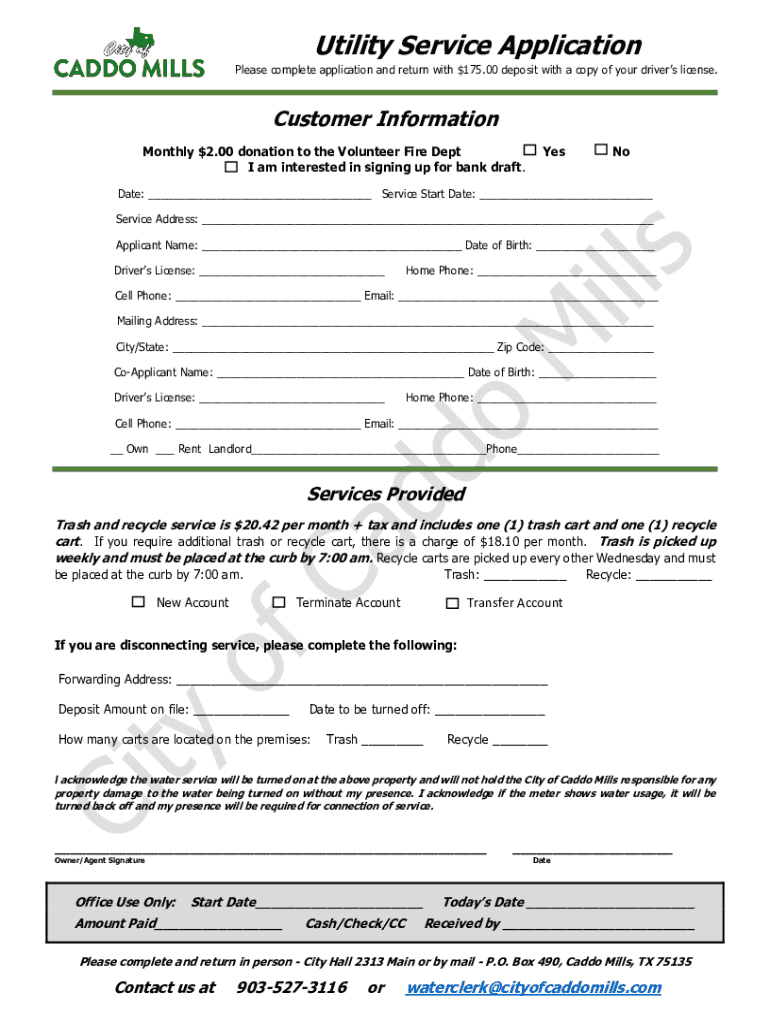

Contacting the Nebraska County Treasurer’s office

For individuals seeking assistance with the Nebraska County Treasurer's Manual Form, contacting the local treasurer’s office may be necessary. Most counties provide specific phone numbers and email addresses designed for public inquiries, along with operating hours. Knowing how to reach these offices can significantly reduce confusion and expedite clarification on complex matters.

Additionally, pdfFiller offers customer support for users experiencing technical issues. Their community forums can provide valuable insights shared by other users, contributing to a wealth of shared knowledge on navigating common problems and enhancing the overall user experience.

Enhancing your efficiency in document management

To further streamline the workflow, leveraging the features of pdfFiller is essential. Automation tools can save considerable time for repetitive tasks, allowing employees in the treasurer's office to focus on high-priority responsibilities. Understanding analytics related to document performance can also provide insights into processing times and areas needing improvement.

Staying compliant with changes in legislation is another pivotal factor. Keeping informed about the latest developments that may impact treasurer forms helps ensure that submissions remain valid and accurate. Regularly consulting resources such as newsletters or official state websites for updates can assist in maintaining compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute nebraska county treasurer039s manual online?

Can I sign the nebraska county treasurer039s manual electronically in Chrome?

Can I create an eSignature for the nebraska county treasurer039s manual in Gmail?

What is nebraska county treasurer039s manual?

Who is required to file nebraska county treasurer039s manual?

How to fill out nebraska county treasurer039s manual?

What is the purpose of nebraska county treasurer039s manual?

What information must be reported on nebraska county treasurer039s manual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.