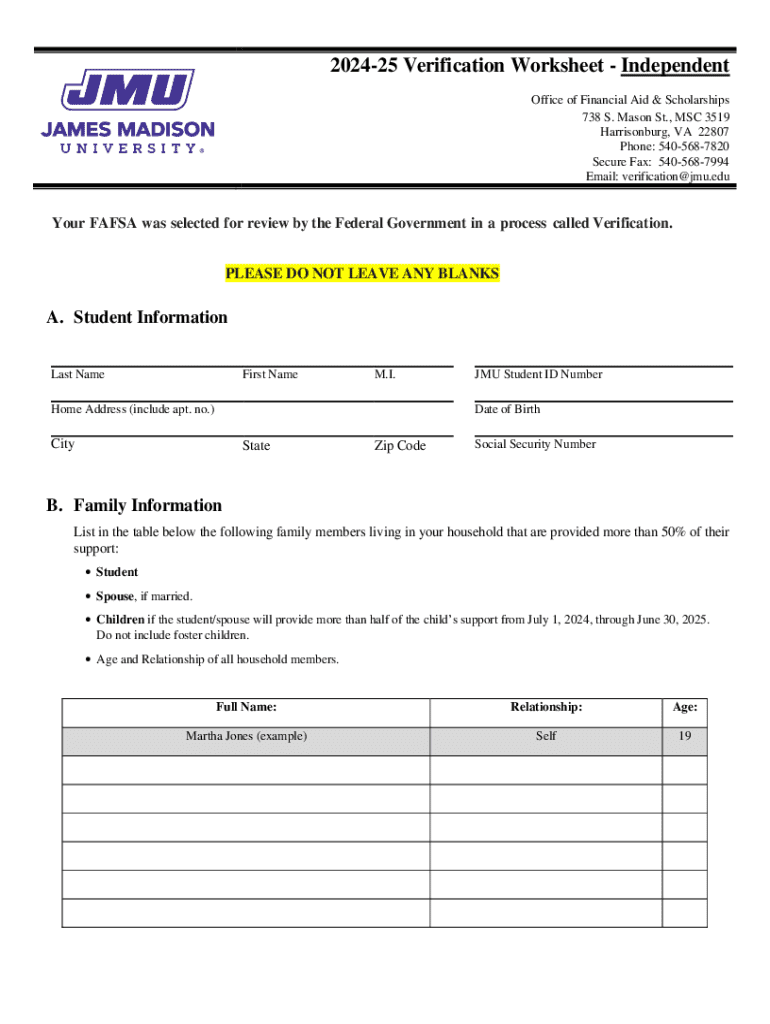

Get the free Financial Aid: Verification of FAFSA Information - JMU

Get, Create, Make and Sign financial aid verification of

How to edit financial aid verification of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial aid verification of

How to fill out financial aid verification of

Who needs financial aid verification of?

Financial aid verification of form: A comprehensive guide

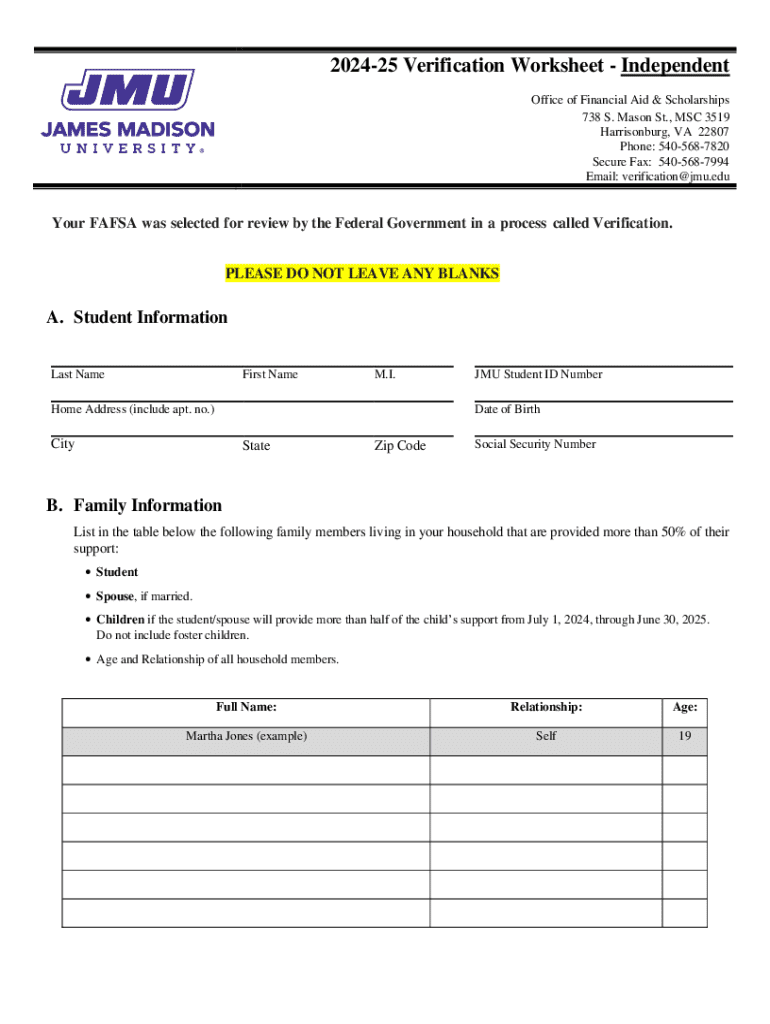

Understanding financial aid verification

Financial aid verification is a crucial process that ensures the accuracy and authenticity of the information provided on the Free Application for Federal Student Aid (FAFSA) form. This verification process helps verify the details related to income, household size, and other financial data, which ultimately influence a student’s eligibility for various forms of financial aid.

The importance of this verification process cannot be overstated. By confirming the accuracy of financial information, it protects the integrity of federal aid programs, ensuring that funds are awarded to those who genuinely need assistance. Verification helps to minimize errors and fraud within the system, therefore maintaining equity and fairness in the distribution of financial resources.

Financial aid verification is generally conducted by the college or university the student plans to attend. Each institution is responsible for its verification processes, which may vary slightly based on their policies.

What triggers financial aid verification?

Several factors can trigger financial aid verification, causing some students to undergo additional scrutiny. One common trigger is discrepancies in reported data. If the information provided on the FAFSA does not match other documentation, it may raise red flags prompting verification.

The FAFSA process also employs a random selection mechanism, where students are chosen at random for verification, regardless of how accurate their information may be. Additionally, significant changes in income or family size since filing the FAFSA can trigger verification as well.

Various factors can affect an applicant's probability of being reviewed. These factors include the types of financial aid applied for (e.g., federal vs. institutional aid) and the specific policies of the institution regarding their verification processes.

How to determine if you are selected for verification

Once you submit your FAFSA application, it is essential to monitor for notifications regarding your selection for verification. Typically, you can check your FAFSA confirmation page immediately after submission, which will indicate whether your application has been selected.

In addition to the FAFSA page, it's critical to keep an eye on communications from your college or university. They will send out financial aid award letters and may provide further information about the verification process if you are selected.

Understanding the details provided in your award letter is crucial as it will outline any requirements and deadlines associated with the verification process. Pay attention to any specific documentation needed and the timeline for submission.

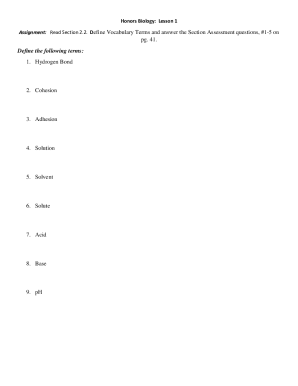

Preparing for the FAFSA verification process

Preparing for the financial aid verification process requires gathering specific documentation. Commonly required documents include IRS Tax Return Transcripts, W-2 forms, and additional income documentation. Each college may have its own set of requirements, so thoroughly check what your institution mandates.

To efficiently collect the necessary documents, utilize the IRS Data Retrieval Tool, which allows for seamless import of tax information directly into your FAFSA. Additionally, gather financial documents from your employers, such as recent pay stubs or other income statements.

Creating a checklist of required items can help keep you organized. Additionally, maintaining electronic records will provide easy access, streamlining the verification process.

Tips to reduce chances of being selected for verification

One of the most effective ways to minimize your likelihood of being selected for financial aid verification is to accurately complete your FAFSA application. Double-checking your information before submission can save you from unnecessary hassle.

If you are uncertain about any part of your application, don’t hesitate to seek assistance from resources such as your school’s financial aid office or online tutorials. Staying informed about common mistakes can also greatly reduce your chances of being asked for verification.

Among the typical mistakes made are incorrect Social Security numbers and misreporting income figures. By recognizing these common errors, you can take proactive steps to avoid them.

Handling institutional documentation service (IDOC) requirements

IDOC, or Institutional Documentation Service, is a tool used by some colleges to streamline the verification process. It allows institutions to collect the required documents from students online, simplifying submissions for both parties.

If your institution uses IDOC, you will receive instructions on how to submit the necessary documentation. The process is typically user-friendly, guiding you through each step. However, it is critical to be aware of important deadlines to avoid delays in your financial aid.

Should you face any challenges or uncertainties while submitting documents through IDOC, do not hesitate to contact your institution for guidance.

Consequences of not completing the verification process

Failing to complete the financial aid verification process can have serious implications. Most significantly, it can impact your financial aid eligibility, leading to a lack of necessary funding for your education.

If you happen to miss deadlines for submitting verification materials, it is essential to reach out to your college's financial aid office immediately. They may provide guidance on any possible alternatives or solutions to ensure you still receive aid.

Specialized situations in financial aid verification

Certain scenarios can complicate the financial aid verification process. For instance, if you filed an amended tax return, be prepared to provide documentation that verifies the changes. Additionally, if you are a non-IRS tax filer, your verification requirements may differ significantly, often necessitating alternative forms of income documentation.

Victims of IRS identity theft or those granted a filing extension may also find themselves facing unique verification challenges. It's crucial to consult with your financial aid office in these situations to ensure compliance with all requirements.

Frequently asked questions about financial aid verification

It’s natural to have queries regarding the financial aid verification process. Common questions include what documents are needed for verification and how long the verification process will take. Understanding these aspects can alleviate anxiety during this time.

The verification process timeline varies based on the institution, but generally, students will receive updates on their status via email or their student portal. Additionally, staying informed about current financial aid regulations can provide deeper insights into the verification process.

Related financial aid topics & resources

As you navigate the financial aid verification process, understanding related topics can further assist you. For instance, being aware of any updates or changes in the FAFSA itself is beneficial for both applicants and institutions.

Additionally, familiarizing yourself with the role of financial aid offices can provide support, while utilizing tools like pdfFiller can enhance your document management capabilities. By leveraging resources effectively, you can streamline your verification process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get financial aid verification of?

How do I edit financial aid verification of in Chrome?

Can I sign the financial aid verification of electronically in Chrome?

What is financial aid verification of?

Who is required to file financial aid verification of?

How to fill out financial aid verification of?

What is the purpose of financial aid verification of?

What information must be reported on financial aid verification of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.