Credit Application Suretyship Standard Form: A Comprehensive Guide

Understanding credit application suretyship

Credit application suretyship is a crucial concept in the lending landscape, particularly when a borrower seeks credit but lacks adequate creditworthiness or collateral. Suretyship serves as a legally binding agreement involving three parties: the borrower, the lender, and the surety. The surety, often a third party, guarantees the borrower’s obligations to the lender, assuring that the lender will be compensated in case of default.

Additionally, using a standard form for credit applications that include suretyship is essential for clarity and efficiency. It streamlines the process, ensures all necessary information is collected uniformly, and minimizes potential legal disputes.

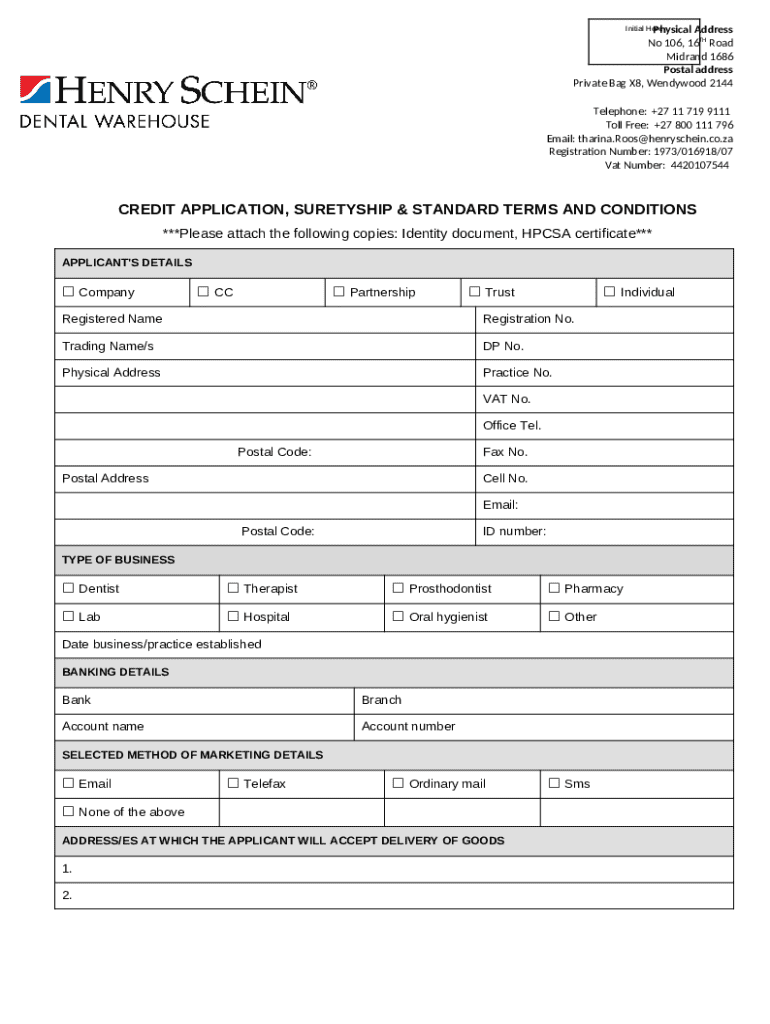

Overview of the credit application suretyship standard form

The credit application suretyship standard form serves as a comprehensive tool that outlines the necessary details and agreements pertinent to a credit application involving a surety. This form is designed to gather essential personal and financial information from the borrower and related surety data to assist lenders in making informed decisions.

Typically, the components found in the standard form include:

Personal and Financial Information Section – Collects data on the borrower’s identity, financial status, and credit history.

Surety Information Requirements – Gathers details pertaining to the surety, including identification and financial capability.

Terms and Conditions Overview – Outlines the legal obligations of all parties involved, specifying the implications in case of default.

Step-by-step guide to filling out the standard form

Completing the credit application suretyship standard form correctly is vital for a successful submission. Here’s a detailed guide on how to properly fill out the different sections of the form.

Section 1: Personal Information

This section requires key details such as your name, address, date of birth, and social security number. Ensure that all entries are accurate to avoid processing delays. Tip: Cross-check each entry to confirm accuracy.

Section 2: Financial Information

You'll need to provide financial data such as income, debts, assets, and other liabilities. Including essential documents like tax returns and W-2 forms may bolster your application’s credibility. Common mistakes include omitting required attachments or providing outdated financial information.

Section 3: Surety Details

Here, you include information about your surety. Provide thorough, accurate data about their financial standing and willingness to support your application. Selecting an appropriate surety is crucial, as their credibility will directly impact your application.

Section 4: Terms and Acknowledgements

Carefully read the terms and conditions outlined in this section and ensure you understand the legal implications. Signing the form can be done via traditional means or digitally using eSignature options with pdfFiller.

Editing and modifying the credit application suretyship form

Once you've completed the form, you may realize that changes are necessary. pdfFiller offers excellent tools for editing your documents, allowing for on-the-go modifications. With pdfFiller, you can easily add additional information or attachments to your application, ensuring your submission is well-rounded.

Frequently asked questions around modifications typically include inquiries about how to revert changes or the best practices when adding significant sections to the form. Users often find the intuitive interface of pdfFiller a significant advantage in managing these edits effectively.

Managing your credit application submissions

Organizing submitted forms is crucial for tracking the status of your credit application. pdfFiller simplifies this process, allowing users to manage submissions from a central dashboard. You can categorize applications by status, such as pending, approved, or declined, making it easier to follow up.

Moreover, collaboration tools provided by pdfFiller enable all involved parties, including sureties and co-applicants, to interact on a single platform, promoting streamlined communication.

Ensuring compliance and legal considerations

Legal compliance is paramount when dealing with credit applications and suretyship. Understanding the key legal terms—like indemnity and default—is critical. Each state imposes its own regulations that govern suretyship, requiring borrowers and lenders to adhere to those standards. Failing to comply can jeopardize the entire application process.

Your surety plays an essential role in this equation, as their agreement to the terms can influence the lender's perception of risk. It’s important to ensure that all documentation is legally sound, requiring thorough review before submission.

Common challenges and solutions

While applying for credit with surety, various challenges can arise. Common pitfalls often include incomplete forms or miscommunication with the surety. It’s essential to maintain clear relations among all parties and utilize resources like pdfFiller’s customer support for troubleshooting any issues that may surface during the submission process.

Anticipating these challenges allows for proactive measures. For instance, double-checking all entries and confirming details with your surety before submission can significantly reduce the likelihood of complications.

Advanced features for managing your forms

pdfFiller offers advanced features aimed at enhancing the document management experience. Automated workflows streamline processing, taking the guesswork out of what steps need to be performed next. Furthermore, digital signing capabilities enable users to eSign multiple documents in one swift action, helping to expedite the approval process.

With increasing concerns about data security and privacy, pdfFiller also implements stringent measures to protect user information, ensuring that sensitive data is safeguarded throughout the application process.

User testimonials and success stories

Real-world experiences provide insight into the effectiveness of the credit application suretyship process. Numerous case studies highlight individuals and teams who successfully secured credit through effective use of suretyship. These stories often emphasize the importance of thorough preparation and accurate documentation.

Feedback from users of pdfFiller consistently lauds the platform's ease of use for form management, making a significant difference in the efficiency of document handling. Users appreciate the seamless ability to edit, sign, and collaborate, which has proven invaluable in navigating the complexities of the credit application process.

Next steps after submission

After submitting your credit application suretyship form, it’s crucial to follow up. Expect to receive communication regarding the status of your application, whether it’s approval, denial, or requests for additional information. Each of these outcomes requires a distinct course of action on your part.

Preparing for various outcomes, including potential rejection, is wise. Resources for financial guidance can assist borrowers in either case. Should you need further clarifications or support post-application, consider leveraging the tools offered by pdfFiller for ongoing management and follow-up.