Get the free Common Application Form + SIP - 5th June 2025.cdr

Get, Create, Make and Sign common application form sip

Editing common application form sip online

Uncompromising security for your PDF editing and eSignature needs

How to fill out common application form sip

How to fill out common application form sip

Who needs common application form sip?

Common Application Form SIP Form: A Comprehensive How-To Guide

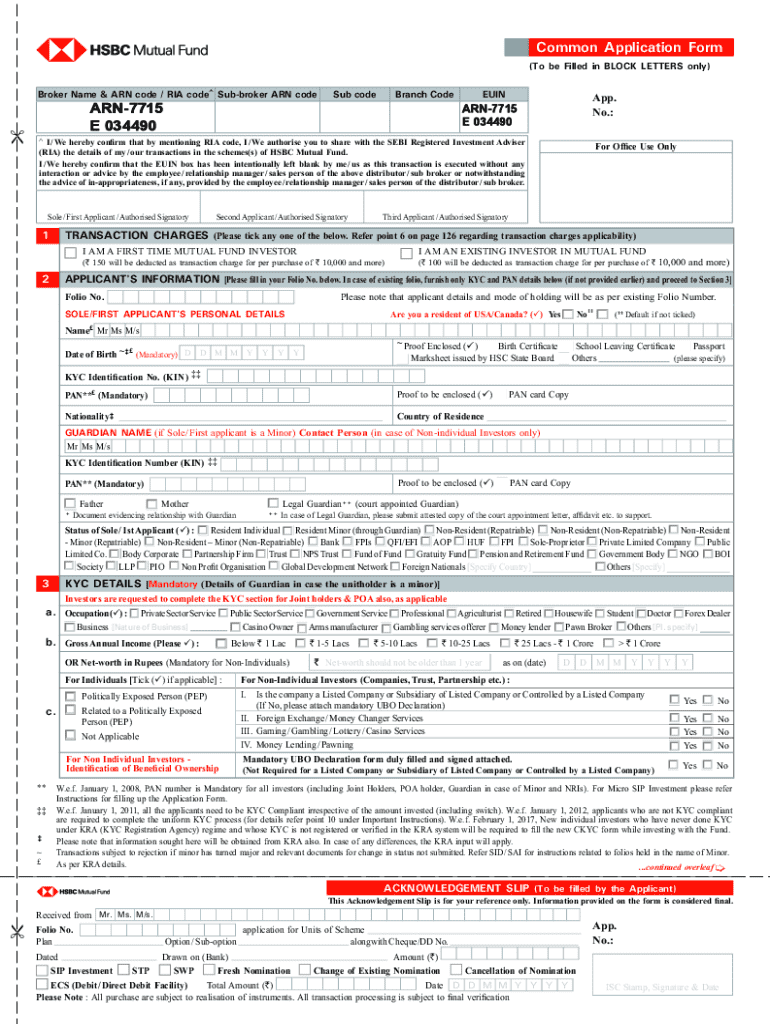

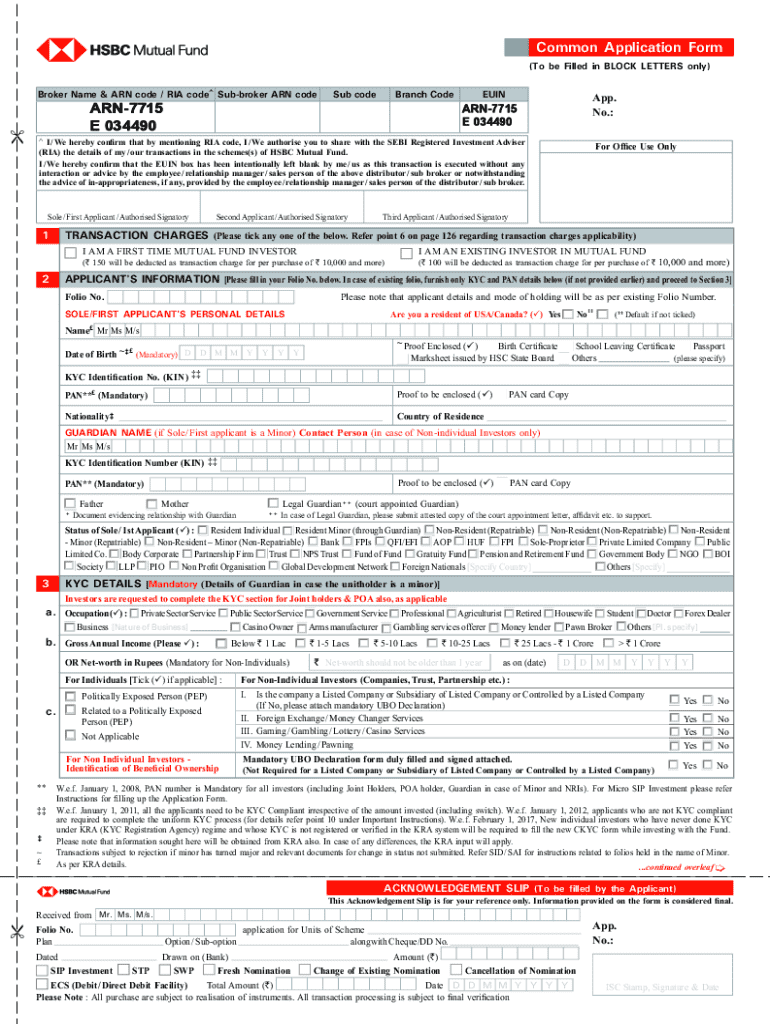

Overview of the Common Application Form SIP Form

A Systematic Investment Plan (SIP) allows investors to contribute a fixed sum regularly to mutual funds, creating a disciplined approach to investing. Understanding the Common Application Form SIP Form is essential for individuals looking to automate their investment journey. This form simplifies the process of initiating a SIP, promoting ease and accessibility.

The common application form for SIPs is designed to capture personal and financial details essential for mutual fund investments. It not only serves as a one-stop solution for multiple investments but also streamlines compliance with regulations, particularly in Know Your Customer (KYC) norms. New investors and experienced ones alike can benefit from this meticulous approach to mutual fund investments.

Individuals looking to invest regularly in mutual funds should consider using the Common Application Form SIP. It caters to both beginners who need straightforward instructions and seasoned investors who appreciate the convenience of managing various investments through one application.

Understanding the components of the common application form

Filling out the Common Application Form SIP requires an understanding of its various components. Here’s a breakdown of the essential sections:

By understanding these components, investors can avoid common pitfalls such as entering inaccurate information or missing crucial documentation.

Step-by-step guide to filling out the common application form SIP form

To fill out the Common Application Form SIP effectively, follow these steps:

Following this systematic approach mitigates the risk of errors, paving the way for a smoother investment process.

Submitting your common application form SIP form

Deciding how to submit your Common Application Form SIP is the next crucial step. Here are your options:

When submitting online via pdfFiller, simply upload your completed PDF and follow the instructions for submission. After submission, expect confirmation via email along with processing timelines, which may vary depending on the fund house.

Managing your SIP post-submission

Once your Common Application Form SIP is submitted, proactive management of your investments is crucial. Here are several strategies:

Reliably managing your SIP can enhance returns and ensure your investments remain in line with your objectives.

Tips for successful SIP investment

Successful SIP investments are built on informed and measured strategies. Consider the following tips:

Additionally, be aware of common concerns such as missed payments, stopping your SIP, or how to withdraw from your investment, as having this information ready can prevent worry during unforeseen circumstances.

Interactive tools and resources available on pdfFiller

pdfFiller provides indispensable tools for managing your SIP forms effectively. Its features include secure document editing and signing, allowing seamless workflows.

By utilizing these pdfFiller tools, users can ensure they effectively manage and streamline their SIP submissions and adjustments over time.

Legal considerations with SIP forms

Understanding the legal aspects of SIP investments is paramount. Properly filling out the Common Application Form SIP ensures compliance with investment regulations and privacy laws.

Investors should be aware of disclaimers surrounding mutual fund investments, particularly regarding the inherent risks. These disclaimers often outline that past performance is not indicative of future results. It’s essential to read and understand these notices.

Further assistance and customer support

Navigating the nuances of SIP forms can sometimes present challenges. That's where robust customer support comes into play.

Having access to these support channels not only facilitates the completion of the Common Application Form SIP but also enhances overall investment experiences.

Staying updated with changes in SIP regulations

The investment landscape is dynamic, with regulations frequently changing. Keeping abreast of new SIP regulations is critical for investors.

These proactive steps will empower investors to adapt to shifts in regulations, ensuring their investments remain compliant and effective.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my common application form sip in Gmail?

How do I edit common application form sip on an Android device?

How do I complete common application form sip on an Android device?

What is common application form sip?

Who is required to file common application form sip?

How to fill out common application form sip?

What is the purpose of common application form sip?

What information must be reported on common application form sip?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.