Get the free Property Tax Exemption For Veterans with a Disability & ...

Get, Create, Make and Sign property tax exemption for

How to edit property tax exemption for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property tax exemption for

How to fill out property tax exemption for

Who needs property tax exemption for?

Property Tax Exemption Form - How-to Guide Long-Read

Understanding property tax exemptions

Property tax exemptions serve a critical role in providing financial relief to eligible taxpayers. These exemptions reduce the assessable value of a property, enabling homeowners to lower their property tax liability significantly. The primary purpose is to alleviate the financial burden of property taxes on qualifying individuals or circumstances, ultimately making homeownership more accessible.

Various types of property tax exemptions exist, each with its unique eligibility requirements and benefits. These include:

Property tax exemptions are vital for financial planning. They can significantly impact overall budget allocation, allowing homeowners to redirect funds to essential living expenses or savings.

Eligibility criteria for property tax exemptions

Understanding eligibility criteria is crucial to successfully navigating the property tax exemption landscape. General requirements typically include ownership of the property, residency, and compliance with necessary income or service thresholds.

Specific criteria vary widely based on the type of exemption. For instance:

Documentation required for verification can include financial statements, residency proof, age or disability records, and military discharge papers. Gathering this information beforehand can streamline the application process.

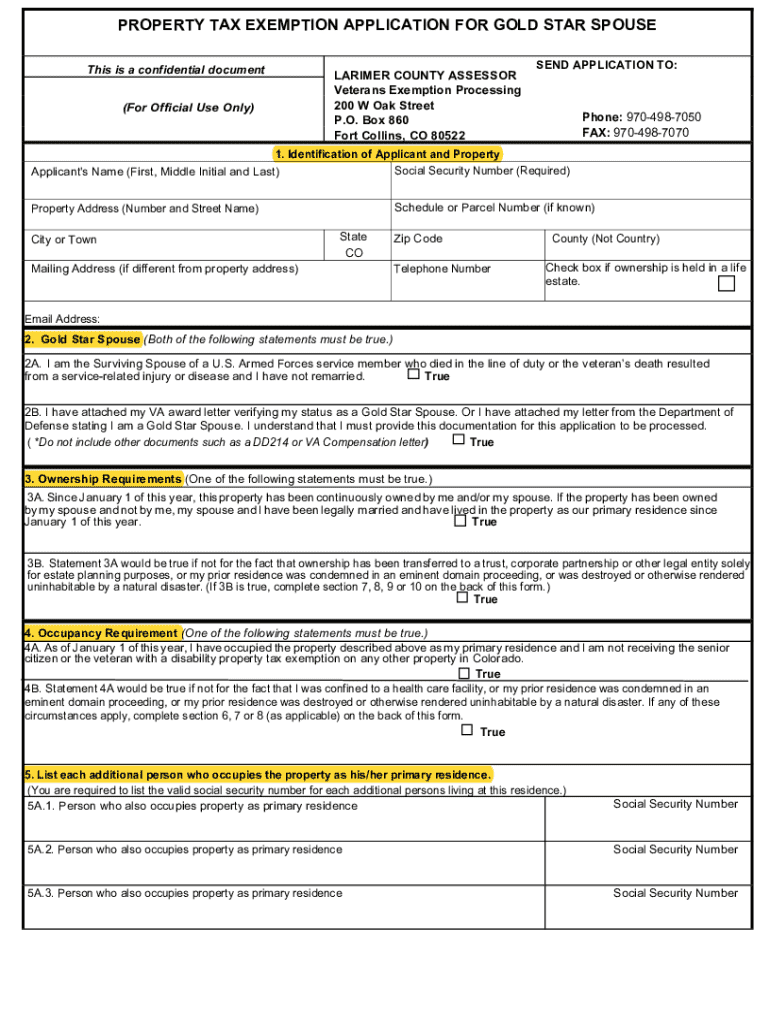

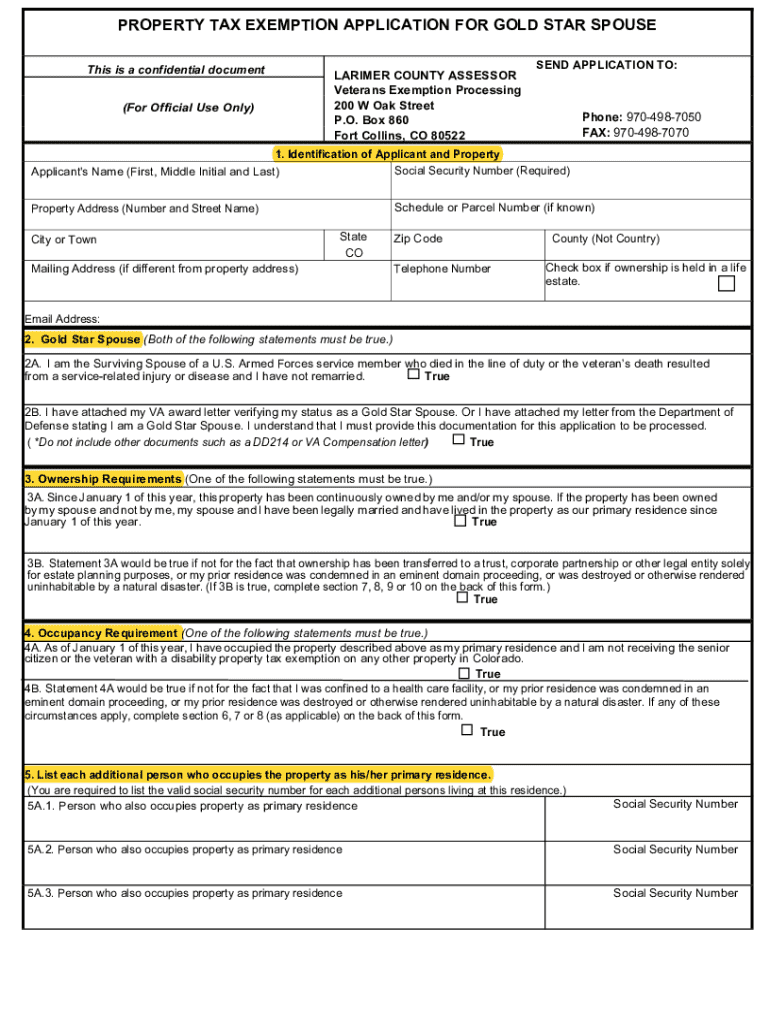

Step-by-step guide to completing the property tax exemption form

Successfully completing a property tax exemption form involves a series of methodical steps. First, you need to access the appropriate form, which can usually be found online on your local tax authority's website. pdfFiller also offers streamlined access to these forms, facilitating easy document editing and e-signatures.

When filling out the form, pay close attention to the following sections:

To avoid common mistakes, ensure all information is accurate and matches your documentation. Double-check that all required fields are filled and that you haven’t missed necessary signatures.

Interactive tools for managing your property tax exemption

In the digital age, managing your property tax exemption has never been easier, thanks to online tools such as those offered by pdfFiller. For example, you can edit the property tax exemption form directly on its platform, making it simple to adapt the document to your specific needs.

pdfFiller also streamlines the signing process through eSigning capabilities, allowing you to provide your signature without printing the form. Beyond submission, you can track the status of your application through the platform, giving you peace of mind during the waiting period.

If collaborating with team members or advisors, pdfFiller enables easy sharing, ensuring that everyone involved can access the necessary documents and provide insights conveniently.

Filing your property tax exemption form

Once your property tax exemption form is complete, the next step is submission. You have multiple methods at your disposal, including online submission through pdfFiller, which is often the easiest course of action. This process typically involves uploading your signed form directly onto your local tax authority’s website.

If you prefer a more traditional approach, you can mail in your application. To do this effectively, consider:

After submission, you can typically expect a review period where tax authorities will process your application, often communicating any necessary follow-up or approval notifications within several weeks.

Appealing a denied property tax exemption application

If your property tax exemption application is denied, it's essential to understand common reasons for denial, such as insufficient documentation or ineligibility based on the specific criteria of exemptions. Knowing these can prepare you for the next steps.

Filing an appeal typically involves a structured process. Follow these steps to increase your chances of a successful appeal:

Resources and support for property tax exemption queries

For any queries regarding property tax exemptions, reach out to your local tax authorities. They are often the most authoritative resource for understanding specific policies in your area. A dedicated hotline or customer service email can provide timely assistance.

Additionally, utilize both internal resources and external tax advisory services for expert advice. pdfFiller offers support tools, ensuring you can access knowledgeable assistance and streamline the paperwork process with ease.

Frequently asked questions (FAQs) about property tax exemptions

Reading through common queries can help clarify uncertainties surrounding property tax exemptions. Questions often revolve around eligibility, filing timelines, and specific processes encountered during application.

Some common inquiries include:

Best practices for managing your property taxes

Managing property taxes effectively demands ongoing attention and updates. Staying informed about changing tax regulations is crucial—these laws can shift, impacting your eligibility for exemptions or tax rates.

Leveraging resources like pdfFiller for ongoing document management can dramatically ease your workload. By storing documents digitally, reviewing your tax status annually becomes a straightforward task. Consider establishing reminders to check in on your property tax status regularly.

Conclusion of the property tax exemption process

Staying organized throughout the property tax exemption process is paramount. It not only ensures a smoother application but also prepares you for potential future claims. Utilizing tools like pdfFiller for all documentation needs further simplifies your experience and instills confidence in managing property taxes.

By understanding the entire process, knowing eligibility, completing forms accurately, and utilizing available resources, you empower yourself to maximize your benefits and manage your property taxes efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit property tax exemption for online?

Can I create an electronic signature for the property tax exemption for in Chrome?

How can I fill out property tax exemption for on an iOS device?

What is property tax exemption for?

Who is required to file property tax exemption for?

How to fill out property tax exemption for?

What is the purpose of property tax exemption for?

What information must be reported on property tax exemption for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.