Get the free Forte Insurance, Forte Life Assurance, and Oriental Bank ...

Get, Create, Make and Sign forte insurance forte life

Editing forte insurance forte life online

Uncompromising security for your PDF editing and eSignature needs

How to fill out forte insurance forte life

How to fill out forte insurance forte life

Who needs forte insurance forte life?

Comprehensive Guide to the Forte Insurance Forte Life Form

Understanding the Forte Life Form

The Forte Life Form is a crucial document within Forte Insurance's product suite, tailored to meet the diverse needs of policyholders. It serves as a foundational element for securing life insurance coverage, providing the necessary information to assess an individual's insurance needs and qualifications. Understanding this form is essential for anyone seeking to navigate the complexities of life insurance.

In an industry where life insurance plays a pivotal role in financial planning, the Forte Life Form stands out by offering a structured approach. It acts not only as a means of applying for coverage but also ensures that individuals receive tailored protection suited to their unique circumstances. The significance of the Forte Life Form transcends simple formality, highlighting the importance of thorough documentation in insurance operations.

Key features of the Forte Life Form

The Forte Life Form offers several key features that enhance its utility for policyholders. These features are designed to provide comprehensive coverage tailored to individual needs, making it a versatile tool for securing life insurance.

One of the essential advantages of the Forte Life Form is its comprehensive coverage options. Users can select from various plans that cater to different life stages and financial goals, ensuring that they can find a solution that fits their requirements. Additionally, the flexibility in policy options allows individuals to adjust their coverage as their needs evolve over time.

The Forte Life Form also includes the option for additional riders. These riders can be added to the policy to enhance coverage further, addressing specific concerns such as critical illness or accidental death. Furthermore, built-in perks and services, such as second medical opinion services and access to wellness programs, make the coverage even more favorable.

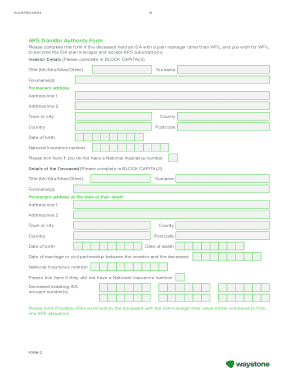

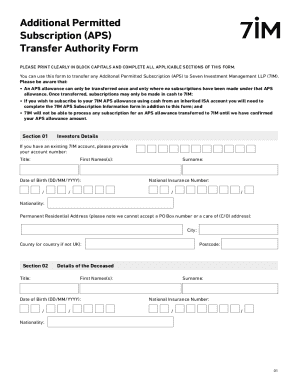

Step-by-step instructions for filling out the Forte Life Form

Filling out the Forte Life Form can seem daunting, but with a clear understanding of the requirements and a systematic approach, the process can be streamlined effectively. To start, individuals should gather their personal information, ensuring they have the necessary documents on hand.

Essential documents typically required include identification, financial records, and health status reports. Frequently asked questions often revolve around the types of personal details to include, such as whether to disclose past medical conditions, which is crucial for accurate assessment.

As you complete the form, it's vital to approach it section by section. Each segment typically requires specific information, from personal data to insurance history. Common mistakes often occur in this area, such as omitting important details or providing inconsistent information. To ensure accuracy, double-check each entry and follow any provided instructions carefully.

Editing and modifying your Forte Life Form

After filling out your Forte Life Form, there may be instances where modifications are required. Utilizing tools like pdfFiller allows users to edit the form easily and effectively. This tool is particularly beneficial for those who may need to adjust their information after initial submission.

To collaborate with team members on the form, pdfFiller provides sharing and collaboration tools. These features enable multiple users to review and edit documents in real-time, enhancing communication and reducing the likelihood of errors. After making edits, securely save and store your modified documents to ensure you have the latest version accessible whenever needed.

Signing the Forte Life Form

Once your Forte Life Form is complete, the next step involves signing the document. With the advent of technology, eSigning your Forte Life Form has become a popular method. Not only does it streamline the process, but it also ensures that the document is legally compliant.

When utilizing electronic signatures, it’s crucial to follow guidelines specific to your jurisdiction to ensure the validity of your signature. Familiarizing yourself with common FAQs regarding the eSigning process can help ease any uncertainty and clarify procedures, including any additional verification steps that might be required.

Managing your Forte Life Form

Managing your Forte Life Form doesn’t end once it’s submitted. Forte Insurance provides several tools and resources for tracking application statuses and accessing policy documents. These features enable policyholders to stay informed and organized throughout their coverage journey.

By leveraging online tools, individuals can easily manage their policies, review important updates, and retrieve necessary documentation whenever required. This capability empowers customers to take control of their insurance experience with simplicity.

Claiming benefits with the Forte Life Form

Understanding the claims process is essential for every policyholder utilizing the Forte Life Form. Familiarity with the necessary documentation and information required can significantly ease the submission and approval process.

To begin the claims submission, gather all relevant documents, including the Forte Life Form, any supporting paperwork related to the claim, and any additional information requested by Forte Insurance. Following a step-by-step guide through the claim process can be beneficial for ensuring your submission is complete, and tracking the claim after submission is always advisable for peace of mind.

Additional considerations with Forte Life

When securing coverage through the Forte Life Form, it’s crucial to be aware of common exclusions that may apply. Understanding limits and restrictions particular to your policy can help you make informed decisions and avoid any misunderstandings at claim time.

To maximize the benefits of your policy, regularly review your coverage and consider adjustments as life circumstances change. Keeping an open line of communication with your agent at Forte Insurance will allow you to stay informed about any updates or changes that could affect your policy.

Frequently asked questions about the Forte Life Form

When encountering issues with the Forte Life Form, there are several common FAQs that can serve as guidance. It’s important to understand the procedures for addressing issues and how policy changes can affect your given policy.

For those with questions about the implications of changes within their policy, understanding the procedures for updating the Forte Life Form is critical. Any modifications may require refilling the form or additional documentation, making it essential to stay informed.

Connecting with Forte Insurance support

Connecting with Forte Insurance support is essential for enhancing your experience with the Forte Life Form. The company offers several customer support channels, including phone, email, and live chat options.

Utilizing interactive portals for assistance can streamline your inquiries, allowing for quick responses to your questions about claims or policy management. Requesting assistance is made easy, ensuring that help is available when needed to address any matters related to your coverage.

Leveraging pdfFiller for your document needs

Choosing pdfFiller for your Forte Life Form provides numerous advantages. The platform facilitates access-from-anywhere document management, which is particularly appealing to individuals and teams who require flexibility in handling their documents.

The enhanced collaboration features promote efficient teamwork, allowing multiple users to engage with the Forte Life Form simultaneously. Furthermore, its user-friendly interface accommodates all levels of tech-savviness, making it an ideal solution for drafting, editing, and managing documents seamlessly.

Related products and services

Exploring other insurance products from Forte Insurance can provide a fuller understanding of coverage options available to you. Along with the Forte Life Form, the company offers a range of insurance solutions designed to address various needs, whether for health, auto, or home insurance.

By understanding the entirety of coverage offered, individuals can make educated decisions regarding their insurance portfolio. Recommendations can also be provided based on specific needs, ensuring customized solutions that work for you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in forte insurance forte life without leaving Chrome?

Can I edit forte insurance forte life on an iOS device?

Can I edit forte insurance forte life on an Android device?

What is forte insurance forte life?

Who is required to file forte insurance forte life?

How to fill out forte insurance forte life?

What is the purpose of forte insurance forte life?

What information must be reported on forte insurance forte life?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.