Get the free Donor Advised Non-endowed Fund Agreement

Show details

Este documento establece un acuerdo para un fondo asesorado por donantes, no endowado, con la Wichita Foundation, detallando las contribuciones iniciales y subsecuentes, la administración del fondo y la autoridad de la Fundación sobre las decisiones de inversión y distribución.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign donor advised non-endowed fund

Edit your donor advised non-endowed fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donor advised non-endowed fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing donor advised non-endowed fund online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit donor advised non-endowed fund. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out donor advised non-endowed fund

How to fill out donor advised non-endowed fund

01

Identify the purpose of the donor advised non-endowed fund.

02

Select a charitable organization or cause to support.

03

Determine the initial contribution amount you wish to donate.

04

Complete the donor advised fund application form with your personal and financial information.

05

Designate the recipients or causes you want to support over time.

06

Submit the application along with the initial donation to the fund provider.

07

Review and familiarize yourself with the grant-making process and guidelines provided by the fund.

08

Keep records of your contributions and disbursements for tax purposes.

Who needs donor advised non-endowed fund?

01

Philanthropists looking to manage their charitable giving over time.

02

Individuals or families wanting to involve multiple generations in charitable decision-making.

03

Non-profit organizations seeking support for specific projects funded through donor advised funds.

04

Businesses aiming to fulfill corporate social responsibility goals through charitable contributions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my donor advised non-endowed fund in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your donor advised non-endowed fund and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I edit donor advised non-endowed fund on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing donor advised non-endowed fund right away.

How can I fill out donor advised non-endowed fund on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your donor advised non-endowed fund. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

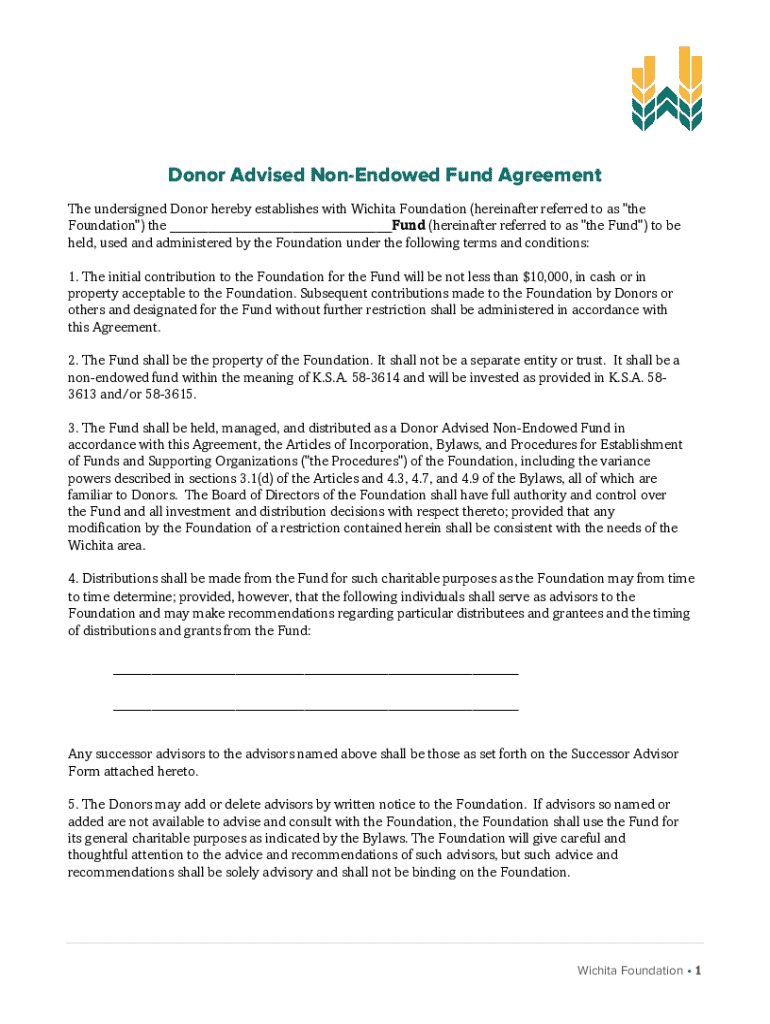

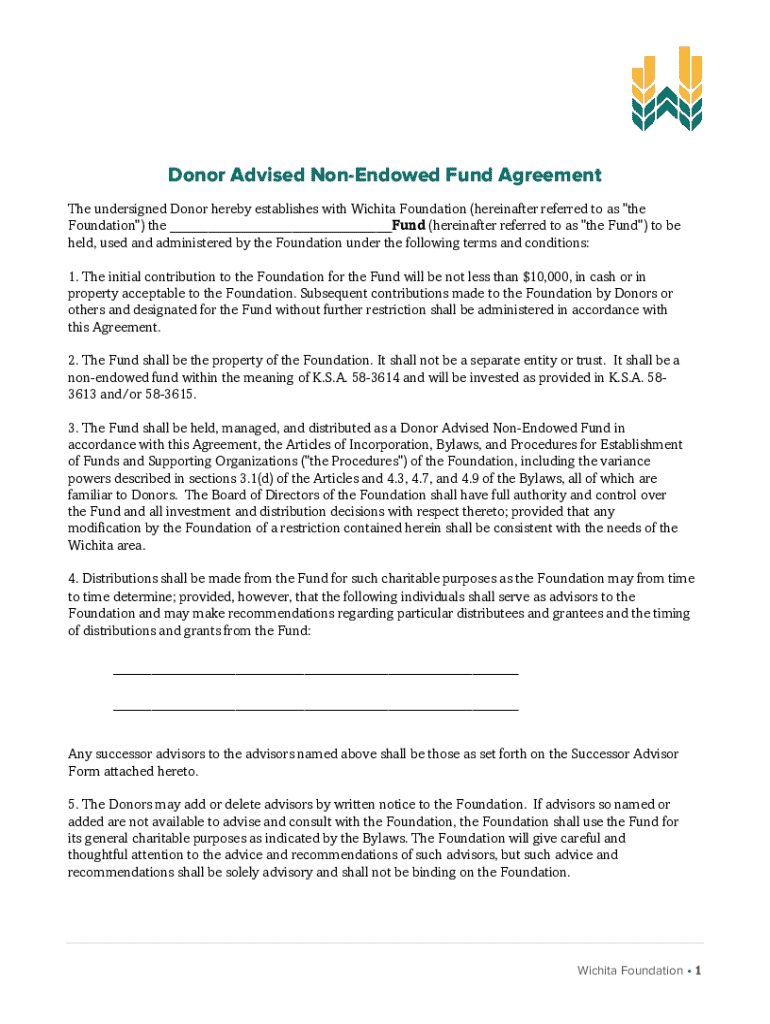

What is donor advised non-endowed fund?

A donor advised non-endowed fund is a type of charitable fund established by a donor that allows them to recommend how the funds are distributed to various charitable organizations. Unlike endowed funds, which are meant to be permanently invested, non-endowed funds can be fully distributed over time.

Who is required to file donor advised non-endowed fund?

Donor advised non-endowed funds are typically filed by the sponsoring charitable organization or community foundation that manages the fund, along with any donors who are required to report their contributions for tax purposes.

How to fill out donor advised non-endowed fund?

To fill out a donor advised non-endowed fund form, a donor should provide their personal information, details about the fund, including the fund name, and specify the charitable purposes or organizations they wish to support. Documentation may also be required to ensure compliance with tax regulations.

What is the purpose of donor advised non-endowed fund?

The purpose of a donor advised non-endowed fund is to provide donors with the flexibility to support charitable causes of their choice while receiving immediate tax benefits. This fund allows for strategic philanthropic planning and encourages ongoing charitable giving.

What information must be reported on donor advised non-endowed fund?

Information that must be reported on donor advised non-endowed funds typically includes the donor's name, the fund's name, the total contributions made, the grants recommended, and the purposes of those grants, as well as compliance with IRS regulations.

Fill out your donor advised non-endowed fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Donor Advised Non-Endowed Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.