Get the free Charitable Contributions You Think You Can Claim but Can't

Get, Create, Make and Sign charitable contributions you think

How to edit charitable contributions you think online

Uncompromising security for your PDF editing and eSignature needs

How to fill out charitable contributions you think

How to fill out charitable contributions you think

Who needs charitable contributions you think?

A Comprehensive Guide to Charitable Contributions Form

Overview of charitable contributions

Charitable contributions refer to the donations made to qualified non-profit organizations intended for public benefit, tackling issues like poverty, education, health, and the environment. Such contributions are essential not just for the funding of various societal needs but also play an important role in tax deduction opportunities for donors. When individuals or businesses donate to recognized charitable organizations, these contributions can significantly reduce their taxable income, ultimately benefiting their tax liabilities.

Understanding the relevant tax regulations surrounding charitable contributions is crucial. The Internal Revenue Service (IRS) has specific guidelines about what qualifies as a deductible contribution and how individuals can accurately report these donations to maximize their tax benefits. Given the evolving nature of tax laws, being informed about these regulations can aid in effective financial planning.

Types of charitable contributions

Charitable contributions can broadly be categorized into monetary and non-monetary forms. Each type has its own specific implications for tax deductibility, compliance with IRS rules, and potential impact on the recipient organizations.

Eligibility criteria for claiming deductions

Claiming deductions for charitable contributions is not solely limited to individuals. Both individuals and businesses can take advantage of these tax benefits, provided they meet the qualifying criteria. Individuals often report donations on their personal tax returns, while corporations may deduct contributions on their business tax returns.

To qualify for deductions, contributions must be made to organizations designated by the IRS as 501(c)(3) entities. It’s also essential to consider state-specific requirements that may affect eligibility. There are also contribution limits based on the donor's adjusted gross income (AGI) and other limit formations that one must adhere to when strategizing philanthropic efforts.

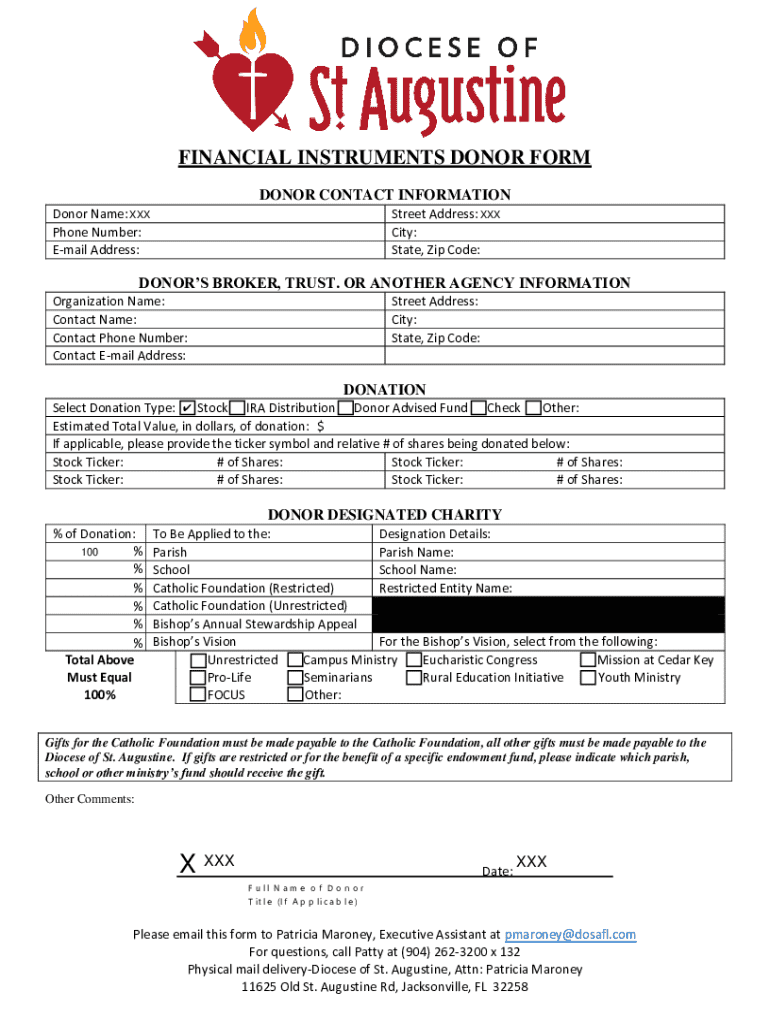

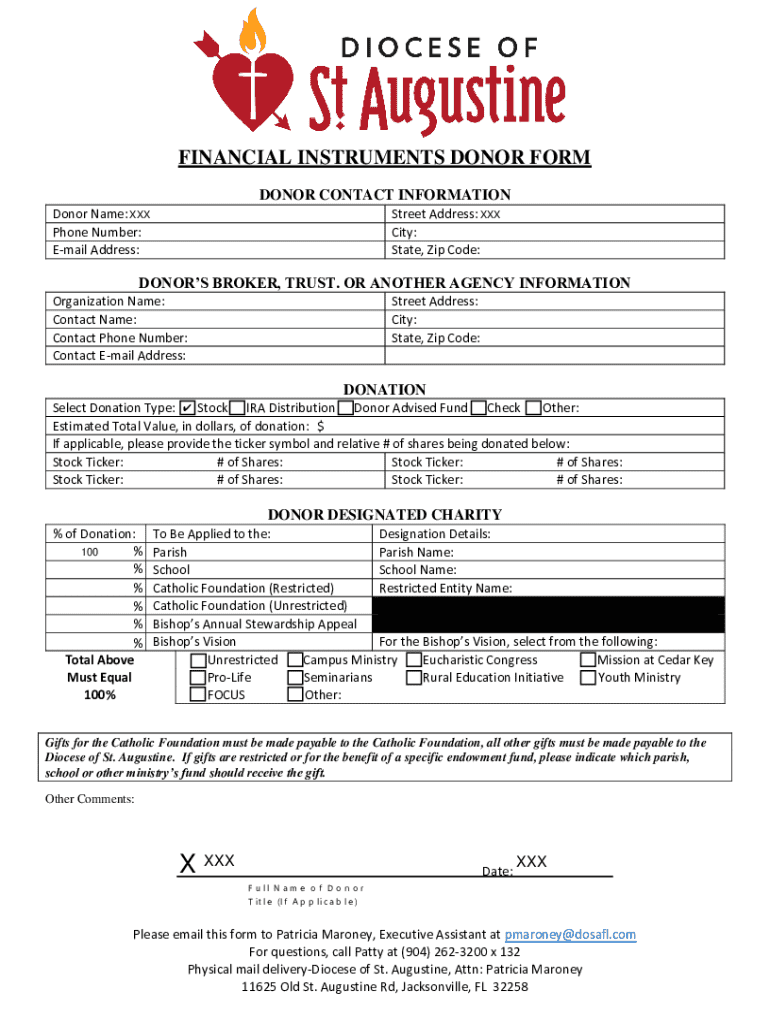

Filling out the charitable contributions form

Completing the charitable contributions form accurately is crucial for claiming your deductions. Start by gathering all necessary documentation such as receipts, bank statements, and any relevant valuations for non-monetary contributions.

It's critical to avoid common mistakes, such as underreporting contributions or failing to obtain required receipts. Such oversights can lead to complications during the audit process.

Claiming your charitable contributions on your tax return

To claim charitable contributions effectively, several steps are necessary. Navigating tax software can streamline the reporting process, allowing you to input donation details accurately. A common form utilized in these claims is the IRS Schedule A, where contributions can be reported alongside other itemized deductions.

Additionally, understanding the impact of carryforward provisions for excess deductions can enhance your long-term tax strategy.

Additional considerations and best practices

Effective record-keeping is key when managing charitable contributions. Best practices suggest maintaining a digital record of receipts and donations using solutions like pdfFiller to organize your documentation. This eliminates the potential for lost paper records and simplifies the retrieval process when filing your taxes.

Managing your charitable contributions

Utilizing interactive tools can significantly enhance how you track donations. Platforms that incorporate features for managing and editing contributions records, like pdfFiller, make it straightforward to log and adjust entries as needed.

Tax professionals can offer insights into changing regulations and ensure you're optimizing your charitable contributions for maximum benefit.

Legal implications and changes in tax law

Tax laws can frequently change, and staying updated is essential for anyone engaging in charitable contributions. Regularly reviewing resources for legal updates will help ensure compliance with evolving regulations. Being informed about potential auditing triggers related to charitable contributions is also important, as certain patterns can raise flags for the IRS.

Empirical insights into charitable giving trends

Charitable contributions play a pivotal role in the economy, demonstrating trends and patterns that are closely influenced by economic conditions. Recent studies indicate that charitable giving often increases during prosperous times, yet faces declines in economic downturns. Understanding these trends can guide both individual and organizational giving strategies.

Conclusion on charitable contributions

Charitable contributions represent more than just a means for tax deductions; they foster a community spirit and philanthropic mindset that can lead to profound change. By understanding how to maximize the benefits derived from informed giving, individuals and organizations can not only achieve tax efficiency but also empower their communities. Engaging with platforms like pdfFiller helps streamline the management of documents related to charitable contributions, emphasizing the synergy between charitable giving and effective tax strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify charitable contributions you think without leaving Google Drive?

How do I complete charitable contributions you think online?

How do I edit charitable contributions you think on an iOS device?

What is charitable contributions you think?

Who is required to file charitable contributions you think?

How to fill out charitable contributions you think?

What is the purpose of charitable contributions you think?

What information must be reported on charitable contributions you think?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.