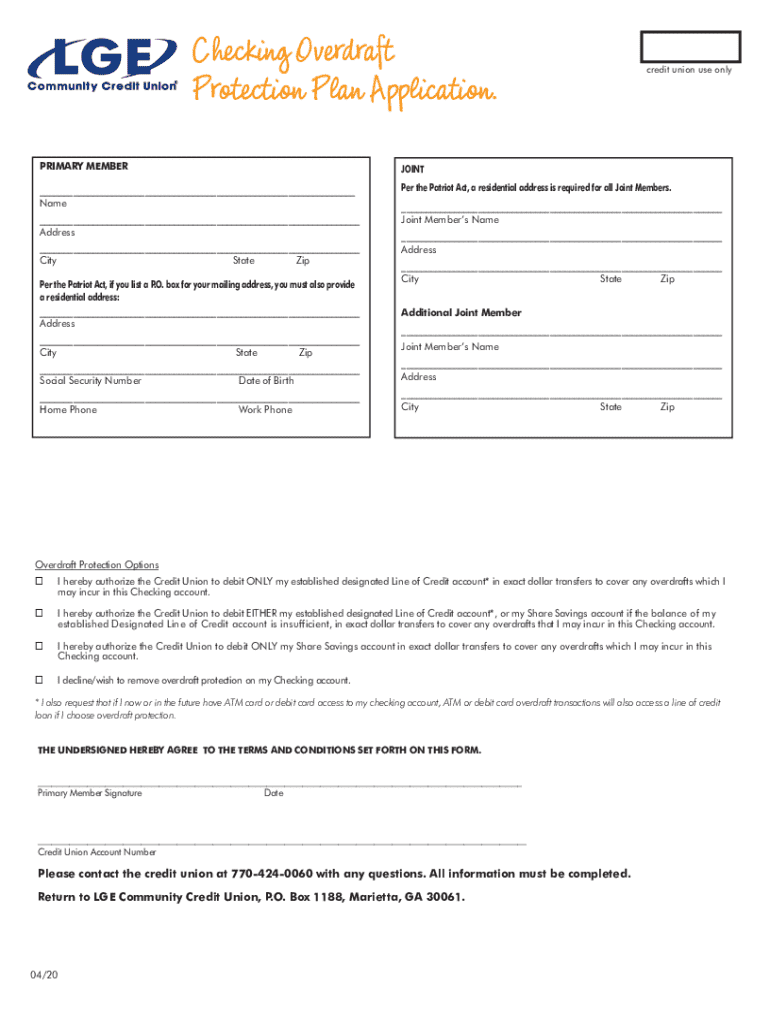

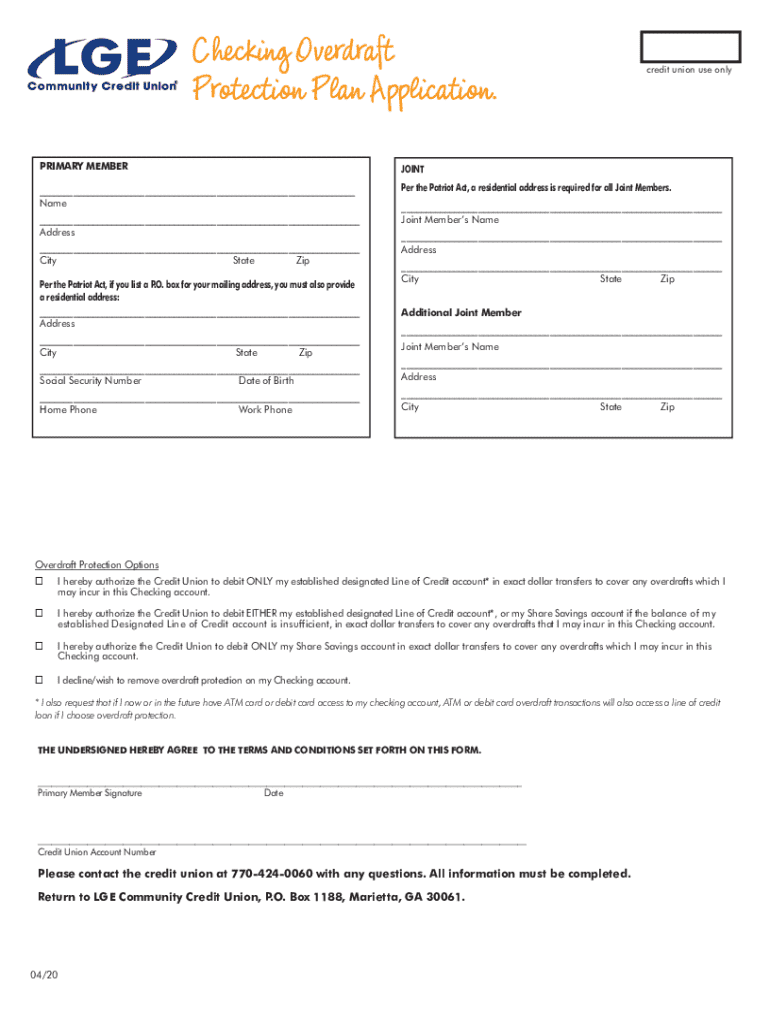

Get the free Checking Overdraft

Get, Create, Make and Sign checking overdraft

How to edit checking overdraft online

Uncompromising security for your PDF editing and eSignature needs

How to fill out checking overdraft

How to fill out checking overdraft

Who needs checking overdraft?

A comprehensive guide to completing your checking overdraft form

Understanding overdrafts

An overdraft occurs when you withdraw more money from your bank account than what is currently available. This can happen through checks, debit card transactions, or automated payments. Essentially, an overdraft allows you to continue making transactions even when your account balance falls below zero, but it's crucial to understand how this service works.

Overdrafts work by linking your checking account with either a savings account or a credit line, enabling you to cover any shortfalls temporarily. There are generally two types of overdraft services offered by banks: standard overdraft coverage, which may apply to certain types of transactions, and overdraft protection, which prevents your transactions from bouncing altogether.

While having an overdraft can provide a financial safety net, it's essential to weigh the benefits against the risks, such as incurring fees or damaging your credit score if not managed properly.

Overview of the checking overdraft form

The checking overdraft form is pivotal for individuals who wish to apply for or modify their overdraft services. Its primary purpose is to collect necessary information from the account holder to establish how the overdraft services will be utilized.

To successfully complete the form, you'll need to fill in several key pieces of information, including personal details such as your name and contact information, specific account details like account numbers, and your preferences regarding overdraft services.

Step-by-step guide to completing the checking overdraft form

To ensure a smooth application process, follow this detailed guide to fill out the checking overdraft form using pdfFiller.

Common issues when filling out the checking overdraft form

Completing the checking overdraft form accurately is crucial, but some common pitfalls can lead to submission delays. Misentering personal or account information can cause processing issues. It's also vital to understand the bank's policies on overdraft services to avoid misunderstandings.

Frequently asked questions (FAQs) often touch on topics like how to change your overdraft preferences or what to do if an error is spotted after submitting. Organizing your documents and keeping your account information handy can simplify this process.

Tracking the status of your overdraft application

Once you've submitted your application via the checking overdraft form, it's natural to want to know the status of your submission. Most banks provide a confirmation notification indicating that your form is under review.

You can typically track the progress of your overdraft application through the bank's website or mobile app. If your application isn't showing the expected progress, contacting customer support for clarification can provide insight into any issues or delays.

Managing your overdraft services

After establishing your overdraft services, ongoing management is vital. You can periodically assess and update your preferences based on your financial habits. Most banking platforms allow you to make these changes easily.

Additionally, to avoid overdraft fees, always monitor your account closely. Setting up alerts can help you stay informed about your balance. Embracing strategies for maintaining a healthy account balance, such as budgeting or using mobile banking tools, promotes good financial hygiene.

Utilizing pdfFiller for your document needs

pdfFiller offers a seamless experience for users needing to manage financial documents like the checking overdraft form. With features such as editing, eSigning, and an intuitive interface, it empowers individuals and teams to handle their documentation efficiently.

Moreover, the cloud-based nature of pdfFiller enables users to access their documents from anywhere, ensuring that important financial forms are always just a click away.

Resources and tools available

In addition to the checking overdraft form insights, pdfFiller offers a variety of resources to assist users. Interactive guides on various banking forms provide valuable tips and examples, while FAQs assist with common queries and concerns.

Effective document collaboration is essential in financial management, and pdfFiller delivers excellent tools to facilitate this process. Utilizing these resources can significantly enhance your document experience.

Personalizing your banking experience

Your overdraft preferences should align with your financial goals. As you set up or modify your checking overdraft form, consider how your decisions influence your overall finance management.

Personalizing your banking experience with custom alerts and notifications related to overdrafts can help you remain vigilant about your account balance. Staying proactive about your finances can significantly mitigate potential overdraft situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find checking overdraft?

Can I create an electronic signature for the checking overdraft in Chrome?

How do I complete checking overdraft on an iOS device?

What is checking overdraft?

Who is required to file checking overdraft?

How to fill out checking overdraft?

What is the purpose of checking overdraft?

What information must be reported on checking overdraft?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.