Get the free Section 36A in Insolvency and Bankruptcy Board of India ...

Get, Create, Make and Sign section 36a in insolvency

Editing section 36a in insolvency online

Uncompromising security for your PDF editing and eSignature needs

How to fill out section 36a in insolvency

How to fill out section 36a in insolvency

Who needs section 36a in insolvency?

Understanding Section 36A in the Insolvency Form

Overview of Section 36A in the insolvency form

Section 36A plays a vital role in the corporate insolvency resolution process, emphasizing the structured approach to manage insolvency. This section outlines not only the purpose of the insolvency form but also serves as a bridge between the various stakeholders involved in insolvency cases, including creditors, corporate debtors, and insolvency professionals.

The significance of Section 36A lies in its ability to clarify the obligations of the corporate debtor while providing a framework for the resolution process. By standardizing information required from debtors, Section 36A helps to streamline the filing process and makes it easier for all parties to understand their responsibilities.

Detailed examination of Section 36A regulations

A thorough understanding of the regulations encapsulated in Section 36A is imperative for effective compliance. The section predominantly focuses on the corporate debtor’s obligations during insolvency proceedings. This includes the need to submit detailed resolution plans and other pertinent information that impacts the resolution strategy.

The regulatory framework governing Section 36A is rooted in the Insolvency and Bankruptcy Board of India (IBBI) regulations. Understanding how Section 36A interfaces with related sections such as Section 25 on the powers and duties of the insolvency professional is crucial for those involved in insolvency cases.

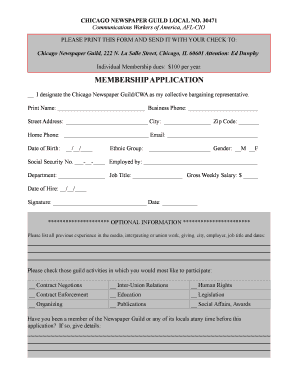

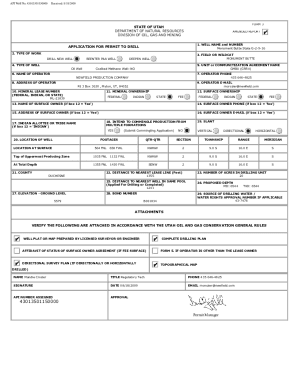

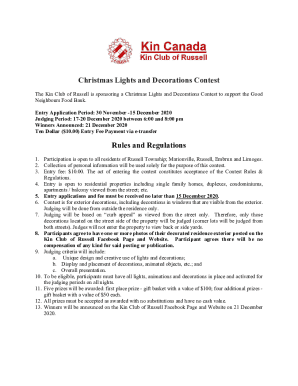

Step-by-step guide for filling out the Section 36A form

Filling out the Section 36A form correctly is crucial for successful insolvency proceedings. Pre-filling considerations include gathering all required documents such as financial statements and creditor details, ensuring the eligibility of the corporate debtor for filing under this section.

When completing the form, certain sections require meticulous attention. For instance, Section 1 demands accurate identification of the corporate debtor including the registration number, while Section 2 should detail the resolution plan to ensure creditors understand the proposed strategy. Understanding compliance declarations in Section 3 is also essential, as it verifies the debtor’s legal obligations during the insolvency process.

Editing and customizing the Section 36A form

Utilizing tools like pdfFiller can significantly enhance the ease of editing and customizing your Section 36A form. This platform allows you to make changes directly to the PDF form, ensuring that the final document meets compliance requirements and reflects the most accurate information concerning your insolvency case.

Customization can include integrating specific details regarding the corporate debtor or adapting the resolution plan to meet the unique circumstances of the insolvency. Leveraging interactive tools will enable a seamless experience as you collaborate with team members or insolvency professionals.

Signing and validating the Section 36A form

The signing process for the Section 36A form typically involves electronic signatures, which are accepted as legally binding. Understanding the requirements for digital signatures is critical since it streamlines the submission process and eliminates unnecessary delays in the insolvency proceedings.

The electronic signing process typically includes confirming the identity of the signer, which can be done through email verification or unique digital keys. The validity of e-signed documents is recognized in most legal frameworks, ensuring that your Section 36A filing holds up under scrutiny.

Managing and submitting the Section 36A form

After completing the Section 36A form, understanding the submission methods available is crucial. You may choose between digital submission, which is more efficient, or physical submission, depending on the requirements of the jurisdiction or the preferences of the insolvency professional.

Tracking submission status can also enhance accountability and allow for timely follow-ups. After submission, ensure to execute any required post-submission steps such as additional disclosures or attending hearings to maintain compliance with the insolvency proceedings.

Common issues and solutions related to Section 36A

Navigating the intricacies of Section 36A comes with its challenges, and many filers encounter recurring issues such as missing information or misunderstandings related to compliance declarations. Recognizing these challenges early can save considerable time and reduce the risk of rejection or resubmission.

Solutions include thorough checks of all required information and close collaboration with legal advisors or insolvency professionals. Tools available through pdfFiller can assist in identifying common pitfalls and offer suggestions on rectifying them efficiently.

Updates and amendments in Section 36A regulations

Staying informed about updates and amendments to Section 36A is crucial for maintaining compliance. Recent amendments may introduce stricter guidelines or clarify existing regulations, impacting how corporate debtors should engage with the insolvency process.

Notifications from the IBBI regarding changes in the regulatory landscape can be particularly significant. These changes might involve deadlines for submissions or data requirements that need to be adhered to promptly to avoid penalties.

Case studies and real-world examples

Analyzing successful applications of Section 36A in real insolvency cases reveals key insights for future filings. For instance, cases where debtors have effectively communicated their resolution plans using the guidelines provided by Section 36A often showcase better outcomes for both creditors and debtors.

Lessons learned from these examples emphasize the importance of transparency and prompt communication in the insolvency process. Simple adjustments based on these observations can significantly streamline the resolution process.

Frequently asked questions about Section 36A

Common queries surrounding Section 36A often include clarifications about eligibility, filing requirements, and the implications of non-compliance. Addressing these questions can alleviate concerns and foster smoother engagements during the insolvency process.

It’s essential for individuals and teams looking to file under this section to stay well-informed and prepared, as this can significantly impact the resolution's success. Engaging with professionals for advice can often clarify specific situations that might not be easily understood.

Conclusion: The role of Section 36A in the insolvency process

Section 36A serves as a crucial element in the insolvency landscape, prominently shaping the obligations and expectations of corporate debtors. Its proper understanding and application can markedly influence the effectiveness of the insolvency process and ultimately benefit all stakeholders involved.

Emphasizing the use of tools like pdfFiller can significantly ease the process of drafting, editing, managing, and signing the necessary forms. By doing so, individuals and teams can ensure compliance and clarity, thus fostering a constructive approach to insolvency resolution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out section 36a in insolvency using my mobile device?

How do I complete section 36a in insolvency on an iOS device?

How do I fill out section 36a in insolvency on an Android device?

What is section 36a in insolvency?

Who is required to file section 36a in insolvency?

How to fill out section 36a in insolvency?

What is the purpose of section 36a in insolvency?

What information must be reported on section 36a in insolvency?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.