Get the free Certificate of Deposit Account IRA - MY Safra Bank

Show details

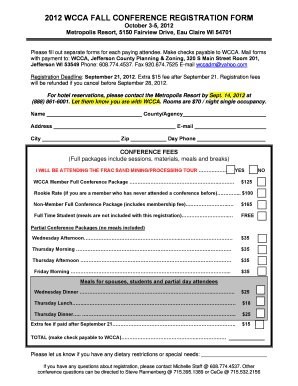

Certificate of Deposit Account IRA Mail to: M.Y. Sara Bank 499 Park Avenue, 10th Floor New York, N.Y. 10022 ? Use this form to: Open an IRA Certificate of Deposit account (CD) with M.Y. Sara Bank

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate of deposit account

Edit your certificate of deposit account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate of deposit account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit certificate of deposit account online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit certificate of deposit account. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certificate of deposit account

How to fill out a certificate of deposit account:

01

Start by gathering all the necessary documents - your identification (such as driver's license or passport), social security number, and any other information required by the bank or financial institution.

02

Visit the bank or financial institution and ask to open a certificate of deposit account. You may need to make an appointment with a bank representative or fill out an application form.

03

Provide all the requested information on the application form, such as your personal details, contact information, and employment details.

04

Choose the type of certificate of deposit account you want to open. There are various options available, such as fixed-term or variable-rate certificates. Consider your financial goals and needs when making this decision.

05

Deposit the desired amount of money into the certificate of deposit account. The minimum deposit requirement may vary depending on the institution. Ensure that you have the funds available to meet this requirement.

06

Review the terms and conditions of the certificate of deposit account and ask any questions you may have. Pay attention to the interest rate, maturity period, penalties for early withdrawal, and any other terms outlined by the bank.

07

Sign the necessary documents and provide any additional information requested by the bank.

08

Keep a copy of all the documents and agreements for your records.

09

Once the account is successfully opened, the bank will provide you with a certificate of deposit account number.

10

Monitor your certificate of deposit account periodically to track its maturity date, interest earnings, and any other relevant information.

Who needs a certificate of deposit account?

01

Individuals who want to earn higher interest rates on their savings while keeping their funds in a safe and secure account.

02

Investors who are looking for a low-risk investment option and are willing to commit their money for a specific period.

03

Those who are saving for specific financial goals, such as a down payment on a house, college tuition, or retirement.

04

Individuals who want to diversify their investment portfolio and spread their savings across different types of accounts.

05

People who prefer a fixed-term investment with predictable returns over high-risk investments like stocks or cryptocurrencies.

06

Those who have a surplus of funds and want to put their money to work without taking on significant risks.

07

Individuals who are planning for their future financial needs and want to ensure a steady income stream.

08

Anyone who wants to take advantage of tax benefits or incentives offered for certain types of certificate of deposit accounts.

09

Savers who prefer the stability and security of a bank or financial institution over other investment options.

10

Individuals who are seeking a reliable and conservative financial product that aligns with their risk tolerance and investment objectives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is certificate of deposit account?

A certificate of deposit (CD) account is a type of time deposit offered by banks and credit unions that typically pays a higher interest rate than a regular savings account.

Who is required to file certificate of deposit account?

Individuals who have opened a certificate of deposit account at a financial institution are required to file the necessary paperwork for tax reporting purposes.

How to fill out certificate of deposit account?

To fill out a certificate of deposit account, you will typically need to provide information such as your name, account number, the amount of the deposit, and the interest rate.

What is the purpose of certificate of deposit account?

The purpose of a certificate of deposit account is to earn a higher interest rate on your savings compared to a regular savings account.

What information must be reported on certificate of deposit account?

Information such as the amount of the deposit, the interest rate, and any earnings generated must be reported on a certificate of deposit account.

How do I make changes in certificate of deposit account?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your certificate of deposit account to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit certificate of deposit account straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing certificate of deposit account right away.

How do I complete certificate of deposit account on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your certificate of deposit account, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your certificate of deposit account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate Of Deposit Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.