Get the free Retirement Income & Taxation with NCDOR

Show details

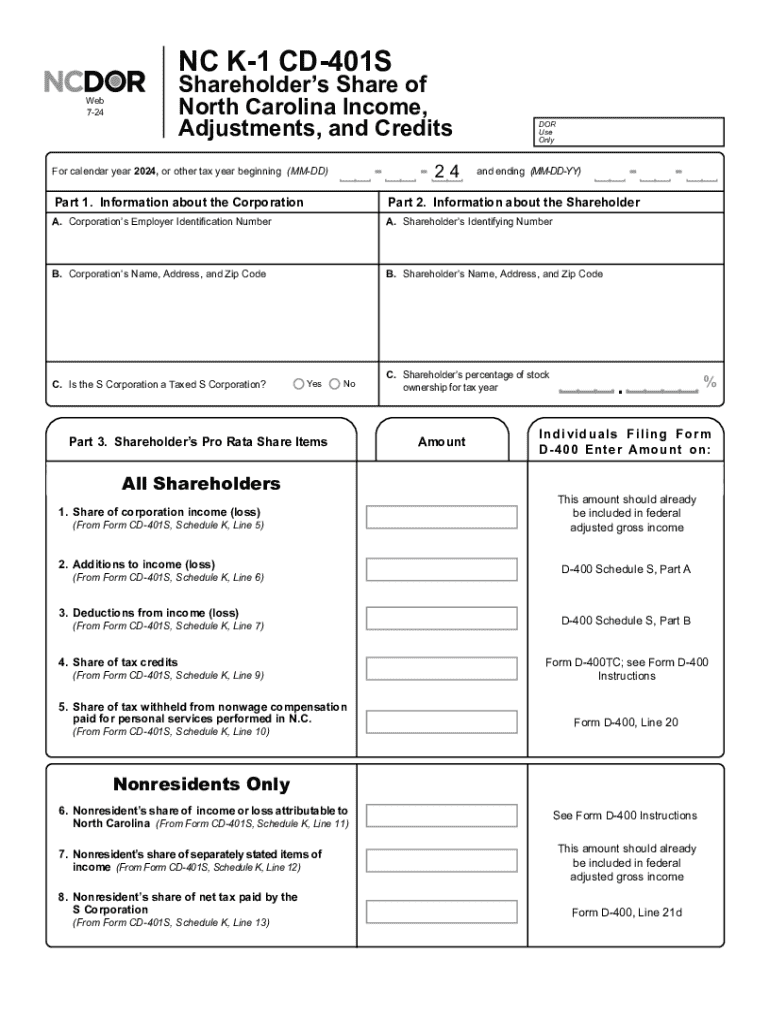

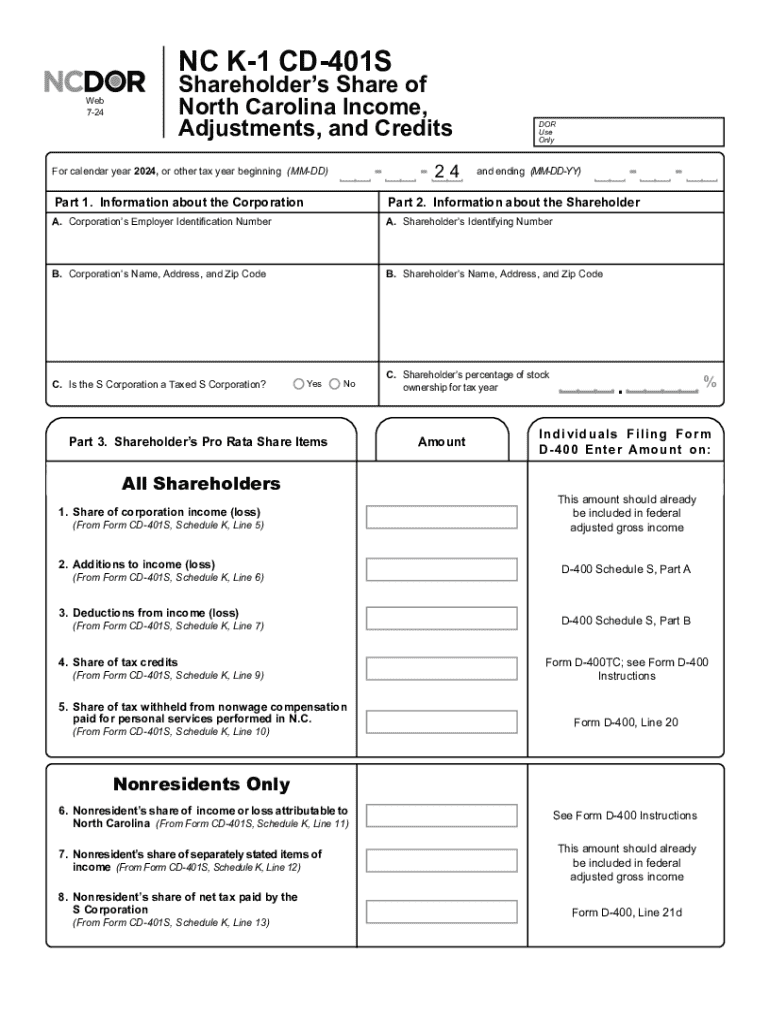

NC K1 CD401SShareholders Share of North Carolina Income, Adjustments, and CreditsWeb 72424For calendar year 2024, or other tax year beginning (MMDD)DOR Use Onlyand ending (MMDDYY)Part 1. Information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retirement income amp taxation

Edit your retirement income amp taxation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retirement income amp taxation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit retirement income amp taxation online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit retirement income amp taxation. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retirement income amp taxation

How to fill out retirement income amp taxation

01

Gather all relevant financial documents, including income sources and tax statements.

02

Identify all sources of retirement income, such as pensions, Social Security, and retirement accounts.

03

Calculate total retirement income by summing all sources.

04

Determine the tax implications for each source of income, as some may be taxable while others are not.

05

Complete the necessary tax forms, ensuring to include all retirement income and any deductions applicable to retirees.

06

Review the completed forms for accuracy and submit them to the appropriate tax authority.

Who needs retirement income amp taxation?

01

Individuals approaching retirement age who need to understand their financial situation.

02

Retirees seeking to manage their income and tax liabilities effectively.

03

Financial planners and advisors assisting clients with retirement planning.

04

Anyone currently receiving retirement income benefits and wanting to ensure compliance with tax laws.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute retirement income amp taxation online?

Filling out and eSigning retirement income amp taxation is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit retirement income amp taxation straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing retirement income amp taxation right away.

Can I edit retirement income amp taxation on an Android device?

The pdfFiller app for Android allows you to edit PDF files like retirement income amp taxation. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is retirement income amp taxation?

Retirement income refers to the money that individuals receive after they retire, which can include pensions, Social Security benefits, retirement account distributions, and annuities. Taxation on retirement income involves the federal and state taxes that may be applied to these sources of income, depending on various factors such as the type of account and the individual's tax bracket.

Who is required to file retirement income amp taxation?

Individuals are generally required to file a tax return if they receive retirement income that meets the minimum income thresholds set by the IRS, regardless of their age. This includes retirees who draw from pensions, annuities, and retirement accounts like 401(k)s and IRAs.

How to fill out retirement income amp taxation?

To fill out retirement income taxes, individuals must gather relevant tax documents such as 1099-R forms for distributions from retirement accounts. These amounts should be reported on the appropriate lines of the IRS Form 1040. Consideration should also be given to any deductions, tax credits, or exemptions related to retirement income.

What is the purpose of retirement income amp taxation?

The purpose of retirement income and its taxation is to provide individuals with financial support during their retirement years while also ensuring that the government collects revenue through taxes on that income. This taxation helps fund public services and benefits.

What information must be reported on retirement income amp taxation?

The information that must be reported includes total retirement distributions received during the tax year, including amount and sources, such as pensions, IRAs, and 401(k)s. Additionally, any taxes withheld and any applicable credits or deductions should be reported.

Fill out your retirement income amp taxation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retirement Income Amp Taxation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.