Get the free Credit and Debt - Department of Financial Services - NY.gov

Show details

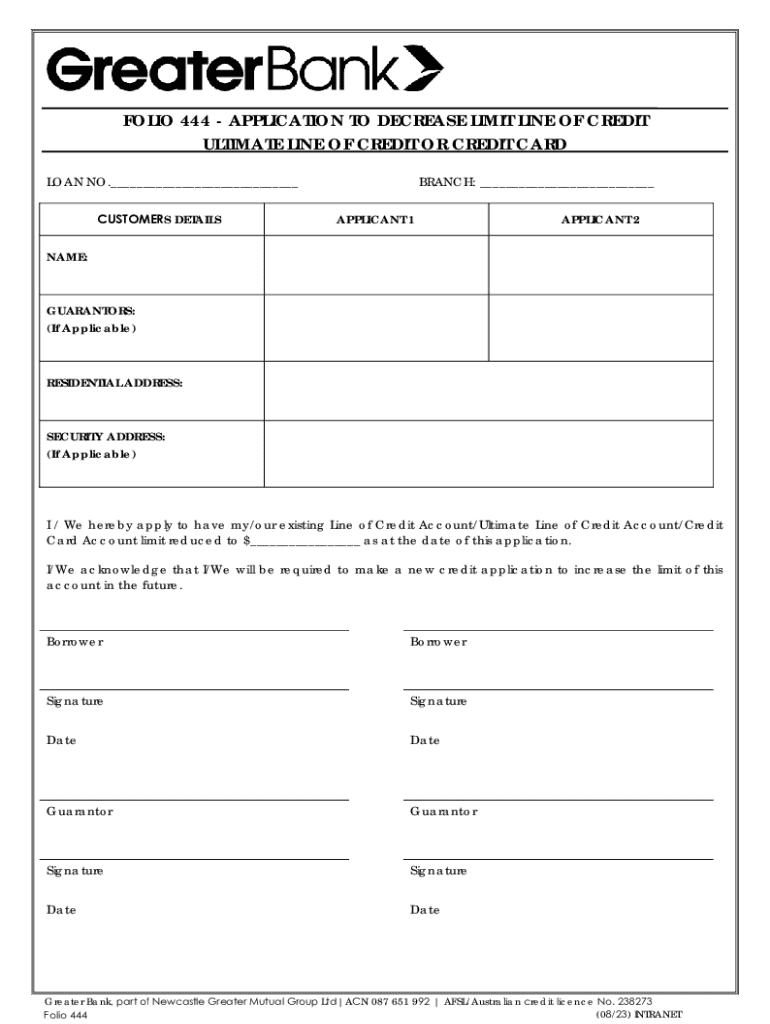

FOLIO 444 APPLICATION TO DECREASE LIMIT LINE OF CREDIT ULTIMATE LINE OF CREDIT OR CREDIT CARD LOAN NO.___ CUSTOMERS DETAILSBRANCH: ___ APPLICANT 1APPLICANT 2NAME:GUARANTORS: (If Applicable)RESIDENTIAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit and debt

Edit your credit and debt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit and debt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit and debt online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit and debt. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit and debt

How to fill out credit and debt

01

Gather your financial documents, including income statements and existing debts.

02

List all sources of income, including salary, side jobs, and passive income.

03

Identify your fixed expenses, such as rent, utilities, and loan payments.

04

Determine your variable expenses, including groceries, entertainment, and miscellaneous spending.

05

Calculate your total monthly income and total monthly expenses.

06

Use the difference between income and expenses to decide how much credit you need or how much debt to repay.

07

When applying for credit, fill out a credit application with accurate income and employment information.

08

If taking on debt, ensure you understand the terms, interest rates, and repayment schedules.

Who needs credit and debt?

01

Individuals looking to make large purchases, such as homes or cars.

02

Students seeking to finance their education through student loans.

03

Entrepreneurs needing capital to start or expand their businesses.

04

People looking to build or improve their credit scores for future financial opportunities.

05

Those managing ongoing monthly expenses and seeking temporary financial assistance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete credit and debt online?

pdfFiller has made it simple to fill out and eSign credit and debt. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit credit and debt on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign credit and debt. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I complete credit and debt on an Android device?

Complete credit and debt and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is credit and debt?

Credit is the ability to borrow money or access goods and services with the understanding that payment will be made in the future. Debt, on the other hand, is the amount of money that is owed to a lender or creditor.

Who is required to file credit and debt?

Individuals and entities that have taken on credit or have outstanding debts are typically required to file credit and debt, including businesses, lenders, and individuals with significant financial obligations.

How to fill out credit and debt?

To fill out credit and debt forms, gather all necessary financial documents, including loan agreements, credit card statements, and other statements of credit. Complete the forms by providing accurate information about your income, total debt, and any existing credit accounts.

What is the purpose of credit and debt?

The purpose of credit is to facilitate borrowing for consumers and businesses to make purchases or investments. Debt allows individuals and entities to manage cash flow, fund necessary expenses, and invest in growth opportunities.

What information must be reported on credit and debt?

Typically, information such as account details, total balance owed, payment history, and credit limits must be reported on credit and debt filings. Personal identifying information may also be required.

Fill out your credit and debt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit And Debt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.