Get the free Arizona Form 221 Underpayment of Estimated Tax by Individuals

Show details

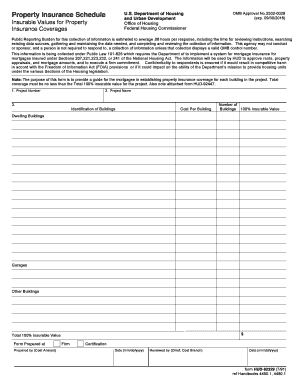

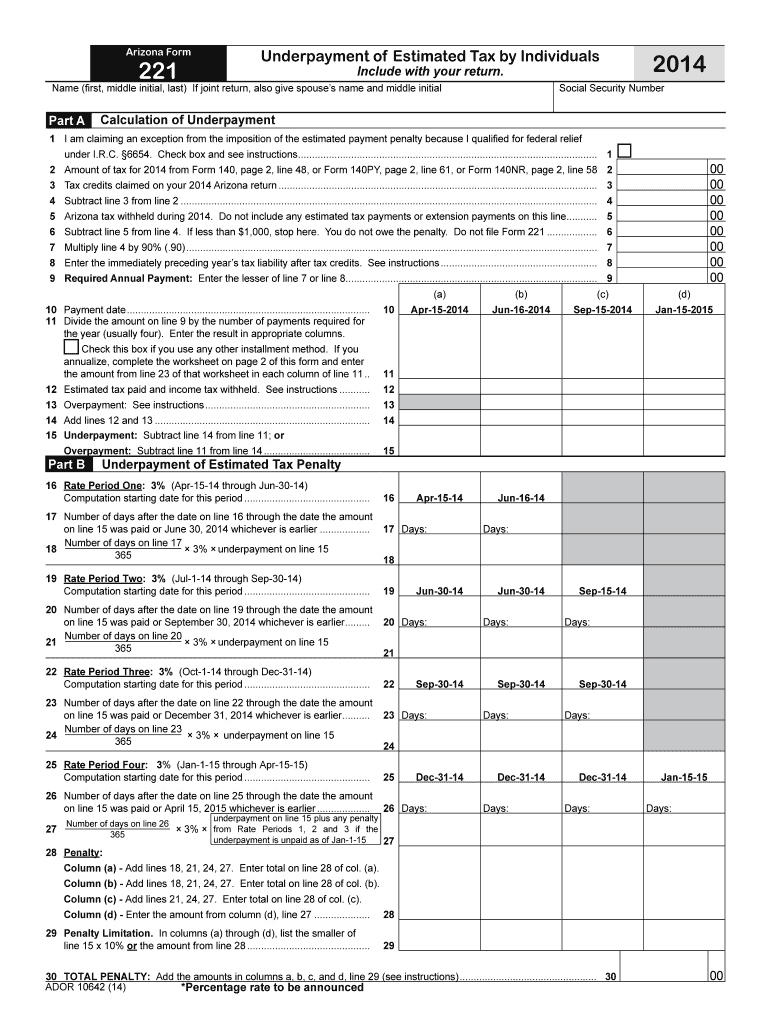

Arizona Form 221 Underpayment of Estimated Tax by Individuals Name (first, middle initial, last) If joint return, also give spouse s name and middle initial Part A 1 Social Security Number Calculation

We are not affiliated with any brand or entity on this form

Instructions and Help about arizona form 221 underpayment

How to edit arizona form 221 underpayment

How to fill out arizona form 221 underpayment

Instructions and Help about arizona form 221 underpayment

How to edit arizona form 221 underpayment

To edit Arizona Form 221 for underpayment, you may use pdfFiller’s tools that allow you to modify details directly on the form. First, upload the completed form to the pdfFiller platform. Use the editing options to make necessary changes. Ensure that any modifications reflect the most current and accurate information to avoid processing issues.

How to fill out arizona form 221 underpayment

Filling out Arizona Form 221 involves several clear steps:

01

Obtain the latest version of Form 221 from the Arizona Department of Revenue website.

02

Provide your name, Social Security number, and details about your income.

03

Calculate the amount of underpayment using the worksheet included with the form.

04

Review your calculations for accuracy before signing the form.

05

Submit the completed form, along with any required payments, by the deadline.

Latest updates to arizona form 221 underpayment

Latest updates to arizona form 221 underpayment

It is essential to stay updated on any changes to Arizona Form 221 as these may affect filing requirements and calculations. Check the Arizona Department of Revenue's official website for the most recent updates, such as changes to reporting requirements or deadlines.

All You Need to Know About arizona form 221 underpayment

What is arizona form 221 underpayment?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About arizona form 221 underpayment

What is arizona form 221 underpayment?

Arizona Form 221 is a tax form used by individual taxpayers to report and calculate underpayment penalties for state income tax. This form helps determine if you owe a penalty for not paying enough tax during the tax year.

What is the purpose of this form?

The purpose of Arizona Form 221 is to formally calculate any penalties due to underpayment of estimated taxes. It helps taxpayers comply with state tax requirements and ensure they pay the correct amount owed to avoid unnecessary fines.

Who needs the form?

Taxpayers who do not pay at least 90% of their total tax liability through withholding or estimated tax payments must complete Arizona Form 221. Additionally, those who had underpayment penalties assessed in previous years may also need to file this form.

When am I exempt from filling out this form?

You are exempt from filing Arizona Form 221 if you meet certain criteria, such as being a low-income taxpayer or if your total tax liability was less than $500 for the current year. Additionally, if you had no tax liability in the previous year, you may not need to file.

Components of the form

Arizona Form 221 includes several components, such as personal identification information, income details, and calculations for the underpayment penalty. It also contains a worksheet to aid in determining the accuracy of your calculations.

What are the penalties for not issuing the form?

If you fail to file Arizona Form 221 when required, you may incur penalties calculated based on the amount of underpayment and the duration of the underpayment period. These penalties can significantly increase the total amount owed to the state tax authority.

What information do you need when you file the form?

When filing Arizona Form 221, you need your federal income tax return, documentation of your estimated tax payments, and any other relevant financial information. Accurate reporting is critical to ensure correct calculations of penalties and potential payments.

Is the form accompanied by other forms?

No, Arizona Form 221 is typically filed as a standalone form. However, you may need to reference your federal tax returns or other state forms when reporting income and calculating your total tax liability.

Where do I send the form?

Completed Arizona Form 221 should be sent to the address provided on the form instructions. Ensure that you check the current mailing address, as it may vary each tax year. If e-filing is available, follow those guidelines to submit your form electronically.

See what our users say