Get the free 1 to our ITN 54354 - its fsu

Show details

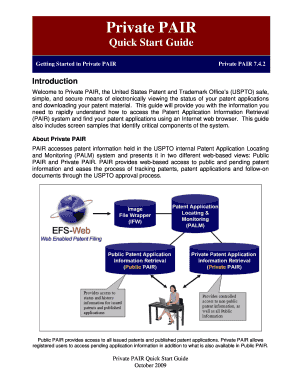

FLORIDA STATE UNIVERSITY PURCHASING DEPARTMENT A1400 UNIVERSITY CENTER TALLAHASSEE FL 323062370 ADDENDUM ACKNOWLEDGMENT FORM DATE: August 5, 2010, ADDENDUM NO. 1 to our ITN 54354 BID TITLE: Document

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1 to our itn

Edit your 1 to our itn form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1 to our itn form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1 to our itn online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 1 to our itn. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1 to our itn

How to Fill Out 1 to our ITN and Who Needs It?

How to fill out 1 to our ITN:

01

Gather necessary information: Before filling out the 1 to our ITN form, make sure you have all the required information handy. This can include personal details, such as your name, address, and contact information.

02

Determine the purpose: Identify the reason for filling out the form. The ITN (Import/Export) Number is typically required for individuals or businesses engaged in international trade. It allows you to import or export goods and commodities across borders.

03

Complete the form accurately: Carefully fill in all the required fields on the 1 to our ITN form. Double-check the information you provide to ensure accuracy. Mistakes or omissions may lead to delays or complications in the import/export process.

04

Submit the form: Once the form is completed, submit it according to the designated instructions. This may involve mailing the form to the appropriate government agency or submitting it online through their official website.

Who needs 1 to our ITN:

01

Importers: Individuals or businesses involved in importing goods into a country may need to obtain an ITN. This ensures compliance with customs regulations and allows for smooth importation processes.

02

Exporters: Likewise, exporters must obtain an ITN to comply with international trade regulations. It enables them to export goods to other countries legally and without unnecessary delays.

03

International Traders: Importers and exporters engaged in international trade activities, such as buying and selling goods across borders, need an ITN. This number helps track and monitor the flow of goods across international boundaries.

04

Customs Brokers: Customs brokers, who act as intermediaries between importers/exporters and government agencies, often require an ITN to assist their clients with the import/export process effectively.

Remember, the exact requirements for obtaining an ITN may vary depending on the specific country's regulations and trade agreements. It is always advisable to consult with the respective government agency or seek professional assistance if you have any doubts or questions regarding the ITN process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 1 to our itn directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your 1 to our itn as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make changes in 1 to our itn?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your 1 to our itn to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I edit 1 to our itn on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute 1 to our itn from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is 1 to our itn?

1 to our itn is a form used to report information about income received from sources outside the United States.

Who is required to file 1 to our itn?

Individuals or entities who receive income from foreign sources are required to file 1 to our itn.

How to fill out 1 to our itn?

1 to our itn can be filled out online or by mail. The form requires specific information about the foreign income received.

What is the purpose of 1 to our itn?

The purpose of 1 to our itn is to report foreign income and ensure compliance with tax laws.

What information must be reported on 1 to our itn?

Information such as the amount of foreign income received, the country of origin, and any taxes paid to that country must be reported on 1 to our itn.

Fill out your 1 to our itn online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1 To Our Itn is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.