Get the free Tax Increment Financing District Supplement

Show details

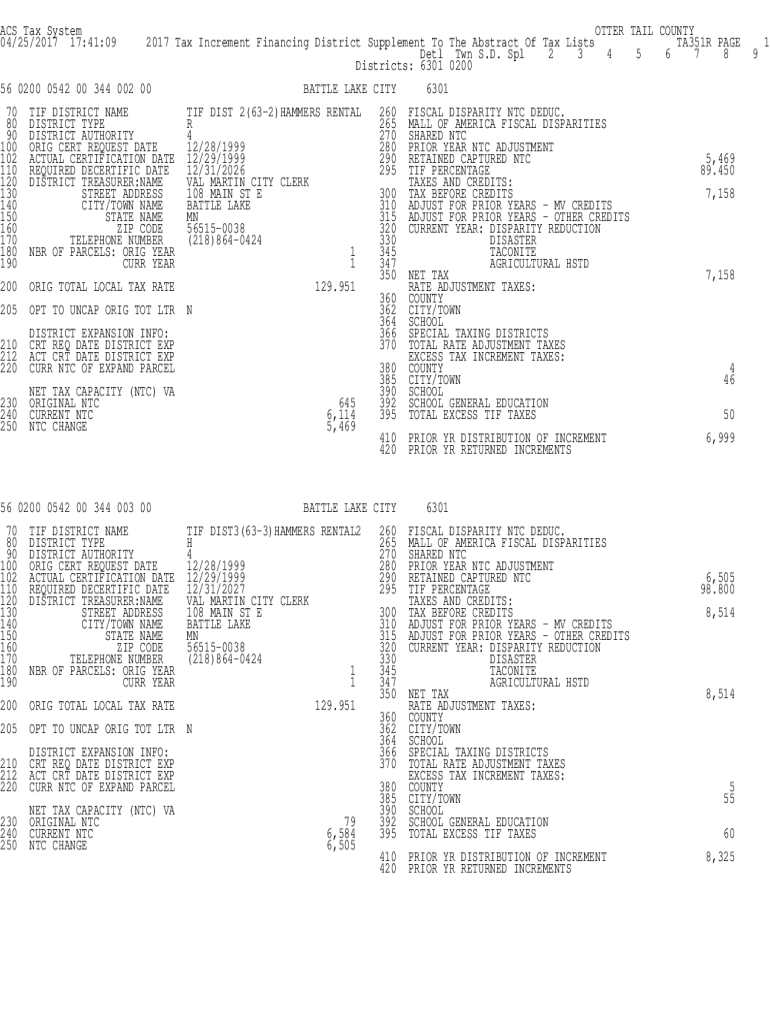

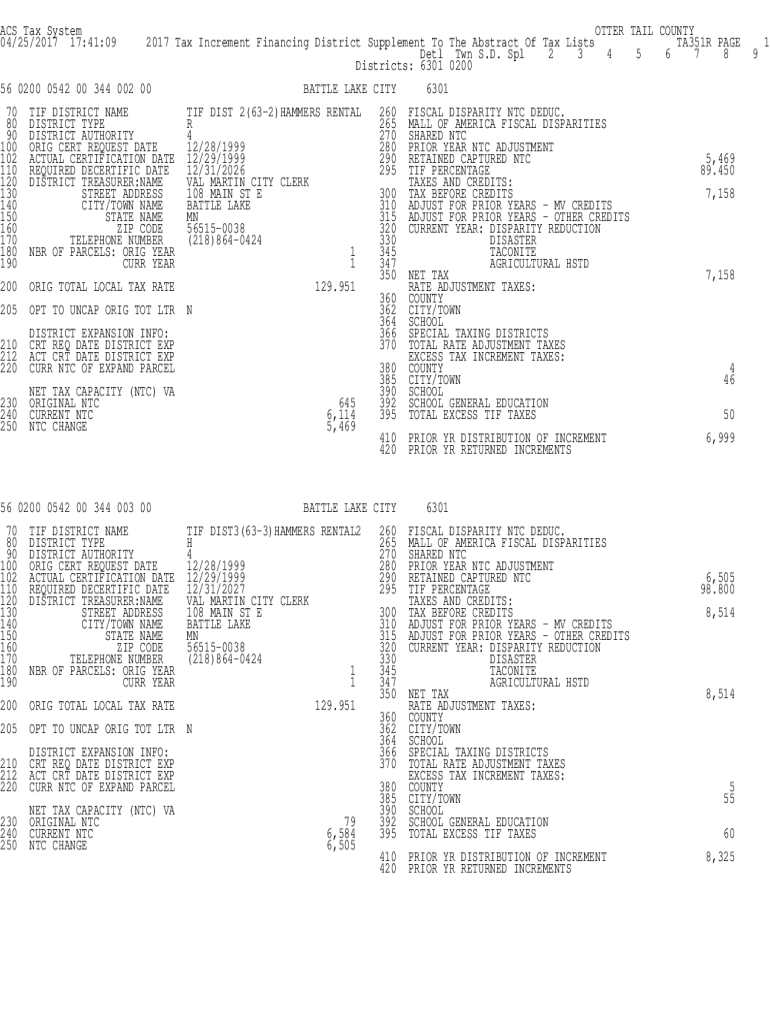

This document provides a comprehensive overview of tax increment financing (TIF) districts in Otter Tail County for the year 2017. It includes details on the creation date, fiscal disparities, retained captured net tax capacity, as well as the taxation metrics and authorities associated with various districts including Battle Lake, Fergus Falls, Henning, New York Mills, Pelican Rapids, and Perham.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax increment financing district

Edit your tax increment financing district form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax increment financing district form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax increment financing district online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax increment financing district. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax increment financing district

How to fill out tax increment financing district

01

Understand the purpose of a Tax Increment Financing (TIF) district.

02

Identify the area that qualifies for TIF, focusing on blighted or underdeveloped regions.

03

Conduct a baseline analysis of property values within the designated area.

04

Develop a redevelopment plan that outlines projected improvements and public investments.

05

Work with local government officials and stakeholders to gain support for the TIF district.

06

Submit the TIF proposal to the relevant municipal or county authorities for approval.

07

Hold public hearings to inform the community and gather feedback on the plan.

08

Finalize the TIF district boundaries and establish the tax increment financing mechanism.

09

Monitor and report on the progress of projects funded by the TIF as they develop.

Who needs tax increment financing district?

01

Local governments looking to stimulate economic development.

02

Property owners in blighted or underdeveloped areas seeking revitalization.

03

Developers interested in investing in new projects with public financing support.

04

Community organizations advocating for the improvement of neighborhood infrastructure.

05

Businesses aiming to expand or relocate to enhanced districts.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax increment financing district in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your tax increment financing district and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Where do I find tax increment financing district?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the tax increment financing district in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I edit tax increment financing district on an Android device?

The pdfFiller app for Android allows you to edit PDF files like tax increment financing district. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is tax increment financing district?

A tax increment financing district (TIF district) is a designated area in which the future tax revenues generated by increased property values are used to finance public improvements within the district.

Who is required to file tax increment financing district?

Typically, the local government or municipality that establishes the TIF district is required to file the necessary documentation to initiate and maintain the TIF financing.

How to fill out tax increment financing district?

To fill out a TIF district application, local authorities must provide information such as the boundaries of the district, the planned improvements, projected tax revenue increases, and the financing plan.

What is the purpose of tax increment financing district?

The purpose of a TIF district is to promote economic development by using the increase in property tax revenues, generated from enhanced property values, to fund infrastructure and community improvement projects.

What information must be reported on tax increment financing district?

Information that must be reported includes the baseline property tax revenue, the increment generated, the expenditures made, the status of projects, and future projections on revenues and expenditures.

Fill out your tax increment financing district online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Increment Financing District is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.