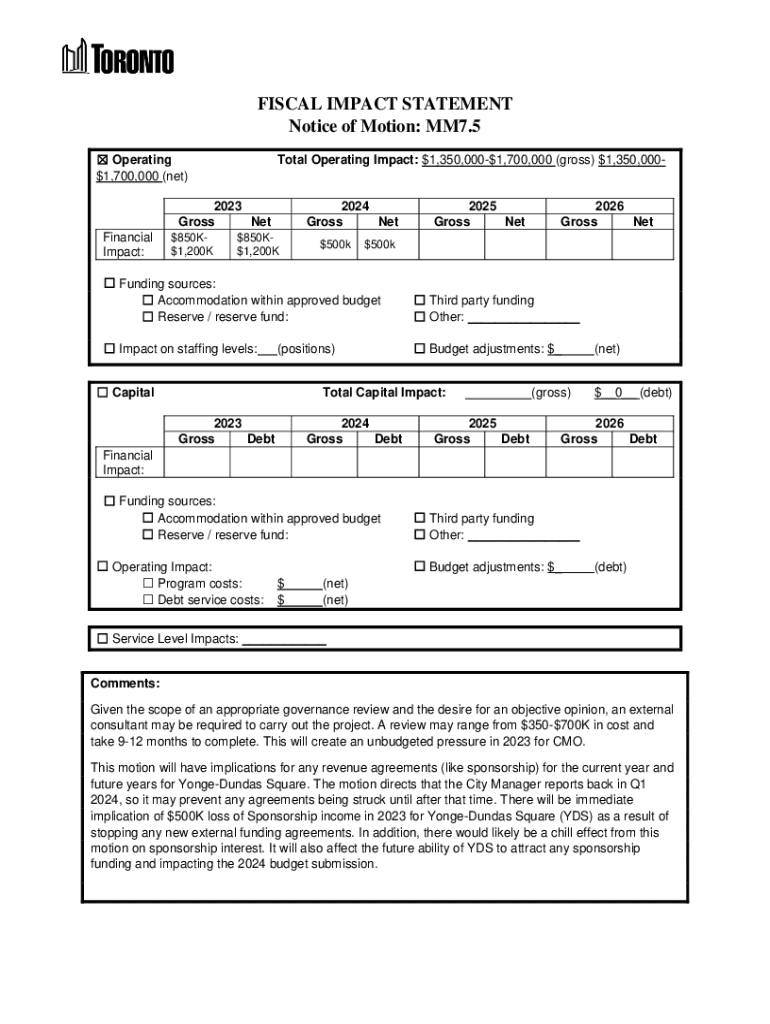

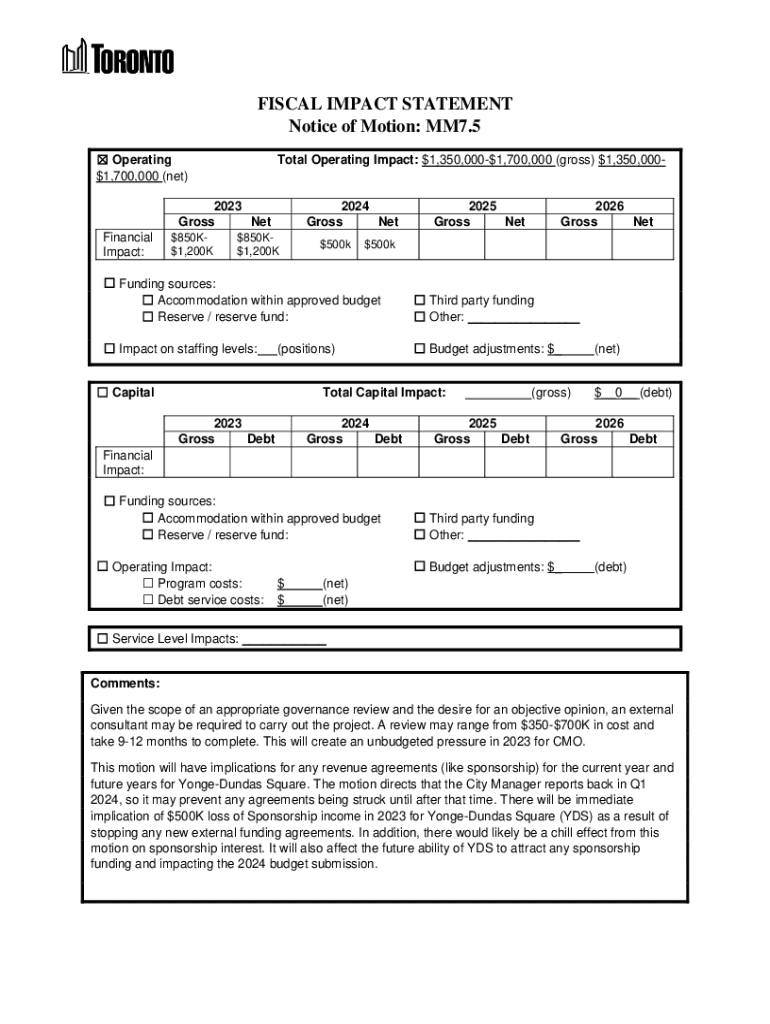

Get the free Fiscal Impact Statement for Motion MM7.5. Fiscal Impact Statement for Motion MM7.5

Show details

rlJill TORONffl FISCAL IMPACT STATEMENT Notice of Motion: MM7.5 Operating $1,700,000 (net)Total Operating Impact: $1,350,000$1,700,000 (gross) $1,350,0002023 Gross Net Financial Impact:$850K$1,200K2024

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiscal impact statement for

Edit your fiscal impact statement for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiscal impact statement for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fiscal impact statement for online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fiscal impact statement for. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiscal impact statement for

How to fill out fiscal impact statement for

01

Begin by gathering all relevant financial data related to the proposed project or policy.

02

Identify the costs associated with implementation, including one-time expenses and ongoing operational costs.

03

Estimate the potential revenue generated from the project or policy, if applicable.

04

Analyze the financial impact on existing budgets and resources, noting any funding gaps or shortages.

05

Document potential economic effects on the community, such as job creation or increased tax revenue.

06

Prepare a clear, concise report summarizing your findings and conclusions.

07

Review and revise the statement to ensure accuracy and clarity before submission.

Who needs fiscal impact statement for?

01

Government agencies considering new projects or policy changes.

02

Local municipalities evaluating the financial sustainability of initiatives.

03

Non-profit organizations seeking funding or support from governmental bodies.

04

Stakeholders and community members interested in understanding fiscal implications.

05

Financial analysts and researchers studying the economic effects of proposed legislation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fiscal impact statement for directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your fiscal impact statement for and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I execute fiscal impact statement for online?

pdfFiller makes it easy to finish and sign fiscal impact statement for online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an eSignature for the fiscal impact statement for in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your fiscal impact statement for and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is fiscal impact statement for?

A fiscal impact statement assesses the financial effects of proposed legislation or policy changes on government budgets and resources.

Who is required to file fiscal impact statement for?

Typically, government agencies, lawmakers, or other entities proposing legislation or policy changes are required to file a fiscal impact statement.

How to fill out fiscal impact statement for?

To fill out a fiscal impact statement, one must include details about the proposed legislation, estimated financial effects, and any assumptions or methods used for calculations.

What is the purpose of fiscal impact statement for?

The purpose of a fiscal impact statement is to inform policymakers and the public about the anticipated economic implications of a proposal, helping them make better-informed decisions.

What information must be reported on fiscal impact statement for?

Information that must be reported includes the estimated costs, revenues, funding sources, and any potential economic impacts on government budgets.

Fill out your fiscal impact statement for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiscal Impact Statement For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.