Get the free Critical Illness Insurance - BenefitHelp

Show details

Coloniallife.com Critical Illness Insurance How will you pay for what your health insurance won't? Help preserve your lifestyle with Colonial s Critical Illness Insurance Chances are, you know someone

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign critical illness insurance

Edit your critical illness insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your critical illness insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit critical illness insurance online

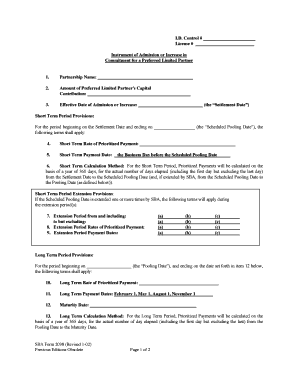

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit critical illness insurance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

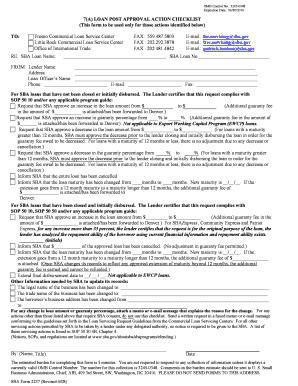

How to fill out critical illness insurance

How to fill out critical illness insurance:

01

Gather necessary documents: Before filling out the application for critical illness insurance, make sure to have important documents ready, such as identification, medical records, and any relevant financial information.

02

Research insurance providers: Explore different insurance providers and compare their policies, coverage options, and premium rates. Consider factors like reputation, customer reviews, and financial stability of the company.

03

Understand the policy: Read the terms and conditions of the critical illness insurance policy thoroughly. Familiarize yourself with the coverage details, exclusions, waiting periods, and benefit payout structure. If you have any questions or concerns, reach out to the insurance provider for clarification.

04

Evaluate your needs: Assess your personal circumstances, medical history, and financial goals to determine the appropriate amount of coverage. Consider factors such as outstanding debts, medical expenses, living expenses in case of illness, and potential loss of income.

05

Complete the application: Fill out the application form for critical illness insurance accurately and honestly. Provide all the required information, including personal details, medical history, lifestyle choices, and any pre-existing conditions. Inaccurate or incomplete information may result in denial of claim in the future.

06

Declare pre-existing conditions: It is important to disclose any pre-existing medical conditions while filling out the application. Failure to do so may lead to claim denial or cancellation of the policy later on if the insurance provider discovers the undisclosed information.

07

Pay attention to medical examinations: Depending on the insurance policy and your age, you may be required to undergo a medical examination to assess your health condition. Cooperate fully with any medical tests or examinations requested by the insurance provider.

08

Review and sign the policy: Once the application is completed, carefully review all the details of the critical illness insurance policy before signing it. Double-check for any errors or discrepancies and ensure that the policy reflects your desired coverage.

09

Make premium payments: After submitting the application, follow the instructions provided by the insurer to pay the premiums for your critical illness insurance. Timely payment is essential to maintain coverage.

Who needs critical illness insurance:

01

Individuals without sufficient savings: Critical illness insurance can be beneficial for individuals who do not have substantial savings to cover medical expenses or financial obligations in the event of a serious illness.

02

Self-employed or freelance workers: If you are self-employed or work on a freelance basis, you may not have access to employee benefits such as disability insurance. Critical illness insurance can provide a safety net to protect your finances during an extended illness.

03

Breadwinners or primary caregivers: If you are the main source of income for your family or the primary caregiver, critical illness insurance can help ensure that your loved ones are financially supported in the event of a serious illness that may prevent you from working.

04

Individuals with a family history of critical illnesses: If you have a family history of certain critical illnesses, such as cancer or heart disease, you may consider obtaining critical illness insurance to provide financial security in case you develop those conditions.

05

Those with high deductible health plans: Critical illness insurance can help cover the gap left by high deductible health insurance plans, providing additional financial protection in the face of medical expenses.

06

Individuals seeking peace of mind: Even if you have some savings or health insurance coverage, critical illness insurance can provide peace of mind by offering an additional layer of financial protection in case of a serious illness.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is critical illness insurance?

Critical illness insurance is a type of insurance policy that provides a lump-sum payment if the policyholder is diagnosed with a serious illness covered by the policy.

Who is required to file critical illness insurance?

Individuals who wish to have coverage for critical illnesses are required to purchase and maintain a critical illness insurance policy.

How to fill out critical illness insurance?

To fill out a critical illness insurance policy, individuals need to provide personal information, medical history, and details of the coverage they require.

What is the purpose of critical illness insurance?

The purpose of critical illness insurance is to provide financial support to policyholders who are diagnosed with serious illnesses, helping them cover medical expenses and other financial obligations.

What information must be reported on critical illness insurance?

Critical illness insurance applications typically require details such as personal information, medical history, lifestyle habits, and information about the desired coverage.

How do I edit critical illness insurance in Chrome?

critical illness insurance can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for signing my critical illness insurance in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your critical illness insurance right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit critical illness insurance on an iOS device?

You certainly can. You can quickly edit, distribute, and sign critical illness insurance on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your critical illness insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Critical Illness Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.