Get the free Role of Forensic Accounting in Corporate

Show details

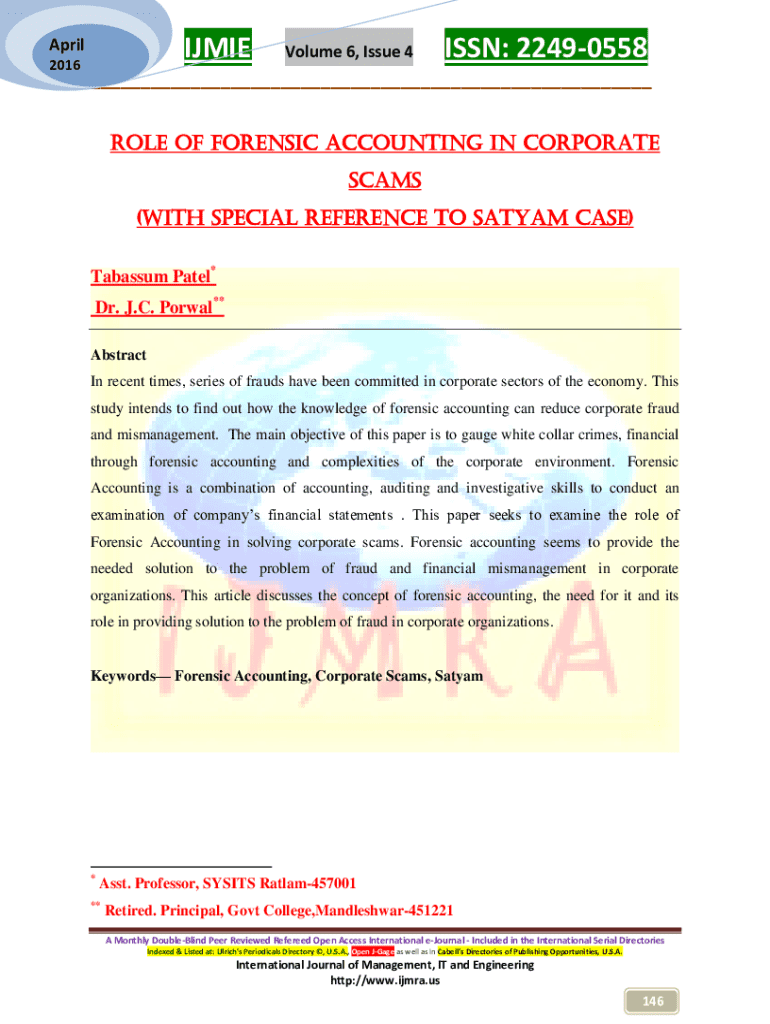

IJMIEApril 2016Volume 6, Issue 4ISSN: 22490558___ Role of Forensic Accounting in Corporate Scams (With special reference to Satyam Case) Tabassum Patel* Dr. J.C. Porwal** Abstract In recent times,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign role of forensic accounting

Edit your role of forensic accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your role of forensic accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

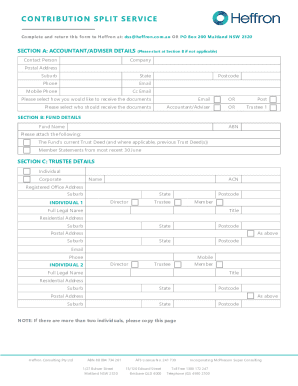

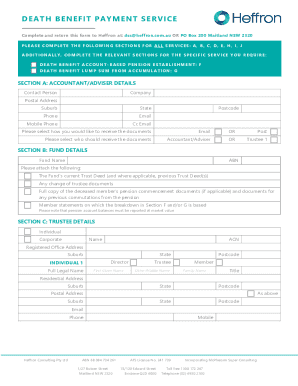

How to edit role of forensic accounting online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit role of forensic accounting. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out role of forensic accounting

How to fill out role of forensic accounting

01

Understand the fundamentals of accounting and auditing principles.

02

Gain expertise in fraud detection techniques and forensic investigation methods.

03

Acquire knowledge of relevant laws and regulations regarding financial crimes.

04

Develop strong analytical skills to interpret financial data and identify anomalies.

05

Obtain certification in forensic accounting, such as CPA or CFE.

06

Practice effective communication skills to present findings in reports and court testimonies.

07

Stay updated on industry trends, tools, and technology used in forensic accounting.

Who needs role of forensic accounting?

01

Businesses facing financial discrepancies or fraud.

02

Law enforcement agencies investigating financial crimes.

03

Legal professionals requiring expert testimony in court cases.

04

Insurance companies assessing claims related to fraud.

05

Government agencies conducting audits or investigations.

06

Individuals needing personal financial investigations or disputes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my role of forensic accounting in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign role of forensic accounting and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I send role of forensic accounting to be eSigned by others?

When your role of forensic accounting is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit role of forensic accounting online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your role of forensic accounting and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

What is role of forensic accounting?

Forensic accounting involves the application of accounting principles and investigative techniques to examine financial statements and other financial data to determine whether fraud, mismanagement, or other financial misconduct has occurred.

Who is required to file role of forensic accounting?

Individuals or organizations involved in legal disputes, fraud investigations, or any form of litigation related to financial matters may be required to file reports or documentation related to forensic accounting.

How to fill out role of forensic accounting?

Filling out a role of forensic accounting involves documenting financial transactions, analyzing financial records, and providing clear and detailed findings in a report format that meets legal standards.

What is the purpose of role of forensic accounting?

The purpose of forensic accounting is to uncover, understand, and provide evidence regarding financial discrepancies, fraud, or criminal activity for use in legal proceedings or investigations.

What information must be reported on role of forensic accounting?

The report should include detailed financial analysis, identification of fraudulent activities, documentation of evidence, methodologies used, and conclusions drawn from the investigation.

Fill out your role of forensic accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Role Of Forensic Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.