Get the free how a supplemental trust deed is drafted form

Show details

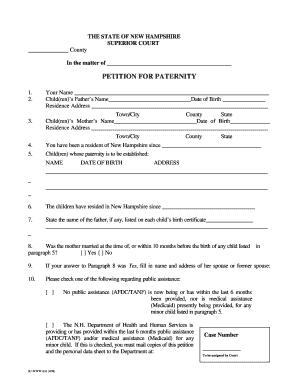

Draft Supplemental Trust Deed Dated 23 October 2007 United Test and Assembly Center Ltd as Company and Chicory Trustee Company Limited as Trustee SUPPLEMENTAL TRUST DEED relating to the Trust Deed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how a supplemental trust

Edit your how a supplemental trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how a supplemental trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing how a supplemental trust online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit how a supplemental trust. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how a supplemental trust

How to Fill Out a Supplemental Trust:

01

Gather all relevant documents: Start by gathering all the necessary documents such as the original trust agreement, any amendments or modifications, and any other supporting documents related to the supplemental trust.

02

Review the instructions: Carefully review the instructions provided with the supplemental trust form. This will give you a clear understanding of the requirements and any specific information that needs to be included in the form.

03

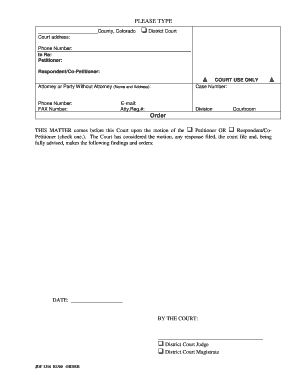

Provide personal information: Begin by providing your personal information, including your full name, address, and contact details. You may also be required to provide additional information such as your social security number or other identification numbers.

04

Identify the main trust: Clearly identify the main trust by providing its name, date of creation, and the jurisdiction under which it was established. This information will help establish the connection between the supplemental trust and the main trust.

05

State the purpose of the supplemental trust: Clearly state the purpose of the supplemental trust and the reasons behind its creation. This can include specifying the assets or funds being transferred to the trust, any specific instructions for how the assets should be managed, or any beneficiaries associated with the trust.

06

Specify the trustees and beneficiaries: Clearly identify the trustees who will be responsible for managing the trust and carrying out its instructions. Provide their full names, contact details, and any additional information required. Similarly, identify the beneficiaries who will benefit from the trust and provide their relevant information as well.

07

Include any necessary provisions: Depending on the specific requirements of the supplemental trust, you may need to include additional provisions such as specific instructions for managing the trust, restrictions or limitations on the use of trust assets, or any other relevant provisions.

Who Needs a Supplemental Trust:

01

Individuals with existing trusts: People who already have a trust in place may need a supplemental trust to address changes in their circumstances or to add additional provisions. This allows them to make amendments and additions to their existing trust without having to create an entirely new trust.

02

Families with special needs dependents: Families with dependents who have special needs often establish supplemental trusts to ensure that their loved ones are provided for even after their own passing. These trusts can provide ongoing support and specific instructions for the care and management of assets for the benefit of the special needs individual.

03

Estate planning purposes: Individuals who wish to enhance their estate planning strategies may utilize supplemental trusts to maximize tax benefits, protect assets, or distribute assets in a specific manner. These trusts can help ensure that their intentions are carried out according to their wishes and can be designed to meet their unique needs.

In conclusion, filling out a supplemental trust involves gathering the necessary documents, carefully reviewing the instructions, providing personal information, identifying the main trust, stating the purpose, specifying trustees and beneficiaries, and including any necessary provisions. This type of trust is commonly used by individuals with existing trusts, families with special needs dependents, and those seeking to enhance their estate planning strategies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is how a supplemental trust?

A supplemental trust is a legal arrangement that allows assets to be held by a trustee on behalf of a beneficiary.

Who is required to file how a supplemental trust?

Beneficiaries of a supplemental trust are typically required to file the trust on their tax returns.

How to fill out how a supplemental trust?

To fill out a supplemental trust, you will need to gather information about the trust assets, income, and beneficiaries.

What is the purpose of how a supplemental trust?

The purpose of a supplemental trust is to protect and manage assets on behalf of a beneficiary.

What information must be reported on how a supplemental trust?

Information on trust assets, income, distributions, and beneficiaries must be reported on a supplemental trust.

How can I manage my how a supplemental trust directly from Gmail?

how a supplemental trust and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I execute how a supplemental trust online?

pdfFiller has made filling out and eSigning how a supplemental trust easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit how a supplemental trust on an Android device?

You can edit, sign, and distribute how a supplemental trust on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your how a supplemental trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How A Supplemental Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.