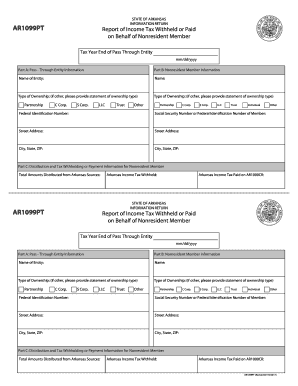

AR AR1099PT 2024-2025 free printable template

Get, Create, Make and Sign arkansas ar1099pt form

How to edit arkansas income withheld paid member online

Uncompromising security for your PDF editing and eSignature needs

AR AR1099PT Form Versions

How to fill out arkansas report income 2024-2025

How to fill out AR AR1099PT

Who needs AR AR1099PT?

Video instructions and help with filling out and completing arkansas report income

Instructions and Help about arkansas report income 2024-2025

Okay so here we have a brand new ar-15 lower receiver made by CMM G we're going to go and backfill all the lower receiver markings we're going to use testers paint we're going to use red, and we're going to use white alright so the first thing that we want to do is we want to take and degrease our receiver, so you can see you got some tape markings from the factory where they put a sticker we're going to be filling in everything on this receiver so before anything you want to degrease it make sure it's free and clear of all debris x' and once you have a degreased then we can go ahead and start the painting process okay so for degreasing I'm actually going to use a solution of simple green and water about a cat full of simple green inside a water bottle a spray bottle and that should be okay for what we're going to do so we're going to go ahead spray the whole thing off everybody has different methods for degreasing everybody has different concepts this is the way that I like to do it and so this is how we're going to do it for this video plain and simple you just need to degrease a receiver that way you can make sure that the paint that you put in adheres properly, and you don't have any problems so let's go ahead and finish cleaning this off for the next step if you have any business cards they're they're perfect to use I'm going to go ahead and use one of my business cards, and we're going to cut little sections just like this we're going to go ahead, and we're going to use our business cards when we apply the paint onto the receiver we're actually going to take we're going to scrape it and that's going to help us when we go and use the nail polish remover to clean off the receiver since we're going to use red and white obviously right here on the semi we're going to paint that red and right here on safe we're going to paint that white I'm going to go ahead and do everything else white because I think it looks perfect that way if you're going to do red and white you want to make sure, and you want to do the red first once you have the red done, and it's completely dry you might want to wait about an hour after you get it completely done then go ahead and do the white because if you accidentally get some of this white over here on the red it's going to turn it pink so let's go ahead and start with the red first we'll get it completely done and dried, and then we're going to go ahead and do the rest of the white okay so starting off with the red we're going to go ahead, and we're going to do we're going to do our semi right there so let's go ahead and start with that alright, so we're going to use a toothpick we're going to get a little of paint on it, and we're just going to go ahead, and we're going to drop it in just like that all right, so you can see we got some red paint there we're going to go ahead, and we're going to take our business card that we just cut up we're just going to thin it out just a little there we go that's good enough...

People Also Ask about

Where can I get Arkansas state tax forms?

What is the difference between composite and PTE?

What is the Arkansas non resident withholding tax?

What is a AR1099PT?

What is form AR1000NR?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit arkansas report income 2024-2025 from Google Drive?

Where do I find arkansas report income 2024-2025?

How do I complete arkansas report income 2024-2025 on an iOS device?

What is AR AR1099PT?

Who is required to file AR AR1099PT?

How to fill out AR AR1099PT?

What is the purpose of AR AR1099PT?

What information must be reported on AR AR1099PT?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.