Get the free PRE-APPLICATION DISCLOSURE AND FEE AGREEMENT FOR USE BY NEW YORK REGISTERED MORTGAGE...

Show details

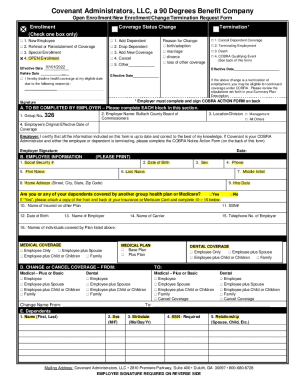

NEW YORK PRE-APPLICATION DISCLOSURE AND FEE AGREEMENT FOR USE BY NEW YORK REGISTERED MORTGAGE BROKERS Pursuant to N.Y. Comp. Codes R. & Reg's. Tit. 3, 38.3(a)(1). Company Name: Address: Telephone:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pre-application disclosure and fee

Edit your pre-application disclosure and fee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pre-application disclosure and fee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pre-application disclosure and fee online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pre-application disclosure and fee. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pre-application disclosure and fee

01

To fill out the pre-application disclosure and fee, start by reading the instructions provided with the form. These instructions will guide you through the process and ensure that you provide all the necessary information accurately.

02

Gather all the required documents and information before starting to fill out the form. This may include personal identification information, financial statements, and any other supporting documents requested.

03

Begin by carefully entering your personal information in the designated fields, such as your name, address, contact details, and social security number.

04

Follow the instructions to provide information about the purpose of the application, such as whether it is for a loan, credit card, rental application, or any other relevant purpose.

05

Provide accurate and detailed information about your financial background, such as your income, employment details, expenses, and any debts or liabilities.

06

If applicable, disclose any co-applicant or co-signer information, including their personal and financial details.

07

Make sure to answer all questions truthfully and to the best of your knowledge. Double-check that you have not missed any essential information or sections of the form.

08

Review the completed form thoroughly for any errors or missing information. Correct any mistakes before submitting the form to avoid delays or rejections.

09

Once you have filled out the form accurately and completely, check if there is a fee associated with the pre-application. If a fee is required, follow the instructions provided to make the payment. Retain proof of payment for your records.

Who needs pre-application disclosure and fee?

01

Individuals who are applying for a loan from a financial institution, such as a bank or credit union, may be required to fill out a pre-application disclosure and fee form.

02

Individuals seeking to rent a property or apply for housing may also need to complete this form as part of the application process.

03

Some credit card companies may require a pre-application disclosure and fee for those interested in obtaining a credit card.

In summary, anyone applying for a loan, rental property, or credit card may need to fill out a pre-application disclosure and fee form. It is essential to carefully follow the instructions, provide accurate information, and pay any required fees to ensure a smooth application process.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of a mortgage broker?

Mortgage brokers research loan options and negotiate with lenders on behalf of their clients. A broker can also pull the buyer's credit reports, verify their income and expenses and coordinate all of the loan paperwork.

Do brokers charge for pre approval?

There's no cost for getting a home loan pre-approval from a mortgage broker or a bank. The reason for this is that the lender you choose will pay the mortgage broker.

What is the agreement between broker and owner?

A brokerage agreement helps a property owner/buyer to authorize a real estate broker to find a buyer/seller for the property on their terms for which they pay the commission to the broker.

What is meant by broker agreement?

The brokerage agreement is a formal agreement between the buyer/seller and the broker. If any dispute should arise between these two parties, this agreement will be the source to understand which duty each party had in the agreement.

What is a mortgage broker agreement?

A mortgage broker agreement is a contract that outlines the terms of service and compensation, typically between a bank and a mortgage company or brokerage. Both parties sign this document before any work begins, ensuring that expectations are clear from the beginning.

When must a broker provide the mortgage fee agreement after receiving an application for a mortgage loan in SC?

(A) Within three business days of the receipt of an application for a mortgage loan, the broker must provide a mortgage broker fee agreement that discloses the total estimated charges to the borrower for the mortgage loan and an itemization of the charges provided if required under, federal or state law.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the pre-application disclosure and fee in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your pre-application disclosure and fee in minutes.

Can I create an eSignature for the pre-application disclosure and fee in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your pre-application disclosure and fee and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete pre-application disclosure and fee on an Android device?

Use the pdfFiller mobile app and complete your pre-application disclosure and fee and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is pre-application disclosure and fee?

Pre-application disclosure and fee refer to the requirement for certain applicants to submit specific information and pay a fee before formally applying for a permit or approval.

Who is required to file pre-application disclosure and fee?

Typically, individuals or entities seeking permits or approvals for certain projects, such as construction or environmental assessments, are required to file pre-application disclosures and fees.

How to fill out pre-application disclosure and fee?

To fill out the pre-application disclosure, applicants should provide all requested information accurately, complete any required forms, and include the appropriate fee as specified by the relevant authority.

What is the purpose of pre-application disclosure and fee?

The purpose of the pre-application disclosure and fee is to ensure that relevant authorities have early access to project details, facilitate informed decision-making, and fund the review process.

What information must be reported on pre-application disclosure and fee?

Information typically required includes the applicant's details, project description, location, potential impacts, and any relevant prior approvals or permits.

Fill out your pre-application disclosure and fee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pre-Application Disclosure And Fee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.