Get the free Tax Appeal Petition

Show details

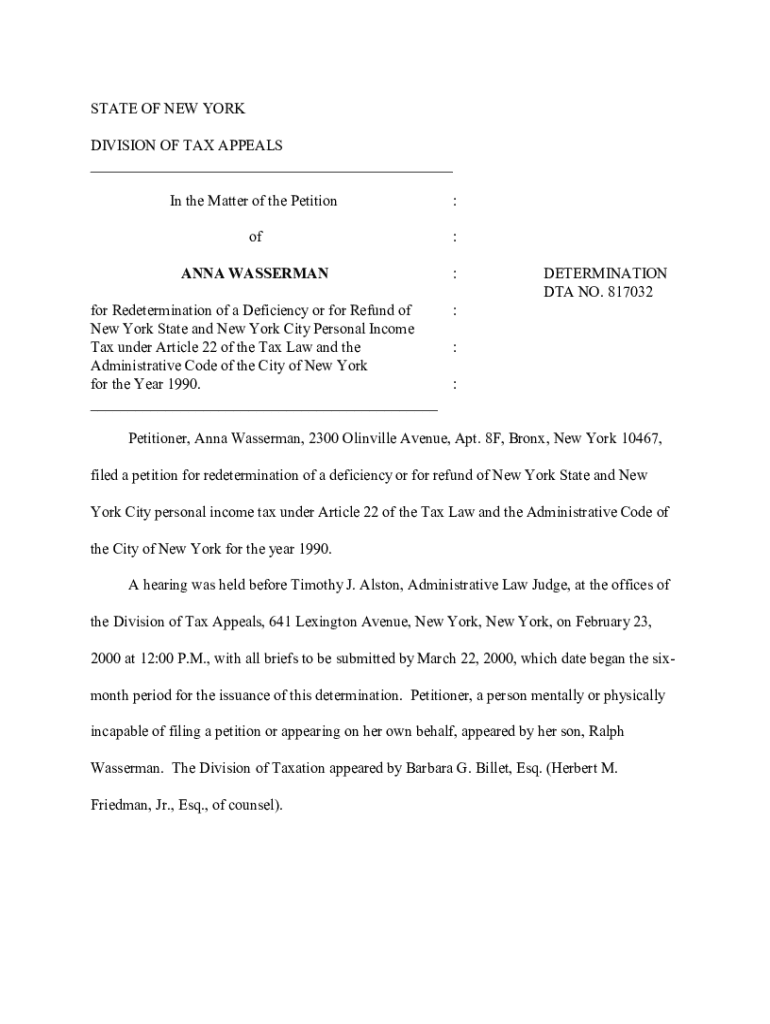

This document outlines the determination of a tax appeal case involving Anna Wasserman, who petitioned for a redetermination of a deficiency or for a refund of New York State and City personal income tax for the year 1990. The case discusses the denial of the refund claim by the Division of Taxation based on statutory limitations under Tax Law § 687(a).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax appeal petition

Edit your tax appeal petition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax appeal petition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax appeal petition online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax appeal petition. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

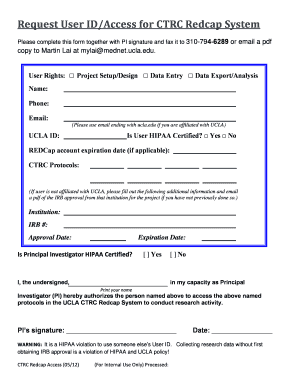

How to fill out tax appeal petition

How to fill out tax appeal petition

01

Gather all necessary documents, including property tax bills and assessment notices.

02

Determine the reason for the appeal, such as incorrect property value or classification.

03

Fill out the tax appeal petition form accurately, providing all requested information.

04

Clearly state your case, referencing any supporting evidence or comparable property assessments.

05

Submit the completed petition form along with any required documents to the appropriate tax assessment office.

06

Pay attention to deadlines for submitting the petition according to local regulations.

07

Prepare for a potential hearing by organizing your arguments and evidence.

Who needs tax appeal petition?

01

Homeowners who believe their property has been overvalued for tax purposes.

02

Business owners disputing their business property assessment.

03

Property owners seeking to reduce their tax burden after improvements or changes have been made.

04

Individuals who receive a notice of a significant change in their property assessment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax appeal petition to be eSigned by others?

Once your tax appeal petition is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I fill out tax appeal petition using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign tax appeal petition and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I fill out tax appeal petition on an Android device?

Complete tax appeal petition and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is tax appeal petition?

A tax appeal petition is a formal request filed by a taxpayer to challenge the assessment of property taxes or the determination made by a tax authority, seeking a reassessment or a change in the tax liability.

Who is required to file tax appeal petition?

Any taxpayer who disagrees with their property tax assessment or any determination made by tax authorities is generally required to file a tax appeal petition.

How to fill out tax appeal petition?

To fill out a tax appeal petition, taxpayers typically need to provide information such as their personal details, property description, the assessment they are disputing, reasons for the appeal, and any supporting documentation necessary to substantiate their claim.

What is the purpose of tax appeal petition?

The purpose of a tax appeal petition is to allow taxpayers the opportunity to contest their tax assessments and potentially reduce their tax liabilities.

What information must be reported on tax appeal petition?

A tax appeal petition must typically report personal identification information, property details, the assessment amount being contested, reasons for the appeal, and any evidence supporting the claim.

Fill out your tax appeal petition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Appeal Petition is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.