Get the free ARIZONA FORM 323 Credit for Contributions to Private School Tuition Organizations 2013

FAQ about arizona form 323 credit

What should I do if I need to correct mistakes on my arizona form 323 credit after submission?

If you've made an error on your arizona form 323 credit after submission, you should submit an amended form to correct the mistakes. Be sure to indicate that this is an amended submission. Keeping a record of the original and corrected forms is essential for your records.

How can I verify the status of my arizona form 323 credit after filing?

To verify the status of your arizona form 323 credit after filing, you can check online through the Arizona Department of Revenue's website or by contacting their support. They typically provide updates on receipt and processing status, which can help address any concerns you may have.

What are common errors when filing the arizona form 323 credit and how can I avoid them?

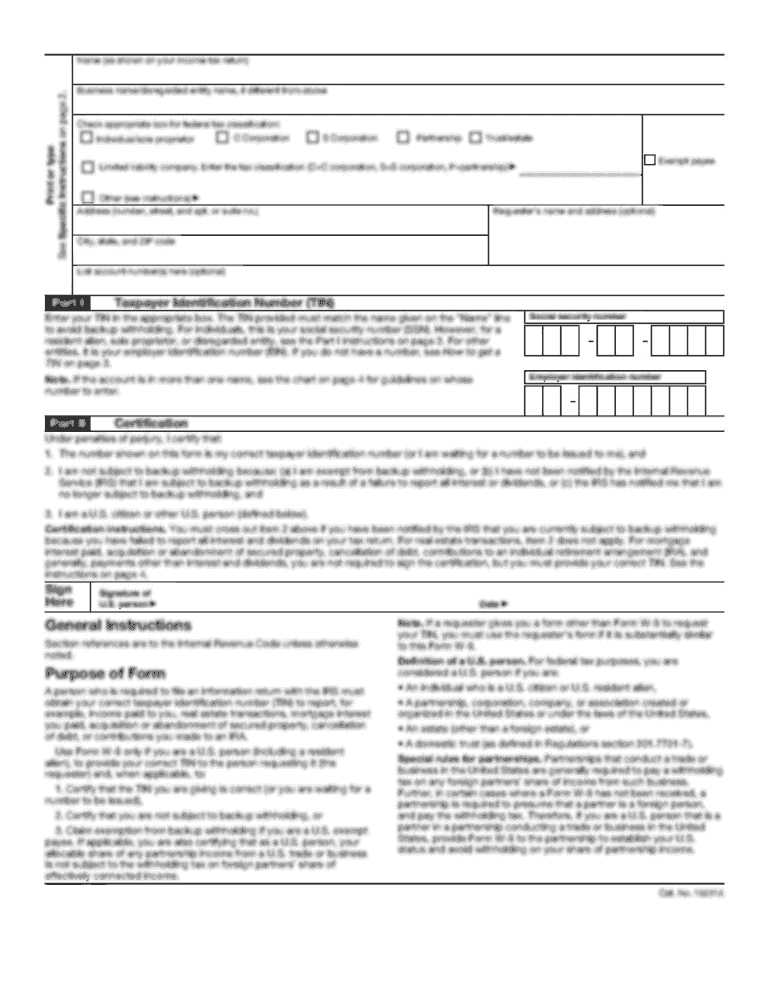

Common errors when filing the arizona form 323 credit include incorrect tax identification numbers and mismatched amounts. To avoid these issues, double-check all entries for accuracy and ensure that all figures align with your financial documents before submission.

What steps should I take if my arizona form 323 credit submission is rejected?

If your arizona form 323 credit submission is rejected, review the rejection notice for specific reasons. Common issues might include missing information or incorrect formats. After addressing the problems identified, resubmit the form using the corrected data.

How long do I need to retain records related to my arizona form 323 credit?

Records related to your arizona form 323 credit should be retained for at least four years after the filing date. This retention period ensures that you have sufficient documentation in case of an audit or to address any questions regarding your submission.