Get the free Sanlam Corporate: Group Risk

Show details

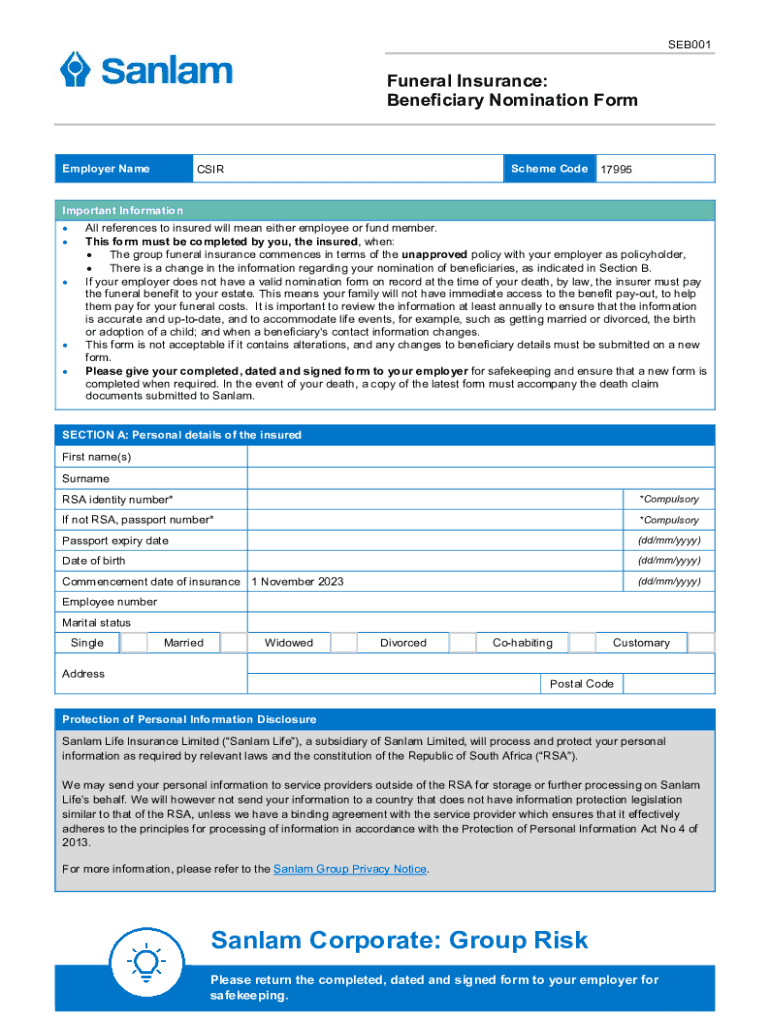

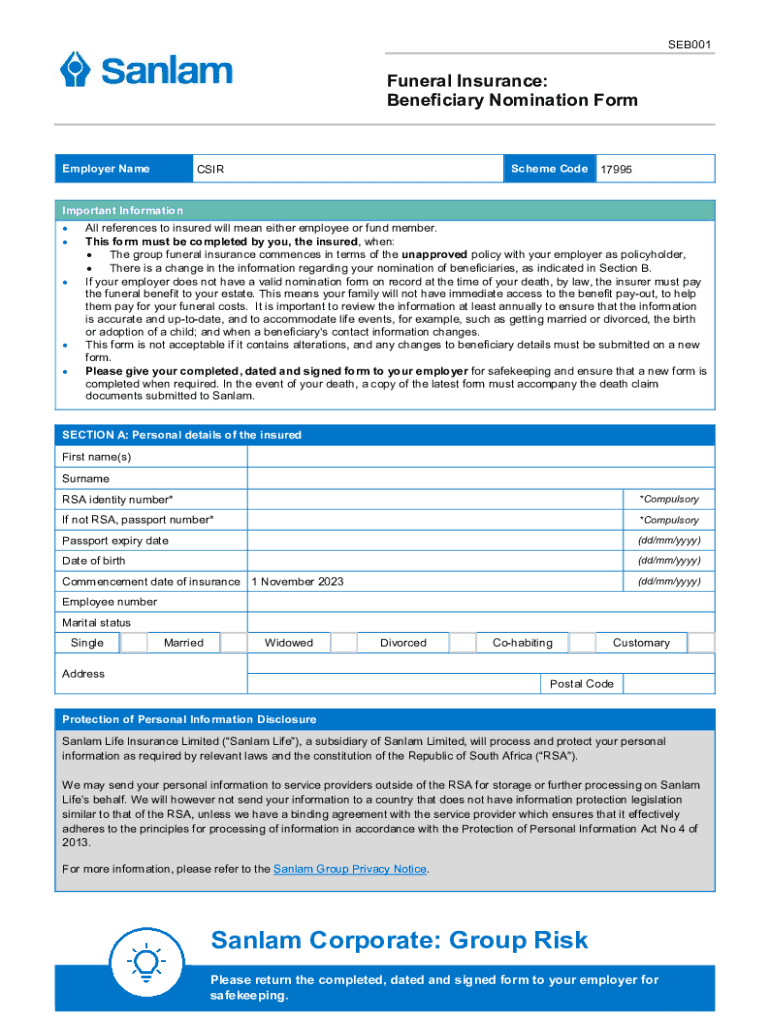

SEB001Funeral Insurance: Beneficiary Nomination FormEmployer NameScheme CodeCSIR17995Important Information All references to insured will mean either employee or fund member. This form must be completed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sanlam corporate group risk

Edit your sanlam corporate group risk form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sanlam corporate group risk form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sanlam corporate group risk online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sanlam corporate group risk. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sanlam corporate group risk

How to fill out sanlam corporate group risk

01

Gather necessary company information, including details of employees to be covered.

02

Choose the type of cover needed, such as life insurance, disability, or critical illness.

03

Fill out the application form accurately, providing all required information about employees.

04

Ensure that you understand the terms, coverage limits, and exclusions of the policy.

05

Submit the completed application along with any required supporting documents to Sanlam.

Who needs sanlam corporate group risk?

01

Businesses seeking to provide employee benefits to enhance workforce security and retention.

02

Companies wanting to protect their employees against unforeseen circumstances.

03

Organizations that are required to comply with labor laws mandating employee insurance coverage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sanlam corporate group risk to be eSigned by others?

When you're ready to share your sanlam corporate group risk, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an eSignature for the sanlam corporate group risk in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your sanlam corporate group risk and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit sanlam corporate group risk on an Android device?

You can make any changes to PDF files, such as sanlam corporate group risk, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is sanlam corporate group risk?

Sanlam corporate group risk is a type of insurance product offered by Sanlam that provides financial protection to companies against the risks associated with the loss of key employees, such as through death or disability. It aims to safeguard the business's financial stability and help with succession planning.

Who is required to file sanlam corporate group risk?

Companies that have taken out Sanlam corporate group risk policies are required to file the necessary documentation. This typically includes employers who wish to ensure coverage for their employees under such policies.

How to fill out sanlam corporate group risk?

To fill out Sanlam corporate group risk documentation, companies need to provide specific information regarding their employees, coverage amounts, and any other relevant details as required by Sanlam. It is advisable to consult with a Sanlam representative for guidance and to ensure all necessary information is accurately completed.

What is the purpose of sanlam corporate group risk?

The purpose of Sanlam corporate group risk is to provide financial security to businesses in the event of the loss of key personnel. It helps manage financial risks associated with employee loss and aids in maintaining business continuity.

What information must be reported on sanlam corporate group risk?

Companies must report information such as employee details, coverage amounts desired, the nature of risks, and other relevant policy details to Sanlam. This ensures that the coverage is tailored accurately to the business's needs.

Fill out your sanlam corporate group risk online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sanlam Corporate Group Risk is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.