Get the free Plan Year vs. Fiscal Year - Retirement Plans in General

Show details

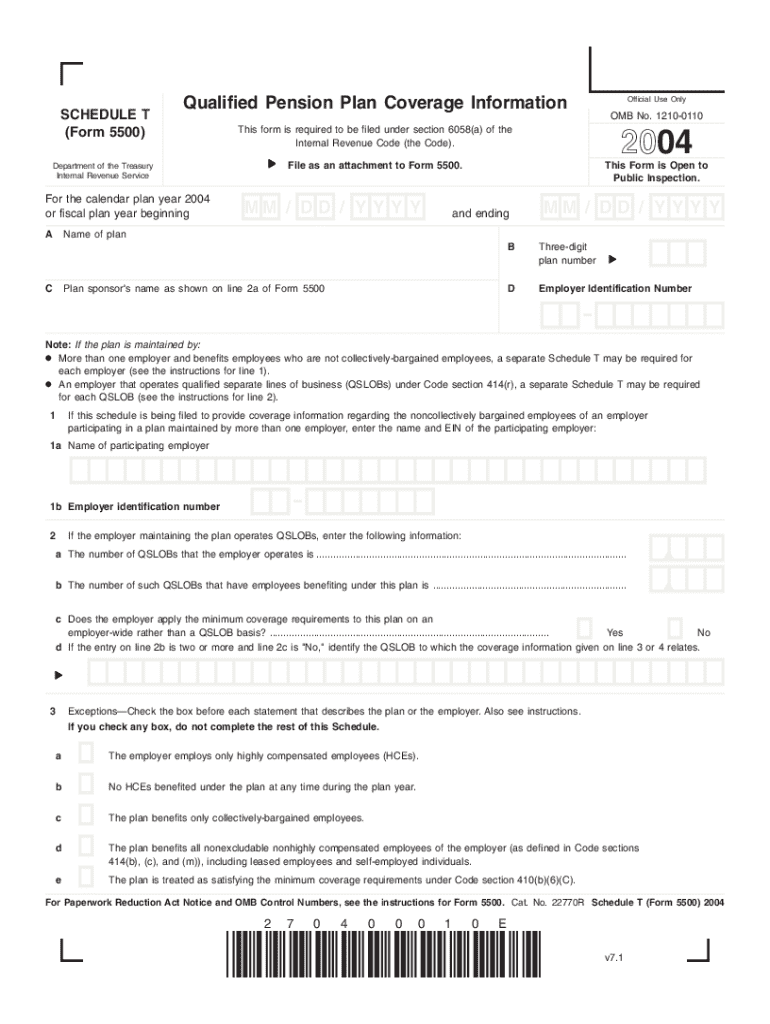

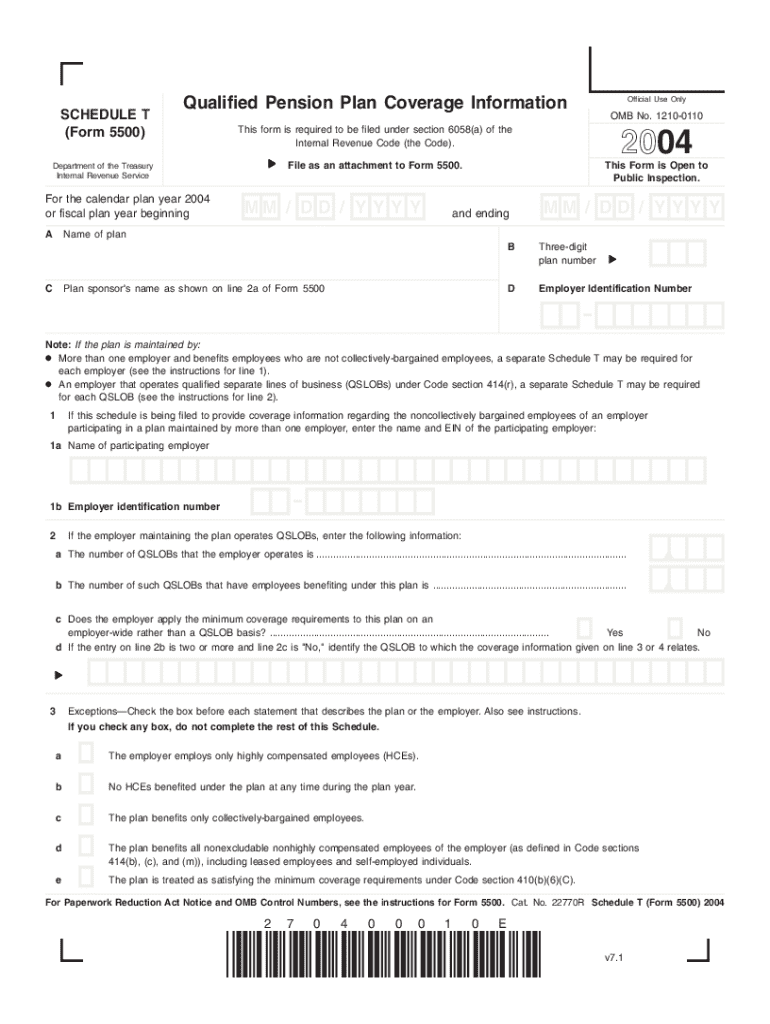

Department of the Treasury Internal Revenue ServiceFor the calendar plan year 2004 or fiscal plan year beginningOMB No. 121001102004This Form is Open to Public Inspection.File as an attachment to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign plan year vs fiscal

Edit your plan year vs fiscal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your plan year vs fiscal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit plan year vs fiscal online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit plan year vs fiscal. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out plan year vs fiscal

How to fill out plan year vs fiscal

01

Determine the overall goals and objectives of your organization for the upcoming year.

02

Identify the time frame for your plan year; it could be January to December or a different set of months.

03

Outline the key activities, programs, or projects that will take place during your plan year.

04

Assign budgetary allocations for each activity or department for the plan year.

05

For fiscal years, identify the starting and ending months (e.g., April to March) as specified by your organization.

06

Map out revenue and expenses according to the fiscal year timeline.

07

Ensure compliance with any applicable regulations regarding financial reporting for both plan year and fiscal year.

08

Review and adjust your plans as needed to align with organizational priorities, ensuring all stakeholders are informed.

Who needs plan year vs fiscal?

01

Organizations that have specific programs or projects that span a calendar year may use a plan year.

02

Businesses that are required to report their financials in accordance with accounting standards may use a fiscal year.

03

Non-profits that align their funding cycles with grant timelines often need a plan year.

04

Government entities that operate on a specific budget cycle typically utilize a fiscal year.

05

Companies looking to match their financial performance with seasonal business trends may benefit from a fiscal year.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find plan year vs fiscal?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific plan year vs fiscal and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for the plan year vs fiscal in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your plan year vs fiscal in minutes.

How do I fill out plan year vs fiscal using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign plan year vs fiscal and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is plan year vs fiscal?

A plan year refers to the 12-month period during which an employee benefit plan is in effect, while a fiscal year is a 12-month period that companies use for financial reporting and budgeting which may not align with the calendar year.

Who is required to file plan year vs fiscal?

Organizations and businesses that sponsor employee benefit plans must file based on their plan year, while businesses that have a fiscal year must file financial reports according to the fiscal year guidelines.

How to fill out plan year vs fiscal?

Filling out for plan year vs fiscal involves completing the appropriate forms for employee benefit plans or financial reports, detailing timelines, contributions, expenditures, and other relevant data according to the respective year formats.

What is the purpose of plan year vs fiscal?

The plan year allows for the administration and management of employee benefits, while the fiscal year is used for budgeting, accounting, and financial reporting by organizations.

What information must be reported on plan year vs fiscal?

Reporting for the plan year typically requires details on contributions, benefits paid, and plan specifics, while fiscal reporting requires income, expenses, profit and loss, and balance sheet information.

Fill out your plan year vs fiscal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Plan Year Vs Fiscal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.