Get the free EMPLOYER APPLlCATlON FLEXlBLE SPENDlNG ... - Sterling HSA

Show details

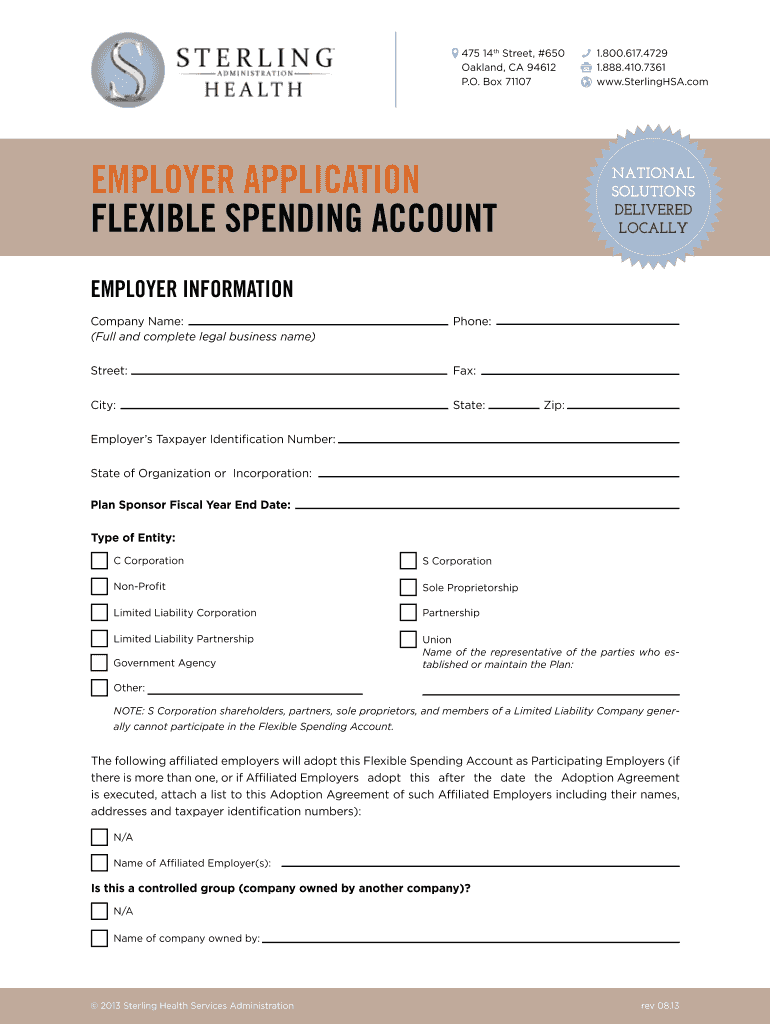

475 14th Street, #650 Oakland, CA 94612 P.O. Box 71107 1.800.617.4729 1.888.410.7361 www.SterlingHSA.com employer application flexible spending account Employer Information Company Name: (Full and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employer appllcatlon flexlble spendlng

Edit your employer appllcatlon flexlble spendlng form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer appllcatlon flexlble spendlng form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employer appllcatlon flexlble spendlng online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit employer appllcatlon flexlble spendlng. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employer appllcatlon flexlble spendlng

How to fill out employer application flexible spending?

01

Start by gathering all the necessary information: Before filling out the employer application for flexible spending, make sure you have all the required information at hand. This may include personal identification, employment details, and information about any dependents you wish to include in your flexible spending account.

02

Review the instructions: Carefully read through the instructions provided with the employer application form. These instructions will guide you on how to accurately fill out the form and ensure you provide all the necessary information.

03

Complete personal information: Begin by filling out the personal information section of the employer application form. This typically includes your full name, address, contact information, and social security number.

04

Provide employment details: Next, provide the required details regarding your current employment, such as the name of your employer, your job title, and your employment start date. Ensure accuracy when entering this information to avoid any processing delays.

05

Include dependents, if applicable: If you have any eligible dependents who are covered under your flexible spending account, make sure to include their relevant information. This may include their full names, dates of birth, and any additional documentation required to prove their eligibility.

06

Determine contribution amount: The employer application form will ask you to indicate the amount you wish to contribute to your flexible spending account. Consider your anticipated eligible expenses for the year and choose a contribution amount that aligns with your needs.

07

Review and submit: Once you have completed all the required sections of the employer application for flexible spending, take the time to review your entries for accuracy. Check for any errors or omissions and make the necessary corrections.

08

Submit the application: After thoroughly reviewing the form, submit it to the designated employer representative or the third-party administrator responsible for managing flexible spending accounts. Follow the specified submission instructions to ensure your application is received and processed in a timely manner.

Who needs employer application flexible spending?

01

Employees seeking tax savings: The employer application for flexible spending is particularly relevant for employees who want to take advantage of tax savings by contributing pre-tax dollars to their flexible spending account. This helps reduce their taxable income, resulting in potential tax savings.

02

Individuals with anticipated medical expenses: Employees who have anticipated medical, dental, or vision expenses throughout the year can greatly benefit from an employer application for flexible spending. By contributing to a flexible spending account, they can set aside pre-tax funds to cover these expenses, thus reducing their out-of-pocket costs.

03

Those with eligible dependent care expenses: Employees who have dependent care expenses, such as childcare or eldercare costs, can also benefit from an employer application for flexible spending. By contributing to a dependent care flexible spending account, they can pay for these expenses with pre-tax funds, potentially saving on taxes.

In summary, individuals who want to save on taxes and have anticipated medical or dependent care expenses are the ones who typically need to fill out an employer application for flexible spending. By following the step-by-step guide provided and ensuring the accurate completion of the form, employees can effectively utilize their flexible spending accounts.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is employer application flexible spending?

Employer application flexible spending is a benefit plan that allows employees to set aside pre-tax funds for eligible medical expenses.

Who is required to file employer application flexible spending?

Employees who wish to participate in the flexible spending program are required to file the application.

How to fill out employer application flexible spending?

Employees can fill out the application form provided by their employer and select the desired contribution amount.

What is the purpose of employer application flexible spending?

The purpose of employer application flexible spending is to help employees save money on eligible medical expenses by using pre-tax dollars.

What information must be reported on employer application flexible spending?

Employees must report their desired contribution amount and any eligible medical expenses incurred.

How do I fill out employer appllcatlon flexlble spendlng using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign employer appllcatlon flexlble spendlng and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit employer appllcatlon flexlble spendlng on an iOS device?

Create, modify, and share employer appllcatlon flexlble spendlng using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Can I edit employer appllcatlon flexlble spendlng on an Android device?

You can edit, sign, and distribute employer appllcatlon flexlble spendlng on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your employer appllcatlon flexlble spendlng online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employer Appllcatlon Flexlble Spendlng is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.