Get the free Corporate Report R163

Show details

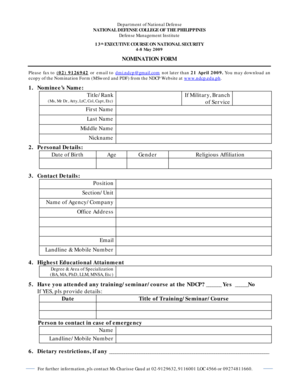

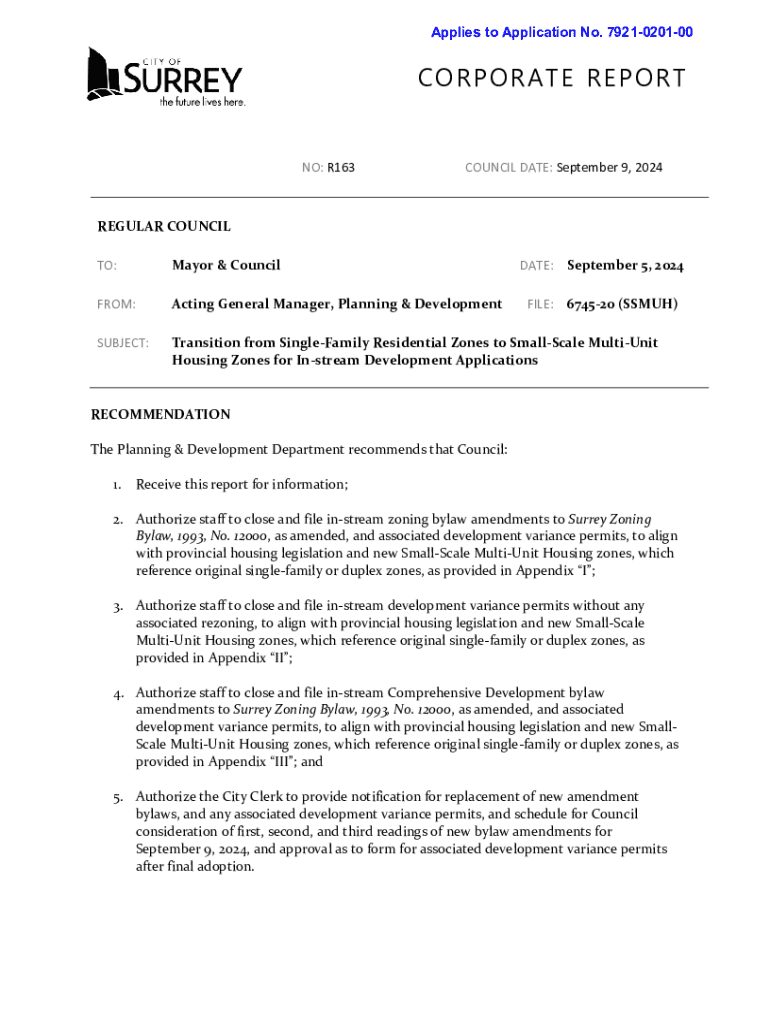

This corporate report addresses the transition of zoning in Surrey from single-family residential zones to small-scale multi-unit housing zones, in accordance with provincial legislation aimed at increasing housing supply and affordability. It includes recommendations for closing and filing in-stream zoning bylaw amendments and development variance permits.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate report r163

Edit your corporate report r163 form online

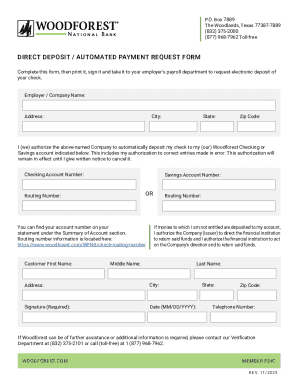

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate report r163 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing corporate report r163 online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit corporate report r163. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate report r163

How to fill out corporate report r163

01

Gather the necessary financial data for the reporting period.

02

Fill out the identifying information such as company name, reporting period, and contact details.

03

Complete the income statement section, detailing revenues and expenses.

04

Provide a balance sheet section showing assets, liabilities, and equity.

05

Fill out the cash flow statement summarizing cash inflows and outflows.

06

Include disclosures and notes explaining significant accounting policies and any relevant information.

07

Review the completed report for accuracy and compliance with relevant regulations.

08

Submit the corporate report R163 by the specified deadline.

Who needs corporate report r163?

01

Publicly traded companies that are required to disclose financial performance.

02

Investors needing insight into company performance for investment decisions.

03

Regulatory authorities that monitor compliance with corporate reporting standards.

04

Stakeholders looking for transparency in the financial health of the company.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in corporate report r163 without leaving Chrome?

corporate report r163 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I edit corporate report r163 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing corporate report r163.

How do I fill out corporate report r163 using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign corporate report r163. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is corporate report r163?

Corporate report R163 is a specific regulatory document that corporations are required to submit to disclose their financial and operational information, ensuring transparency and compliance with legal requirements.

Who is required to file corporate report r163?

Corporations that meet certain criteria, such as size, revenue, or type of business activities, are required to file corporate report R163, typically those operating within regulated industries.

How to fill out corporate report r163?

To fill out corporate report R163, corporations must gather relevant financial statements, operational data, and other required information, then complete the form following the guidelines provided by the regulatory authority.

What is the purpose of corporate report r163?

The purpose of corporate report R163 is to ensure regulatory compliance, provide transparency to stakeholders, and collect necessary data for monitoring the financial health of corporations.

What information must be reported on corporate report r163?

Information that must be reported includes financial statements, revenue details, operational activities, and any relevant disclosures required by the regulatory body.

Fill out your corporate report r163 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Report r163 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.