Get the free New Markets Tax Credit ProgramEmpire State Development

Show details

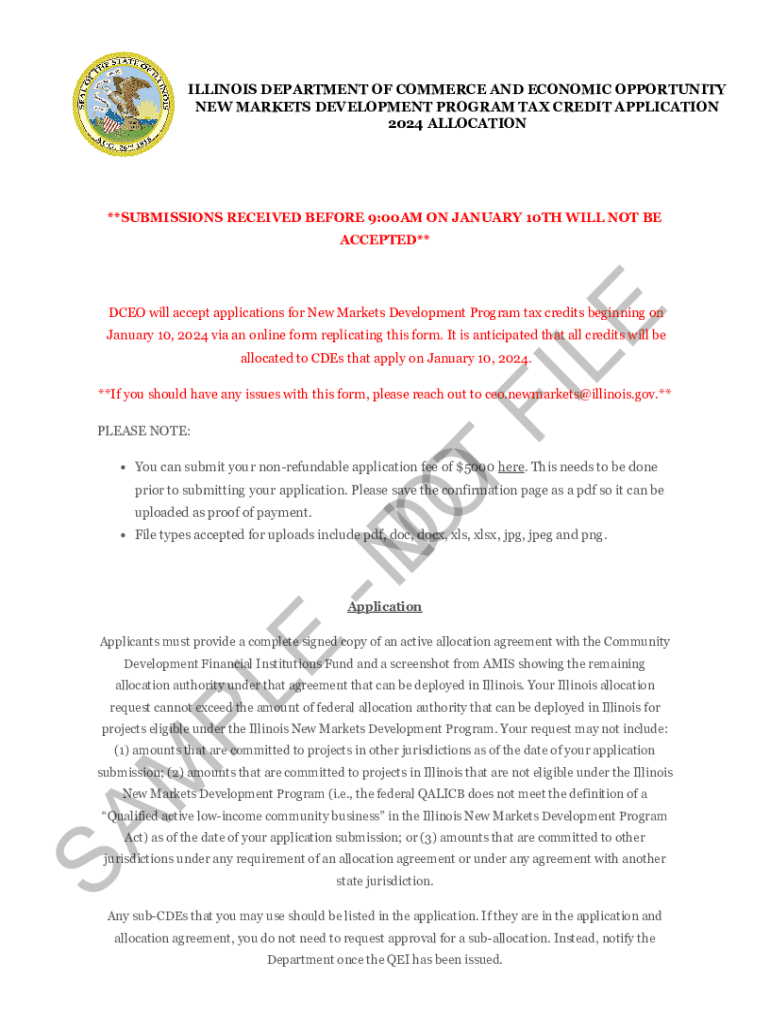

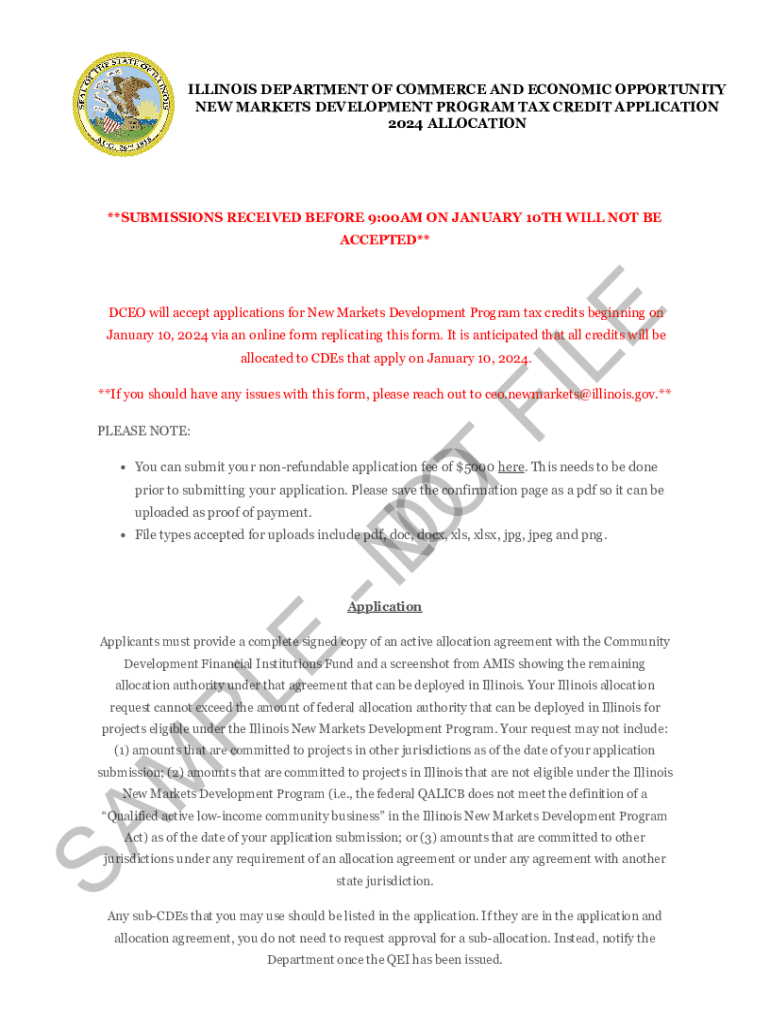

ILLINOIS DEPARTMENT OF COMMERCE AND ECONOMIC OPPORTUNITY NEW MARKETS DEVELOPMENT PROGRAM TAX CREDIT APPLICATION 2024 ALLOCATION**SUBMISSIONS RECEIVED BEFORE 9:00AM ON JANUARY 10TH WILL NOT BELEACCEPTED**FI**If

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new markets tax credit

Edit your new markets tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new markets tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new markets tax credit online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit new markets tax credit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new markets tax credit

How to fill out new markets tax credit

01

Identify eligible projects in low-income communities.

02

Gather necessary documentation, including financial statements and demographic information.

03

Engage with a qualified Community Development Entity (CDE).

04

Prepare a detailed business plan outlining the use of funds and projected impact.

05

Submit an application to the CDE for New Markets Tax Credit allocation.

06

Await approval from the CDE and follow their guidelines for further documentation.

07

Once approved, use the allocated credits according to the approved business plan.

Who needs new markets tax credit?

01

Businesses looking to expand in low-income areas.

02

Investors seeking tax incentives for supporting community development.

03

Community Development Entities (CDEs) involved in financing projects in economically disadvantaged areas.

04

Non-profit organizations aiming to stimulate economic growth in underserved communities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find new markets tax credit?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the new markets tax credit in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete new markets tax credit online?

pdfFiller has made it simple to fill out and eSign new markets tax credit. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How can I fill out new markets tax credit on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your new markets tax credit by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is new markets tax credit?

The New Markets Tax Credit (NMTC) is a program created by the United States federal government to incentivize investment in low-income communities. It provides federal tax credits to investors who invest in Community Development Entities (CDEs) that in turn provide capital to businesses and real estate projects in these communities.

Who is required to file new markets tax credit?

Entities that receive allocations of New Markets Tax Credits and the investors who claim the credits are required to file related forms with the IRS to report their participation in the NMTC program.

How to fill out new markets tax credit?

To fill out the New Markets Tax Credit forms, entities must provide detailed information about their investments, including the amounts, project descriptions, investor details, and compliance with NMTC regulations. Specific forms like IRS Form 8874 must be completed by investors to claim the credit.

What is the purpose of new markets tax credit?

The purpose of the New Markets Tax Credit is to stimulate economic growth in low-income and underserved communities by encouraging private investment that leads to job creation, community development, and revitalization.

What information must be reported on new markets tax credit?

Reporting on New Markets Tax Credits generally includes the amount of the investment, the nature of the project funded, demographic and financial data about the businesses affected, and compliance with NMTC requirements.

Fill out your new markets tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Markets Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.