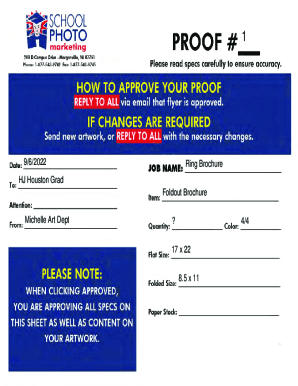

Get the free Salary Reduction Agreement

Show details

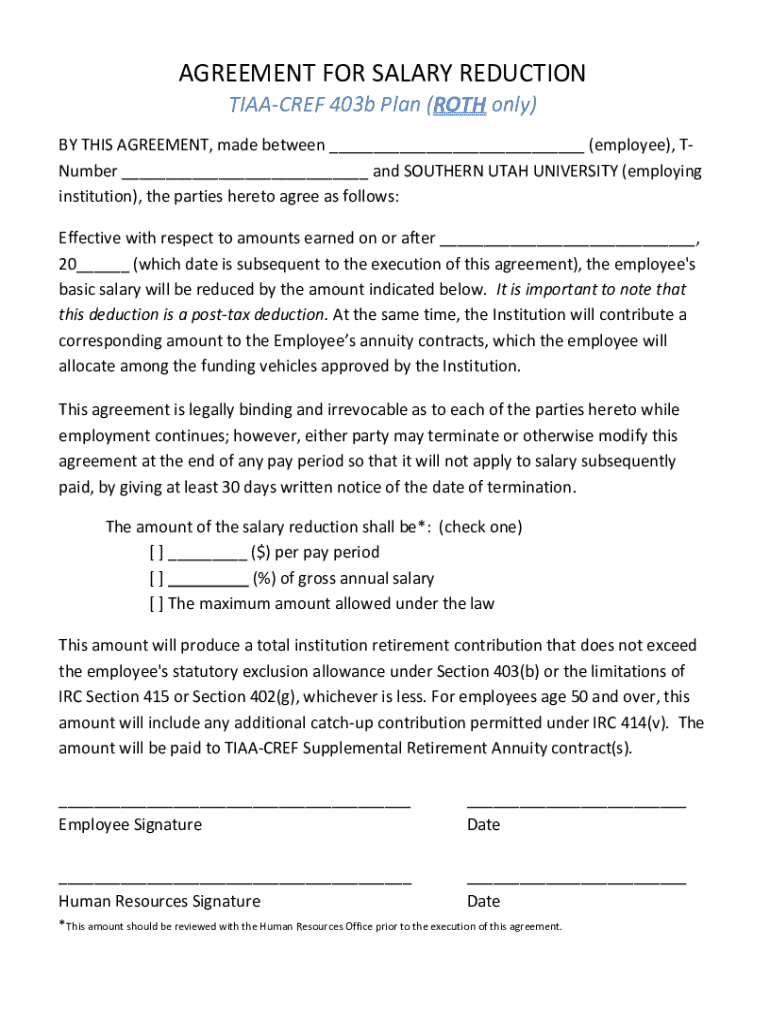

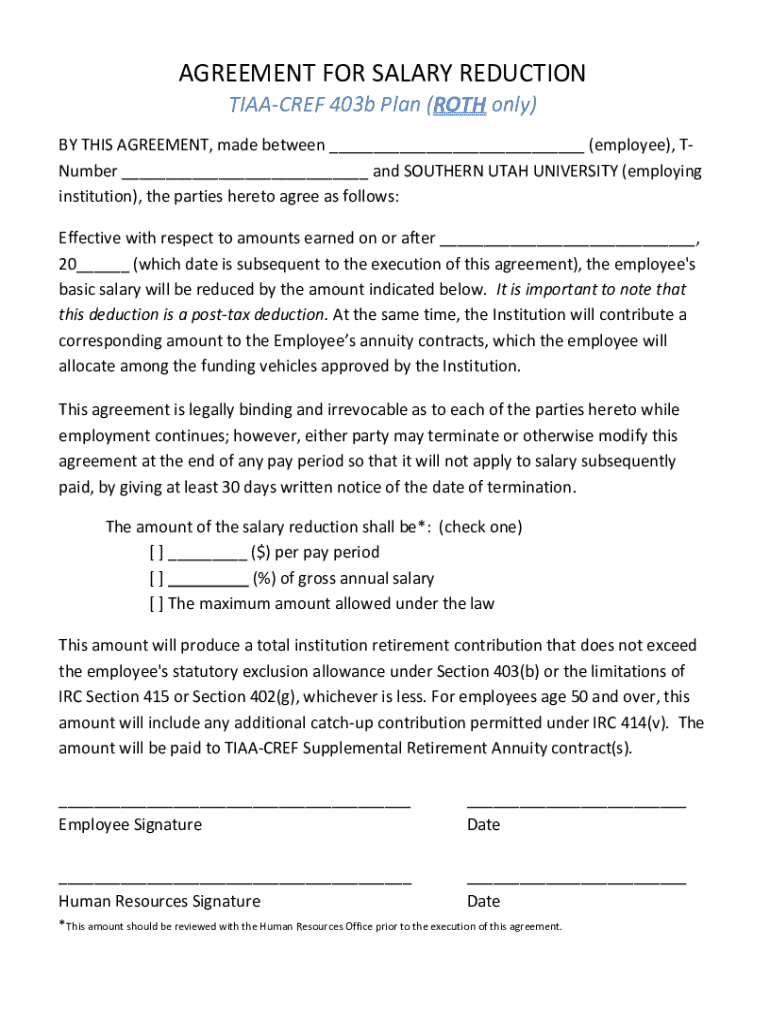

This document outlines the agreement between an employee and Southern Utah University for a salary reduction to contribute to a TIAA-CREF 403b Roth Plan. The agreement specifies the reduction amount, post-tax deductions, and conditions under which the agreement may be modified or terminated. It also ensures compliance with federal law regarding retirement contributions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign salary reduction agreement

Edit your salary reduction agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your salary reduction agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing salary reduction agreement online

To use the professional PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit salary reduction agreement. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

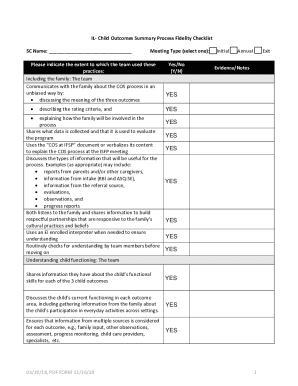

How to fill out salary reduction agreement

How to fill out salary reduction agreement

01

Review the company's policy on salary reductions.

02

Gather necessary employee information (name, position, employee ID).

03

Clearly state the reason for the salary reduction in the agreement.

04

Specify the new salary amount and percentage of reduction.

05

Include the effective date of the salary reduction.

06

Outline the duration of the salary reduction, if applicable.

07

Obtain necessary approvals from HR or management.

08

Ensure both employer and employee sign and date the agreement.

09

Provide a copy of the signed agreement to the employee.

Who needs salary reduction agreement?

01

Employees who are facing temporary financial difficulties.

02

Organizations looking to adjust salary expenses during economic downturns.

03

Employers needing to meet budget constraints.

04

Employees in a role where temporary adjustments are necessary to retain employment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in salary reduction agreement without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your salary reduction agreement, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an electronic signature for signing my salary reduction agreement in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your salary reduction agreement and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete salary reduction agreement on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your salary reduction agreement. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

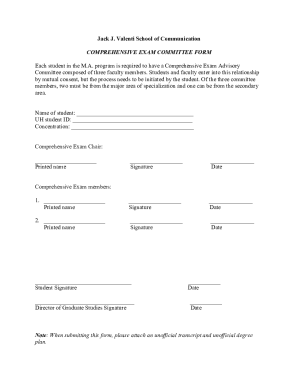

What is salary reduction agreement?

A salary reduction agreement is a document between an employee and employer that allows the employee to reduce their gross salary in exchange for additional benefits, such as contributions to a retirement plan or flexible spending accounts.

Who is required to file salary reduction agreement?

Typically, employees who want to participate in salary reduction arrangements, such as 401(k) or other retirement plans, are required to file the salary reduction agreement with their employer.

How to fill out salary reduction agreement?

To fill out a salary reduction agreement, an employee needs to provide their personal information, specify the amount of salary they wish to reduce, and indicate the benefit program they want that reduction to apply to, ensuring that both the employee and employer sign the document.

What is the purpose of salary reduction agreement?

The purpose of a salary reduction agreement is to enable employees to defer a portion of their salary into tax-advantaged accounts, thereby reducing their taxable income while saving for retirement or other specific benefits.

What information must be reported on salary reduction agreement?

A salary reduction agreement must include the employee's name, their job title, the amount of salary being reduced, the type of benefits being funded, and signatures from both the employee and employer.

Fill out your salary reduction agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Salary Reduction Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.