Get the free Business Credit Application - Rent Rite - rentrite

Show details

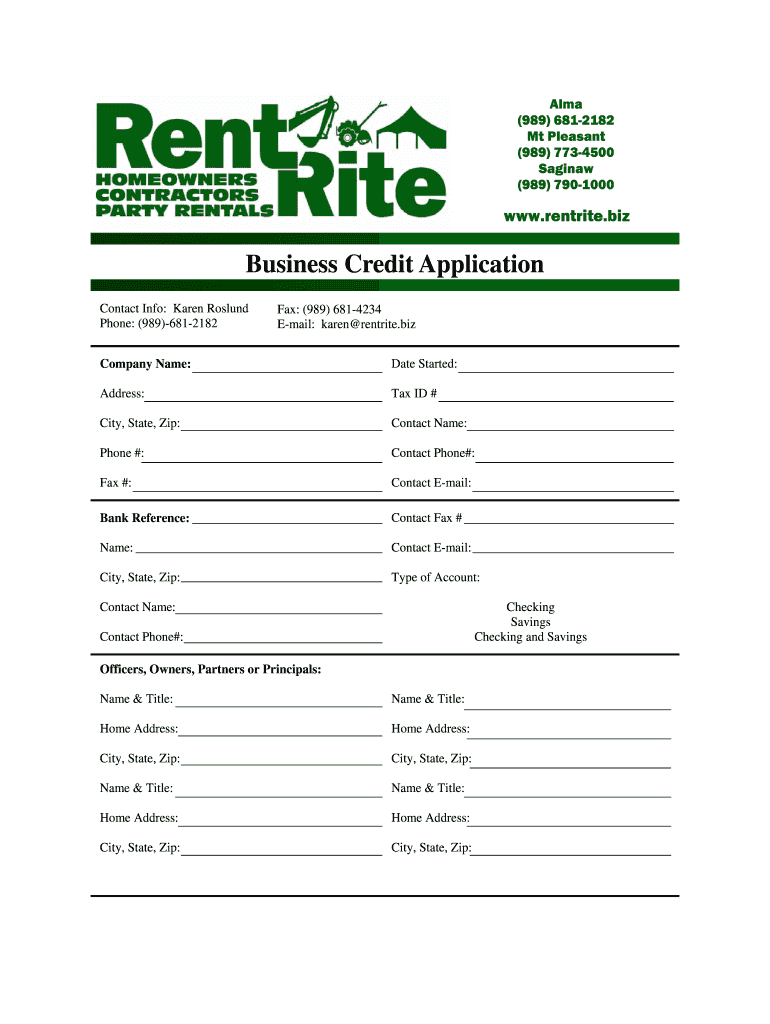

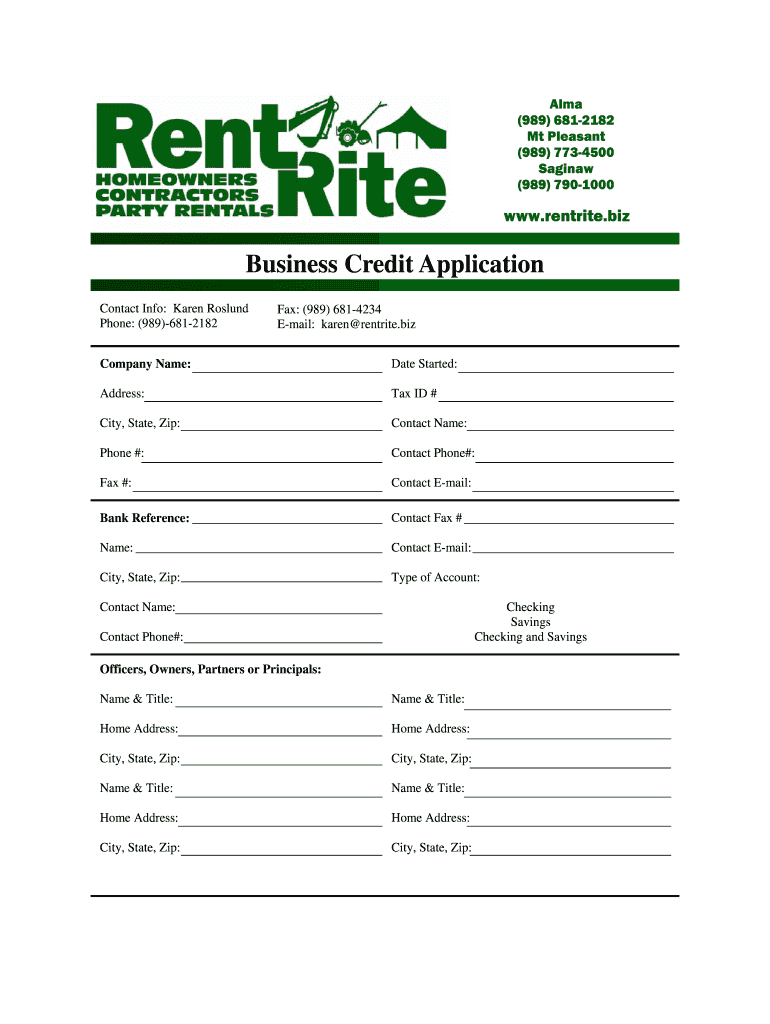

Alma (989) 681-2182 Mt Pleasant (989) 773-4500 Saginaw (989) 790-1000 www.rentrite.biz Business Credit Application Contact Info: Karen Round Phone: (989)-681-2182 Fax: (989) 681-4234 E-mail: Karen

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business credit application

Edit your business credit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business credit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business credit application online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit business credit application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business credit application

How to fill out a business credit application:

01

Gather the necessary information: Before beginning the application, make sure you have all the required documentation and details. This may include your business's legal name, address, contact information, tax ID number, annual revenue, and other financial statements.

02

Research different lenders: Identify the lenders that offer business credit and review their specific requirements and application processes. This will help you understand what documents or information you need to provide.

03

Start the application: Begin by filling out the basic information about your business, such as its legal name, address, and contact details. You may also need to provide details about your industry, the number of employees, and the length of time your business has been operating.

04

Provide financial information: Be prepared to share your business's financial information, such as the annual revenue, profit margins, and any outstanding debts. You may also need to provide statements or documents that show your financial history or creditworthiness.

05

Personal information: Some lenders may require personal information from the business owner, such as their name, social security number, and personal financial information. This is typically done to evaluate the owner's personal creditworthiness.

06

Provide references: Some lenders may ask for references or trade references to verify the credibility and payment history of your business. Be prepared with the contact information of reliable references who can vouch for your business's financial responsibility.

07

Review and submit: Before submitting the application, carefully review all the information provided to ensure accuracy and completeness. Double-check that you haven't missed any required fields or supporting documents. Once you are confident, submit the application as per the lender's instructions.

Who needs a business credit application:

A business credit application is typically needed by:

01

Small businesses: Small businesses often require access to credit or loans to fund their operations, expand their business, or finance new equipment. A business credit application allows lenders to evaluate the creditworthiness of the business and determine if they are eligible for credit.

02

Startups: Startups may also need a business credit application when seeking initial funding or financial support. Lenders use this application to assess the risk associated with providing credit to a new business that may not have an established credit history.

03

Established businesses: Even established businesses may need a business credit application when seeking additional funds, loans, or credit lines. This application helps lenders evaluate the financial health of the business and whether it is capable of repaying the borrowed funds.

Ultimately, any business that wants to establish credit relationships with lenders, suppliers, or vendors may require a business credit application to demonstrate their financial stability and creditworthiness.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is business credit application?

A business credit application is a form used by a business to apply for credit from a lender or creditor.

Who is required to file business credit application?

Any business looking to obtain credit from a lender or creditor is required to file a business credit application.

How to fill out business credit application?

To fill out a business credit application, you will need to provide information about your business, financial history, and credit needs.

What is the purpose of business credit application?

The purpose of a business credit application is for a lender or creditor to evaluate the creditworthiness of a business and determine whether to extend credit.

What information must be reported on business credit application?

Information such as business name, address, financial statements, credit history, and references may be required on a business credit application.

How can I edit business credit application from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your business credit application into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I make changes in business credit application?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your business credit application to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I edit business credit application on an iOS device?

Use the pdfFiller mobile app to create, edit, and share business credit application from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your business credit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Credit Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.