Get the free Charitable Donation of Stocks & Bonds In-Kind

Show details

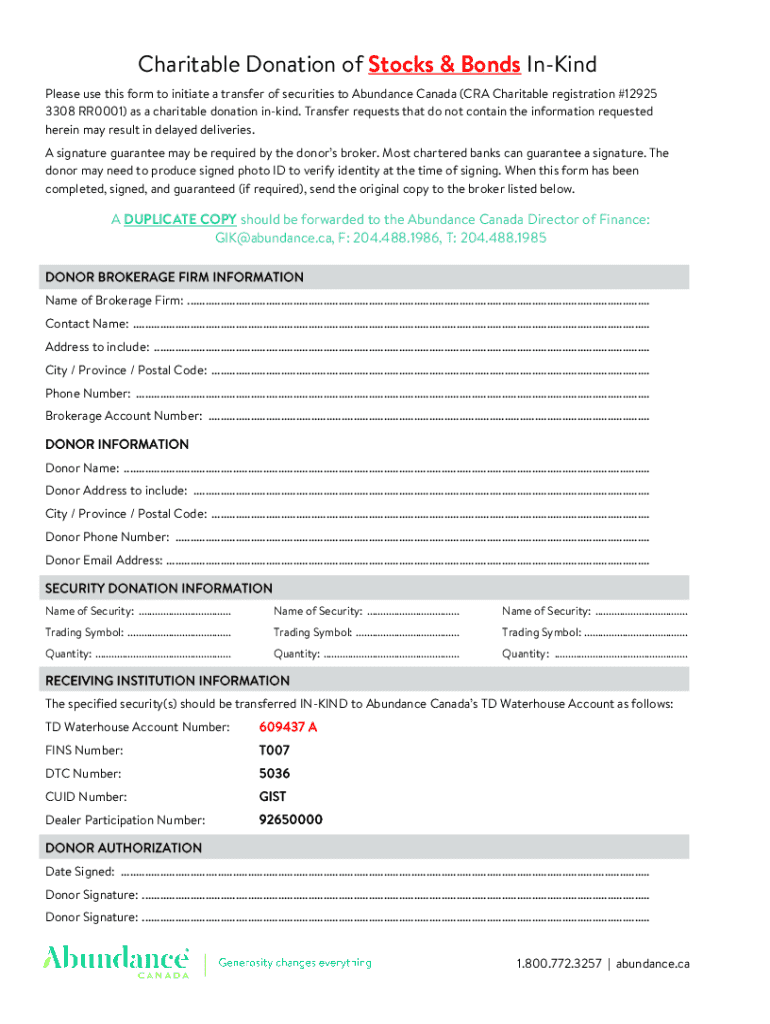

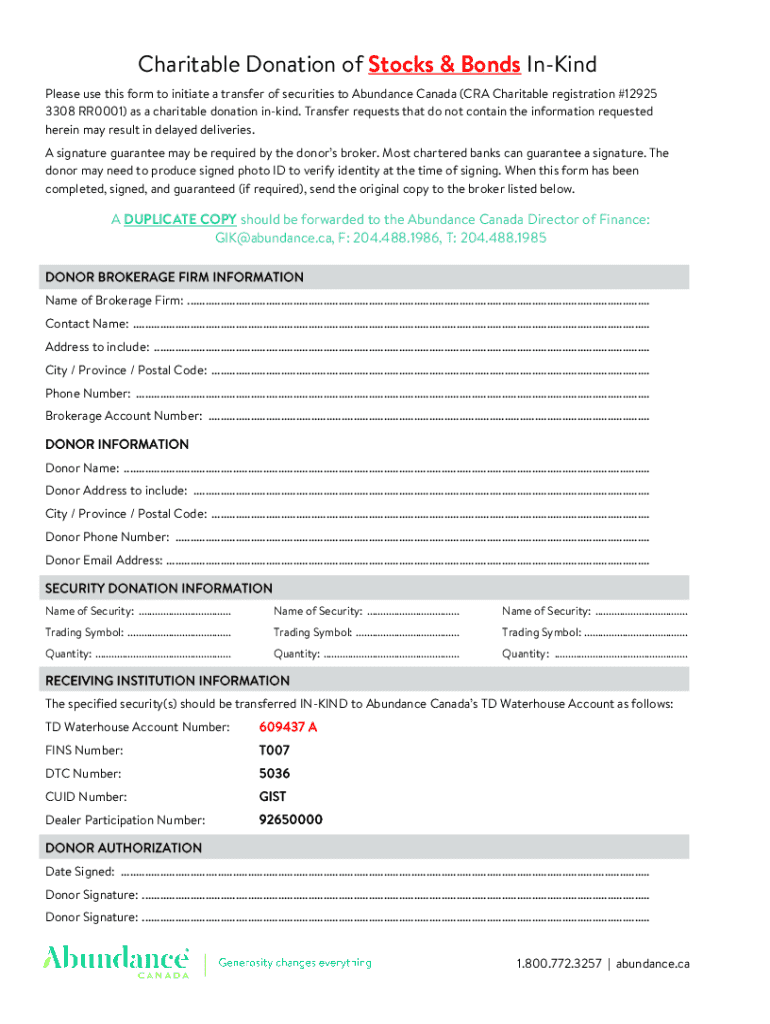

Charitable Donation of Stocks & Bonds InKind Please use this form to initiate a transfer of securities to Abundance Canada (CRA Charitable registration #12925 3308 RR0001) as a charitable donation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable donation of stocks

Edit your charitable donation of stocks form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable donation of stocks form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charitable donation of stocks online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit charitable donation of stocks. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable donation of stocks

How to fill out charitable donation of stocks

01

Determine the value of the stocks you wish to donate.

02

Check if the charity is a qualified 501(c)(3) organization.

03

Contact the charity to inform them of your intention to donate stocks.

04

Obtain the charity's brokerage information, including account numbers.

05

Complete the required paperwork with your brokerage to initiate the transfer.

06

Ensure that you get a receipt from the charity for tax purposes after the stocks are transferred.

Who needs charitable donation of stocks?

01

Individuals looking to reduce their taxable income through charitable contributions.

02

Investors wanting to support causes they care about without incurring capital gains taxes.

03

Charitable organizations seeking donations that can be converted to cash or used for their activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete charitable donation of stocks online?

Easy online charitable donation of stocks completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for the charitable donation of stocks in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your charitable donation of stocks in minutes.

Can I create an electronic signature for signing my charitable donation of stocks in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your charitable donation of stocks right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is charitable donation of stocks?

A charitable donation of stocks refers to the transfer of ownership of publicly traded shares from an individual to a qualified nonprofit organization, often allowing the donor to avoid capital gains taxes.

Who is required to file charitable donation of stocks?

Individuals who claim a charitable deduction on their tax return for donated stocks are required to file the appropriate forms with the IRS.

How to fill out charitable donation of stocks?

To fill out for a charitable donation of stocks, donors typically need to complete IRS Form 8283 for noncash donations and provide a description of the stocks, their value, and information about the charity.

What is the purpose of charitable donation of stocks?

The purpose of charitable donation of stocks is to support nonprofit organizations and causes while providing tax benefits to the donor by avoiding capital gains tax and potentially receiving a charitable deduction.

What information must be reported on charitable donation of stocks?

Information that must be reported includes the name of the charity, the date of the donation, a description of the stocks, their fair market value, and how the value was determined.

Fill out your charitable donation of stocks online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Donation Of Stocks is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.