IRS 6198 2024 free printable template

Show details

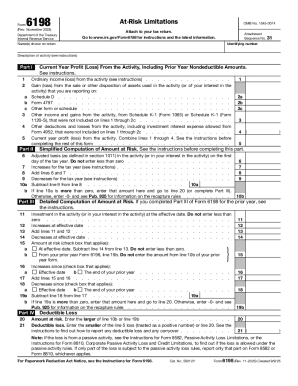

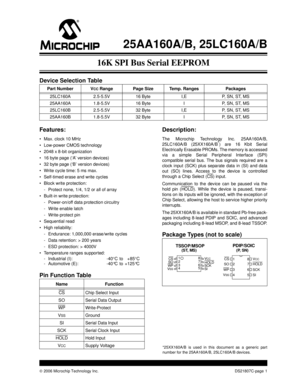

6198Form (Rev. November 2024) Department of the Treasury Internal Revenue ServiceAtRisk LimitationsOMB No. 15450712Attach to your tax return.Attachment Sequence No. 31Go to www.irs.gov/Form6198 for

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 6198

Edit your IRS 6198 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 6198 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 6198 online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 6198. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 6198 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 6198

How to fill out IRS 6198

01

Obtain a copy of IRS Form 6198 from the IRS website or an authorized source.

02

Read the instructions provided with the form to understand the requirements.

03

Fill out your name, Social Security number, and other identifying information at the top of the form.

04

Report the total of your passive activity losses and income in the appropriate sections.

05

Calculate your allowable losses using the passive activity loss rules.

06

Complete any additional sections relevant to your situation.

07

Review all the information for accuracy.

08

Sign and date the form before submitting it with your tax return.

Who needs IRS 6198?

01

Taxpayers who have passive activity losses that exceed their passive activity income.

02

Individuals involved in rental activities or partnerships that generate passive losses.

03

Anyone who needs to report losses under the passive activity loss rules set by the IRS.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to file form 6198?

You are required to file Form 6198 with your tax return if you experience a loss in an income-producing activity deemed by the IRS as at risk. Most business activities are subject to the at-risk limitations.

Where do I report at risk recapture income?

UltraTax CS will report the at-risk recapture amount on Form 1040, Schedule 1, line 8.

What is at risk limitation example?

Example: Unused Losses Due To At-Risk Limitations May Be Carried Forward. You invest $30,000 in a partnership, but suffer $50,000 of your share of the partnership's losses in the 1st year. For the 1st year, you can only deduct your initial investment. However, your suspended loss of $20,000 can be carried forward.

What is the purpose of IRS form 6198?

More In Forms and Instructions Use Form 6198 to figure: The profit (loss) from an at-risk activity for the current year. The amount at risk for the current year. The deductible loss for the current year.

When should I file form 6198?

You are required to file Form 6198 with your tax return if you experience a loss in an income-producing activity deemed by the IRS as at risk. Most business activities are subject to the at-risk limitations.

Do I need to fill out form 6198?

File Form 6198 if during the tax year you, a partnership in which you were a partner, or an S corporation in which you were a shareholder had any amounts not at risk (see Amounts Not at Risk, later) invested in an at-risk activity (defined below) that incurred a loss.

What is the at risk rule and how is it different from the basis limitation?

The amount you have at-risk is similar to basis in that you cannot deduct losses in excess of your at risk amount. The amount at-risk, however, is not the same as basis. In many cases, a taxpayer can still have basis, but his losses are not deductible because they are limited by the amount at risk.

What does at risk limitations mean?

At-risk limitation rules limit any deductions to the amount of money that the taxpayer actually had at-risk at the end of the tax year in any activity for which the taxpayer was not a material participant.

What is considered an at risk activity?

What Are at-Risk Rules? At-risk rules are tax shelter laws that limit the amount of allowable deductions that an individual or closely held corporation can claim for tax purposes as a result of engaging in specific activities–referred to as at-risk activities–that can result in financial losses.

What does at risk mean in a partnership?

A partner's at-risk basis is calculated by adding the amount the partner has contributed to a business and the amount the business has borrowed for which the partner is personally liable or has pledged property as security.

What is 6198 tax form?

More In Forms and Instructions Use Form 6198 to figure: The profit (loss) from an at-risk activity for the current year. The amount at risk for the current year. The deductible loss for the current year.

What is form 6198 at risk limitations?

Form 6198 - At-Risk Limitations is used to determine the profit (loss) from an at-risk activity for the current year. Form 6198 should be filed when a taxpayer has a loss in a business activity reported on a Schedule C, Schedule E, or Schedule F and some or all of their investment is not at risk.

What is at risk basis limitation?

At-Risk Limitations Per IRC § 465(b), the at-risk amount includes: the amount of money and the adjusted basis of property contributed to an activity, amounts borrowed to the extent the taxpayer is personally liable, and qualified non-recourse financing.

Who do at risk limitations apply to?

Generally, the at-risk rules apply to all individuals and to closely-held C corporations in which five or fewer individuals own more than 50% of the stock.

What happens to losses suspended due to the at risk limitation?

The loss subject to the at-risk limitation is the excess of allowable deductions over the income received from the activity for the tax year. Losses disallowed under the at-risk rules are carried forward, while losses that are allowed must be recaptured when a taxpayer's at-risk amount is reduced below zero.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete IRS 6198 online?

pdfFiller has made it easy to fill out and sign IRS 6198. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out IRS 6198 using my mobile device?

Use the pdfFiller mobile app to fill out and sign IRS 6198. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit IRS 6198 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share IRS 6198 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is IRS 6198?

IRS Form 6198 is used by taxpayers to claim a deduction for losses incurred in a passive activity. It is primarily for individuals, estates, and trusts that have passive losses to report.

Who is required to file IRS 6198?

Taxpayers who have passive activity losses, including individuals, estates, and trusts, are required to file IRS Form 6198 to report these losses.

How to fill out IRS 6198?

To fill out IRS Form 6198, taxpayers need to provide information about their passive activities, including income, losses, and any other relevant details necessary to determine the allowable deduction.

What is the purpose of IRS 6198?

The purpose of IRS Form 6198 is to provide the IRS with information on passive activity losses and to calculate the allowable deduction for those losses.

What information must be reported on IRS 6198?

Taxpayers must report information related to their passive activities, including the name of the activity, income generated, losses incurred, and any prior year unallowed losses.

Fill out your IRS 6198 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 6198 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.