TN Benefits Board TRS300 2015-2025 free printable template

Show details

TRS300 Post Office Box 4608 Cleveland, Tennessee 373204608

(423) 4787131 (877) 4787190ACCOUNTABLE REIMBURSEMENT PLAN MINISTRY RELATED EXPENSE FORM

NAME ___YEAR ___POSITION ___MONTH ENDING ___(Please

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TN Benefits Board TRS300

Edit your TN Benefits Board TRS300 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TN Benefits Board TRS300 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TN Benefits Board TRS300 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit TN Benefits Board TRS300. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TN Benefits Board TRS300 Form Versions

Version

Form Popularity

Fillable & printabley

Fill

form

: Try Risk Free

People Also Ask about

How do you write an accountable plan?

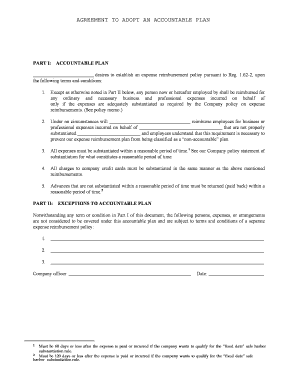

Specifically, an accountable plan must satisfy the following four requirements: The business connection requirement. The adequate substantiation requirement. The return of excess advances requirement. The reasonable time period requirement. Fixed-date method. Periodic-statement method.

What is included in an accountable plan?

Accountable Plans An accountable plan is a reimbursement arrangement that requires employees to substantiate their business-related expenses to the company within a reasonable timeframe (no more than 60 days from the date of the expense).

What is an accountable plan for C Corp?

Typically under the accountable plan, you're going to be able to reimburse yourself through your S or C corporation for any out-of-pocket expenses on behalf of the corporation. These must be reasonable, ordinary, and necessary business expenses.

Can a single member LLC have an accountable plan?

LLC members are not considered employees, so they are not covered by accountable plans. However, if you elected tax treatment as an S Corporation for your LLC, you could use this tax optimization strategy, just like a regular S Corp. An LLC taxed as S Corp has other advantages.

What is an accountability plan for employees?

An accountable plan is a detailed plan or arrangement in which employers give employees an allowance or reimburse them for certain expenses, limiting the amounts to actual expenses. The purpose of an accountable plan is to make the amounts non-taxable to employees.

What is the accountable plan method?

An accountable plan is an expense reimbursement arrangement that requires employees to document their expenses and return any they cannot support. Most payments made by an accountable plan do not count as wage income for the employee or generate payroll tax liability for the business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify TN Benefits Board TRS300 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your TN Benefits Board TRS300 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute TN Benefits Board TRS300 online?

With pdfFiller, you may easily complete and sign TN Benefits Board TRS300 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I edit TN Benefits Board TRS300 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as TN Benefits Board TRS300. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is why providing ministers with?

The 'why providing ministers with' refers to a specific form or document that outlines the financial or operational details of ministries.

Who is required to file why providing ministers with?

Ministers and designated officials within government departments or organizations are required to file this document.

How to fill out why providing ministers with?

To fill out this document, one should provide accurate financial data, operational details, and any required signatures as per the guidelines provided.

What is the purpose of why providing ministers with?

The purpose is to ensure transparency and accountability in government spending and operations.

What information must be reported on why providing ministers with?

Information reported must include financial statements, expenditure details, and any relevant operational metrics.

Fill out your TN Benefits Board TRS300 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TN Benefits Board trs300 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.