Get the free IA Succession Plan 100411 RG

Show details

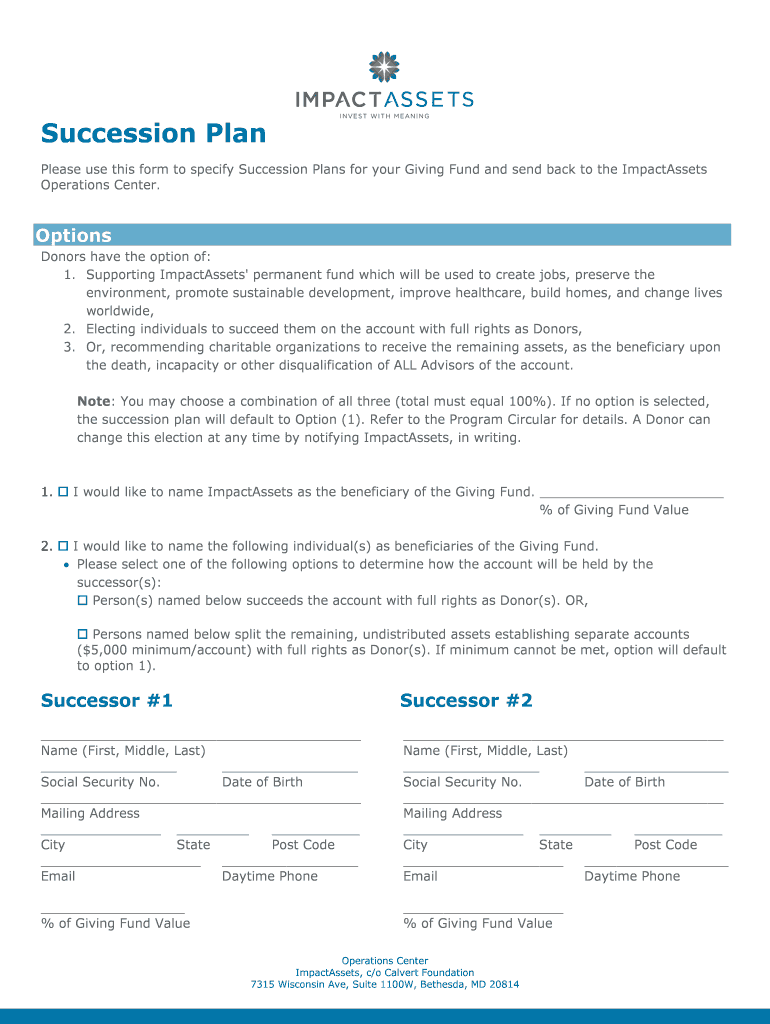

Succession Plan Please use this form to specify Succession Plans for your Giving Fund and send back to the ImpactAssets Operations Center. Options Donors have the option of: 1. Supporting ImpactAssets

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ia succession plan 100411

Edit your ia succession plan 100411 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ia succession plan 100411 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ia succession plan 100411 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ia succession plan 100411. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ia succession plan 100411

How to fill out ia succession plan 100411:

01

Start by gathering all the necessary information and documents required for the succession plan. This may include details about the current owner or leader, key personnel, organizational structure, assets, and any relevant legal or financial information.

02

Review the template or form provided for ia succession plan 100411. Familiarize yourself with the sections and requirements mentioned in the plan.

03

Begin by filling out the basic information section. This typically includes the name of the organization or business, the effective date of the plan, and contact information for the person responsible for the plan.

04

Proceed to the section that outlines the current owner or leader's role and responsibilities. Provide detailed information about their position, duties, and any specific skills or qualifications required.

05

In the next step, identify potential successors or individuals who could fill the role after the current owner or leader. This may include existing employees, family members, or external candidates. Include their contact information and any relevant background or experience.

06

Describe the criteria or factors to consider when evaluating potential successors. This could include skills, knowledge, experience, leadership qualities, or other important attributes.

07

Outline the training, mentoring, or development plans that may be necessary to prepare potential successors for the role. Specify any resources or programs that will be utilized.

08

Discuss any financial or legal considerations that should be addressed during the succession process. This may include estate planning, tax implications, or business valuation.

09

Include a section for contingency planning, in case the identified successors are unable or unwilling to fill the role. Provide alternative options or strategies that can be pursued.

10

Review the entire ia succession plan 100411 once completed. Make sure all sections are filled out accurately and all necessary attachments or supporting documents are included.

11

Seek legal or professional advice if needed, to ensure compliance with any specific regulations or requirements.

12

Keep the ia succession plan 100411 updated and regularly review it to reflect any changes in personnel, business structure, or other relevant factors.

Who needs ia succession plan 100411?

01

Any organization or business that has a current owner or leader and aims to plan for a smooth transition of leadership in the future.

02

Small or medium-sized businesses that want to ensure business continuity and minimize disruption during leadership changes.

03

Family-owned businesses that want to formalize the succession process and establish a framework for passing on ownership to the next generation.

04

Non-profit organizations or associations that rely on key personnel or leaders for strategic decision-making and operational management.

05

Corporations or companies with multiple shareholders or stakeholders, where a succession plan helps address ownership issues and sustain the business.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ia succession plan 100411?

A succession plan 100411 is a document outlining how key positions within an organization will be filled in the event of a planned or unplanned vacancy.

Who is required to file ia succession plan 100411?

All organizations are required to file a succession plan 100411, especially those with key positions that are critical to the functioning of the organization.

How to fill out ia succession plan 100411?

To fill out a succession plan 100411, organizations should identify key positions, potential successors, and development plans for those successors. It should also include a communication strategy for transition periods.

What is the purpose of ia succession plan 100411?

The purpose of a succession plan 100411 is to ensure continuity in leadership and key roles within an organization, minimizing disruptions and ensuring smooth transitions in times of change.

What information must be reported on ia succession plan 100411?

Information that must be reported on a succession plan 100411 includes key positions, potential successors, development plans for successors, and a communication strategy for transitions.

How can I modify ia succession plan 100411 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your ia succession plan 100411 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send ia succession plan 100411 for eSignature?

When you're ready to share your ia succession plan 100411, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I fill out ia succession plan 100411 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign ia succession plan 100411 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your ia succession plan 100411 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ia Succession Plan 100411 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.