Get the free Cash Reserve Funds

Show details

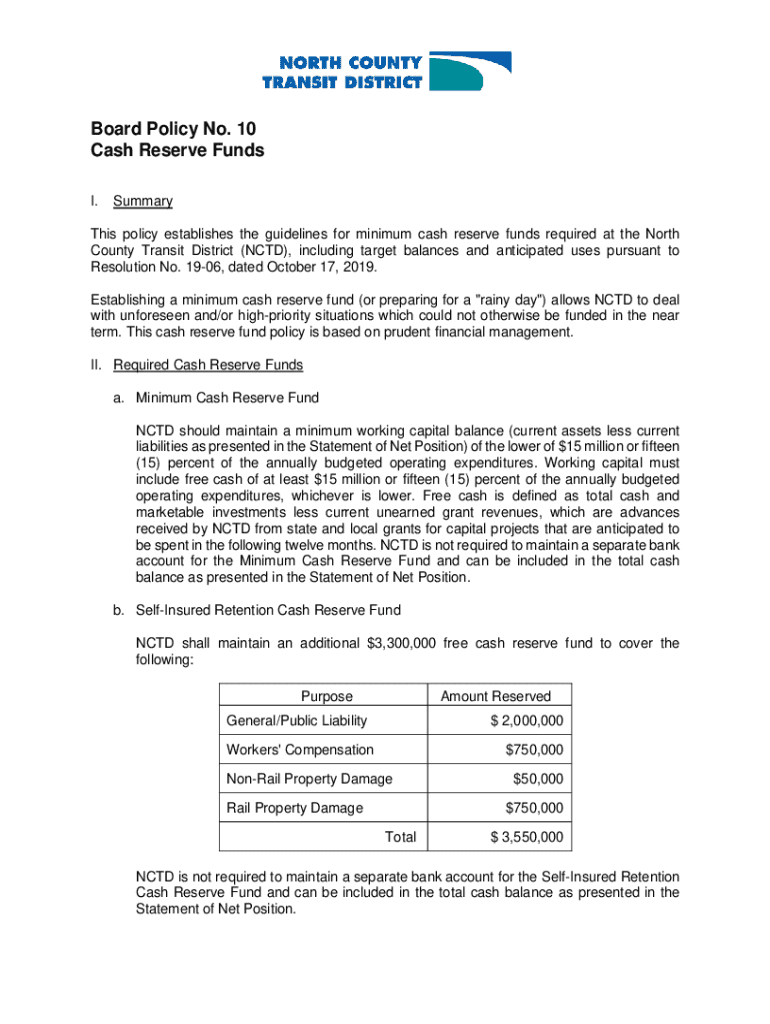

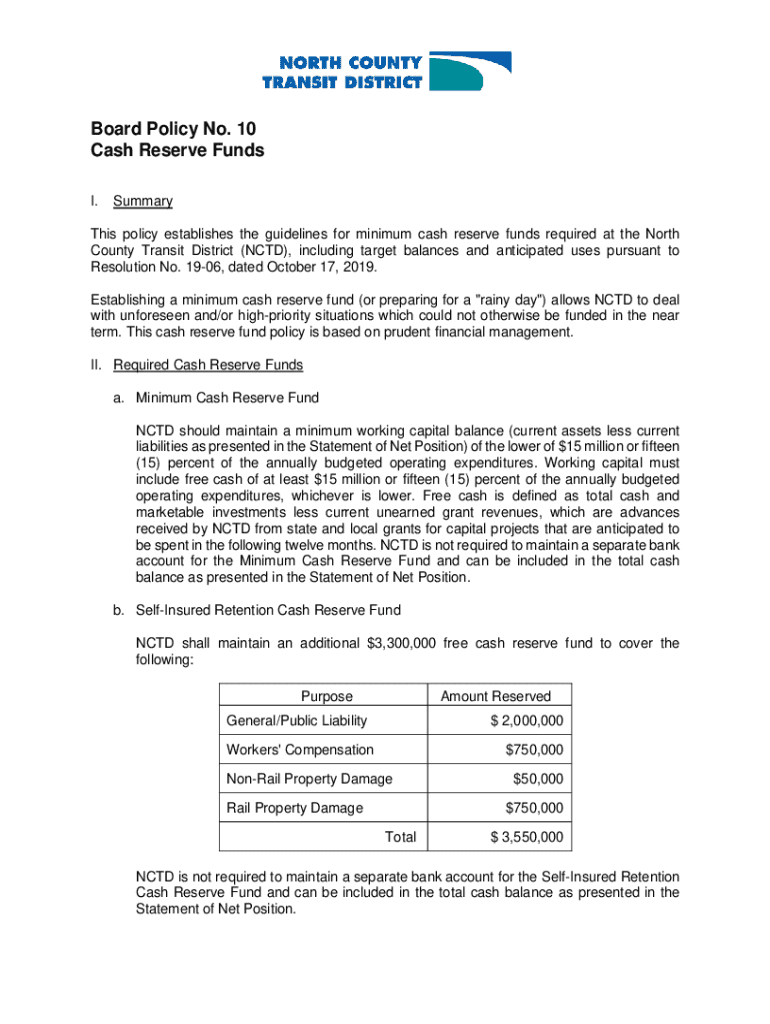

Board Policy No. 10 Cash Reserve Funds I.SummaryThis policy establishes the guidelines for minimum cash reserve funds required at the North County Transit District (NCTD), including target balances

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cash reserve funds

Edit your cash reserve funds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash reserve funds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cash reserve funds online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cash reserve funds. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cash reserve funds

How to fill out cash reserve funds

01

Determine your monthly expenses: Calculate all your essential expenses including rent, utilities, groceries, insurance, etc.

02

Decide on the reserve amount: Determine how many months' worth of expenses you want to save in your cash reserve fund (recommended is 3-6 months).

03

Open a separate savings account: Use a high-yield savings account to store your cash reserve to earn interest while keeping it accessible.

04

Set a savings goal: Calculate the total amount needed for your cash reserve and set a timeline to reach this goal.

05

Automate savings: Set up automatic transfers from your checking account to your cash reserve account each month.

06

Monitor and adjust: Review your expenses and savings regularly to ensure your cash reserve fund meets your needs.

Who needs cash reserve funds?

01

Individuals with irregular income: Freelancers and gig workers who may experience income fluctuations need cash reserves.

02

Homeowners: Those who own a home should have a reserve for unexpected repairs and maintenance.

03

Families: Households with dependents benefit from having a financial cushion for emergencies.

04

Entrepreneurs: Small business owners should maintain reserves to cover operating costs during slow periods.

05

Those planning for major purchases: Individuals saving for significant life events (like weddings or vacations) may need cash reserves.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my cash reserve funds in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your cash reserve funds and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I make edits in cash reserve funds without leaving Chrome?

cash reserve funds can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit cash reserve funds on an Android device?

With the pdfFiller Android app, you can edit, sign, and share cash reserve funds on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is cash reserve funds?

Cash reserve funds are funds set aside by an entity for specific purposes, often to meet future financial obligations or to ensure liquidity in times of need.

Who is required to file cash reserve funds?

Typically, organizations such as government entities, non-profits, or companies that have specific cash reserve requirements based on regulatory guidelines are required to file cash reserve funds.

How to fill out cash reserve funds?

To fill out cash reserve funds, one must provide accurate financial data including reserve amounts, purpose of funds, and any relevant supporting documentation, usually through a prescribed form.

What is the purpose of cash reserve funds?

The purpose of cash reserve funds is to ensure that sufficient liquidity is available for unexpected expenses, emergencies, or to meet specific financial requirements.

What information must be reported on cash reserve funds?

Information that must be reported includes the total amount of cash reserves, the intended use of the reserves, any conditions or restrictions on the funds, and relevant financial statements.

Fill out your cash reserve funds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash Reserve Funds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.