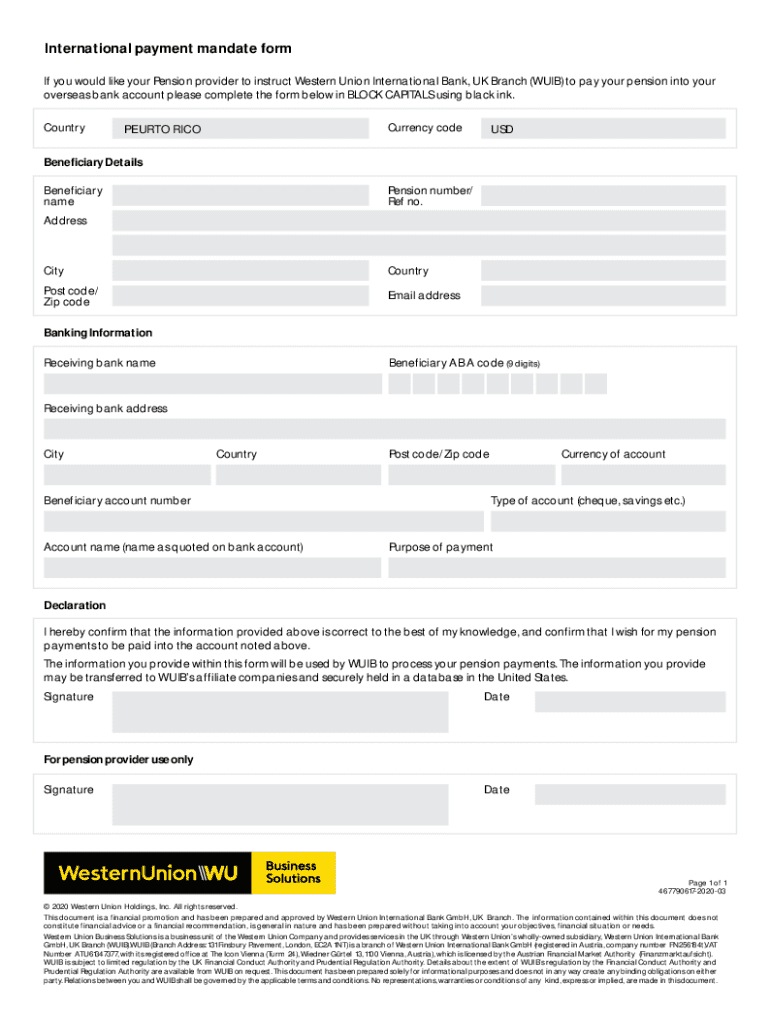

Get the free IBAN vs SWIFT: Which Do I Need for International Transfers?

Show details

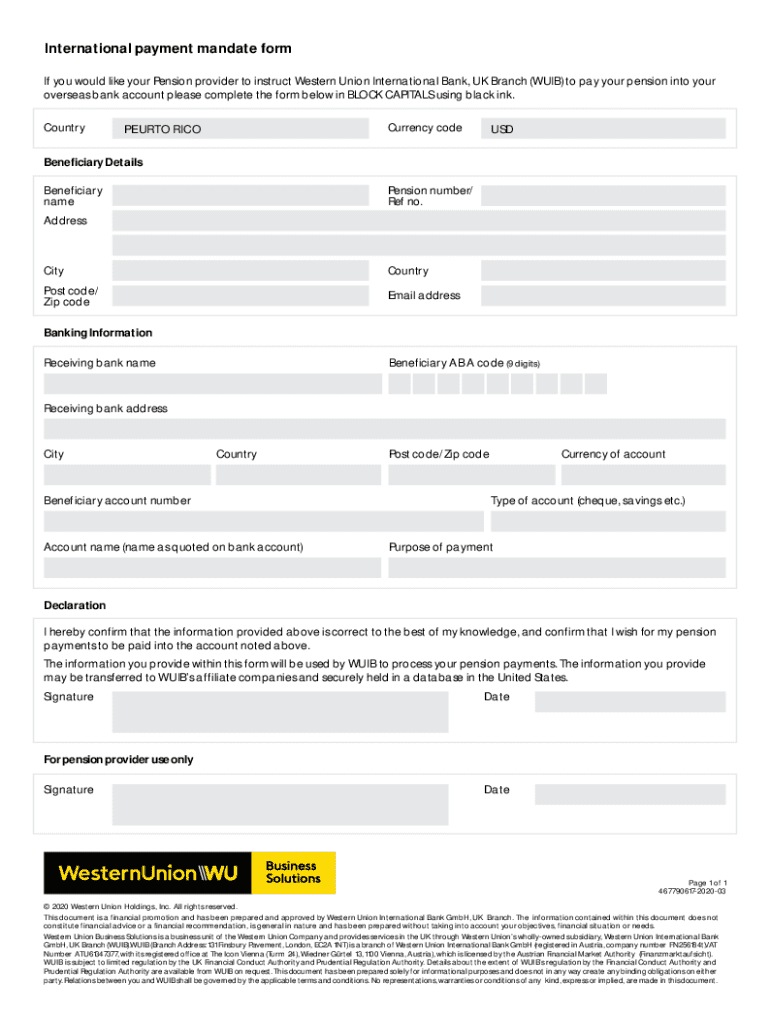

International payment mandate form If you would like your Pension provider to instruct Western Union International Bank, UK Branch (WUIB) to pay your pension into your overseas bank account please

We are not affiliated with any brand or entity on this form

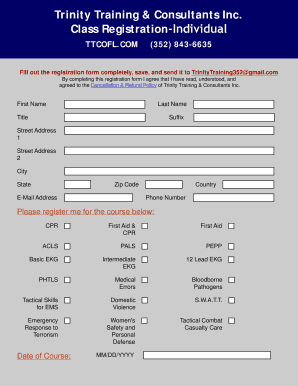

Get, Create, Make and Sign iban vs swift which

Edit your iban vs swift which form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your iban vs swift which form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit iban vs swift which online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit iban vs swift which. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out iban vs swift which

How to fill out iban vs swift which

01

Identify the bank account that requires the IBAN or SWIFT code.

02

For IBAN: Check the bank's website or ask your bank for the correct IBAN format, including the country code, check digits, bank code, branch code, and account number.

03

Enter the IBAN into the appropriate field on the transfer form, ensuring all characters are correct and there are no spaces.

04

For SWIFT: Locate the bank's SWIFT code, usually found on their website or provided by customer service.

05

Fill in the SWIFT code in the designated space on the transfer form.

06

Double-check both the IBAN and SWIFT code for accuracy before submitting.

Who needs iban vs swift which?

01

Individuals and businesses making international wire transfers.

02

Customers transferring money across borders to comply with local banking regulations.

03

Banks and financial institutions requiring these codes for processing cross-border payments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete iban vs swift which online?

With pdfFiller, you may easily complete and sign iban vs swift which online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for the iban vs swift which in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your iban vs swift which in seconds.

How do I edit iban vs swift which on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share iban vs swift which on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

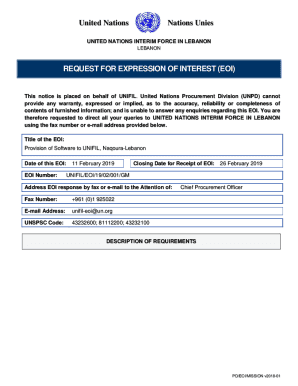

What is iban vs swift which?

IBAN (International Bank Account Number) is a standardized format for identifying bank accounts across national borders, while SWIFT (Society for Worldwide Interbank Financial Telecommunications) codes are used to identify specific banks during international transactions. Essentially, IBAN is used to specify the account number, whereas SWIFT identifies the bank.

Who is required to file iban vs swift which?

Individuals and businesses engaging in international transactions may be required to provide both IBAN and SWIFT codes to ensure accurate and timely processing of their transfers.

How to fill out iban vs swift which?

To fill out IBAN and SWIFT information, locate your bank account's IBAN code on your bank statement or online banking portal. For the SWIFT code, you can find it on your bank’s website or by contacting customer service. Ensure you enter both codes accurately to avoid delays in transactions.

What is the purpose of iban vs swift which?

The purpose of IBAN is to standardize international bank account identification to facilitate cross-border transactions, whereas the SWIFT code helps to ensure that the correct financial institutions are involved in the processing of these transactions.

What information must be reported on iban vs swift which?

Typically, the information that must be reported includes the full IBAN of the account being used for the transaction and the corresponding SWIFT code of the bank processing the transaction.

Fill out your iban vs swift which online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Iban Vs Swift Which is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.