Get the free All Captive Insurance Companies - dfr vermont

Show details

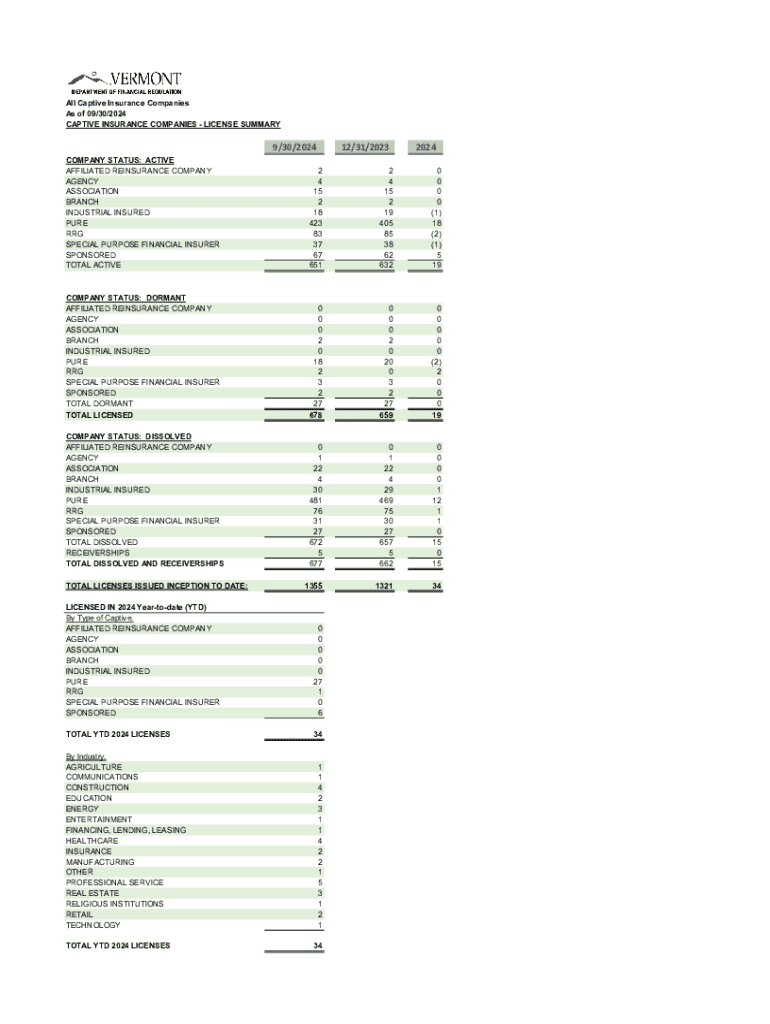

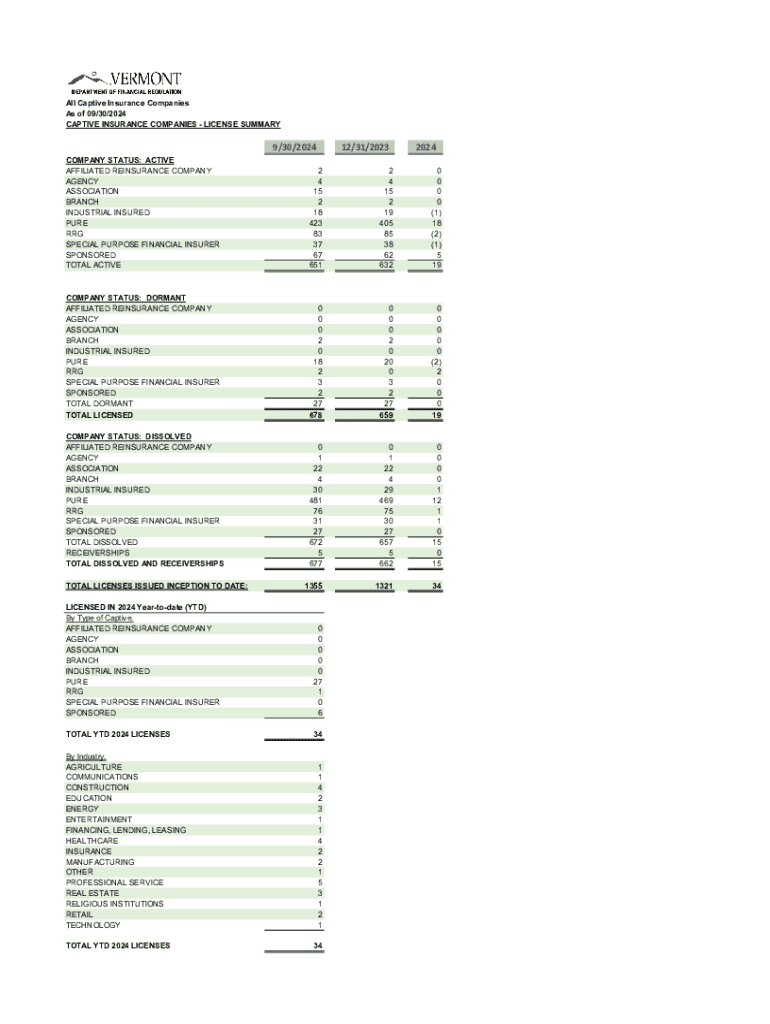

All Captive Insurance Companies As of 09/30/2024 CAPTIVE INSURANCE COMPANIES LICENSE SUMMARY12/31/20239/30/20242024COMPANY STATUS: ACTIVE AFFILIATED REINSURANCE COMPANY AGENCY ASSOCIATION BRANCH INDUSTRIAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign all captive insurance companies

Edit your all captive insurance companies form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your all captive insurance companies form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing all captive insurance companies online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit all captive insurance companies. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out all captive insurance companies

How to fill out all captive insurance companies

01

Determine your insurance needs and assess the potential risks to your business.

02

Conduct a feasibility study to evaluate the potential costs and benefits of establishing a captive insurance company.

03

Choose the appropriate type of captive insurance company (pure, group, or agency captive) that fits your requirements.

04

Select a domicile for your captive insurance company, considering factors such as regulation, tax implications, and operational environment.

05

Prepare the necessary documentation, including a business plan, financial projections, and application forms required by the chosen domicile.

06

Submit the application to the regulatory authority in the chosen domicile and wait for approval.

07

Once approved, capitalize the captive by funding it with sufficient premium amounts to cover expected losses and operational costs.

08

Develop an insurance policy framework and establish the terms of coverage for the risks identified.

09

Put in place reinsurance arrangements if necessary to mitigate risks.

10

Regularly review and update the captive’s operations and policies based on changes in risks, regulations, and the business environment.

Who needs all captive insurance companies?

01

Businesses that face significant risks and wish to reduce insurance costs.

02

Companies that want more control over their insurance policies and risk management.

03

Organizations looking to improve cash flow by retaining risks rather than transferring them to third-party insurers.

04

Groups of businesses that can pool their resources to form a group captive for shared risk coverage.

05

Any entity that seeks tax advantages through a properly structured captive insurance company.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify all captive insurance companies without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like all captive insurance companies, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I fill out the all captive insurance companies form on my smartphone?

Use the pdfFiller mobile app to fill out and sign all captive insurance companies on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit all captive insurance companies on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as all captive insurance companies. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is all captive insurance companies?

Captive insurance companies are wholly-owned subsidiaries created by a parent company to provide insurance coverage exclusively for its own risks. They are used to manage risk, improve flexibility in coverage, and potentially save on insurance costs.

Who is required to file all captive insurance companies?

Captive insurance companies are typically required to file financial statements and other required documentation with the insurance regulatory authority in the jurisdiction where they are licensed.

How to fill out all captive insurance companies?

Filling out documentation for captive insurance companies involves completing forms specific to the regulatory authority, providing financial statements, detailing risk management strategies, and ensuring compliance with local insurance laws.

What is the purpose of all captive insurance companies?

The purpose of captive insurance companies is to provide risk management solutions tailored to the specific needs of the parent company, offering more control over coverage and costs while freeing up capital compared to traditional insurance.

What information must be reported on all captive insurance companies?

Information that must be reported typically includes financial statements, reinsurance agreements, risk management strategies, premium income, claims data, and details about the ownership structure of the captive.

Fill out your all captive insurance companies online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

All Captive Insurance Companies is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.