Get the free Section 83(b) Election: Official IRS Form Coming Soon

Show details

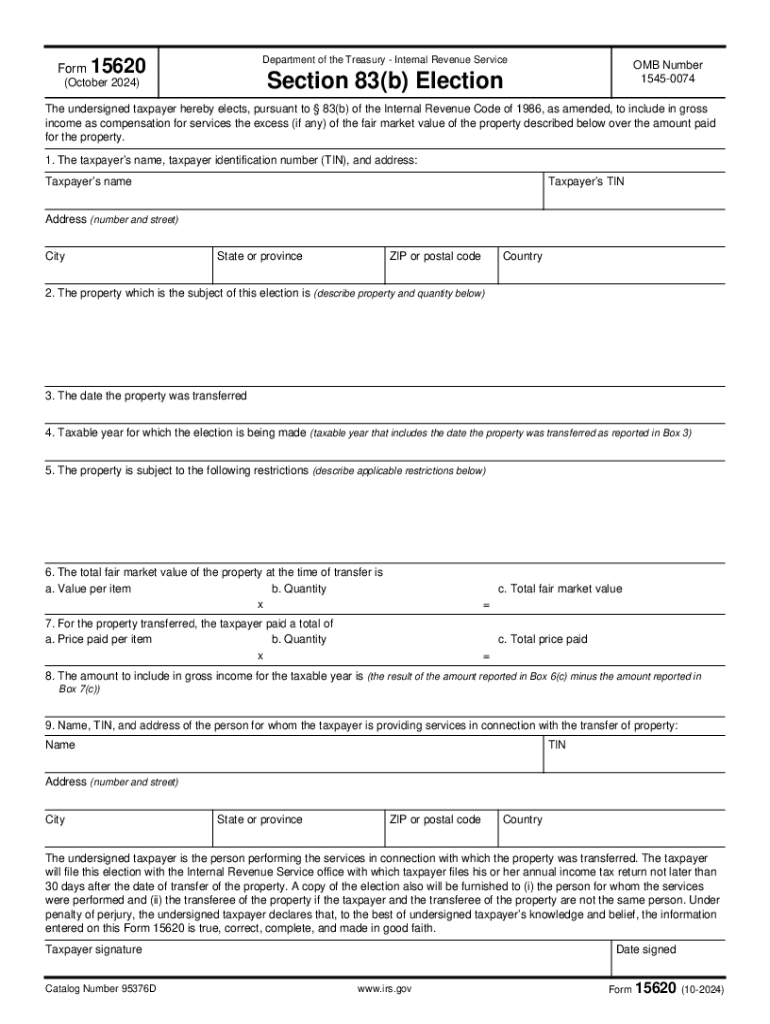

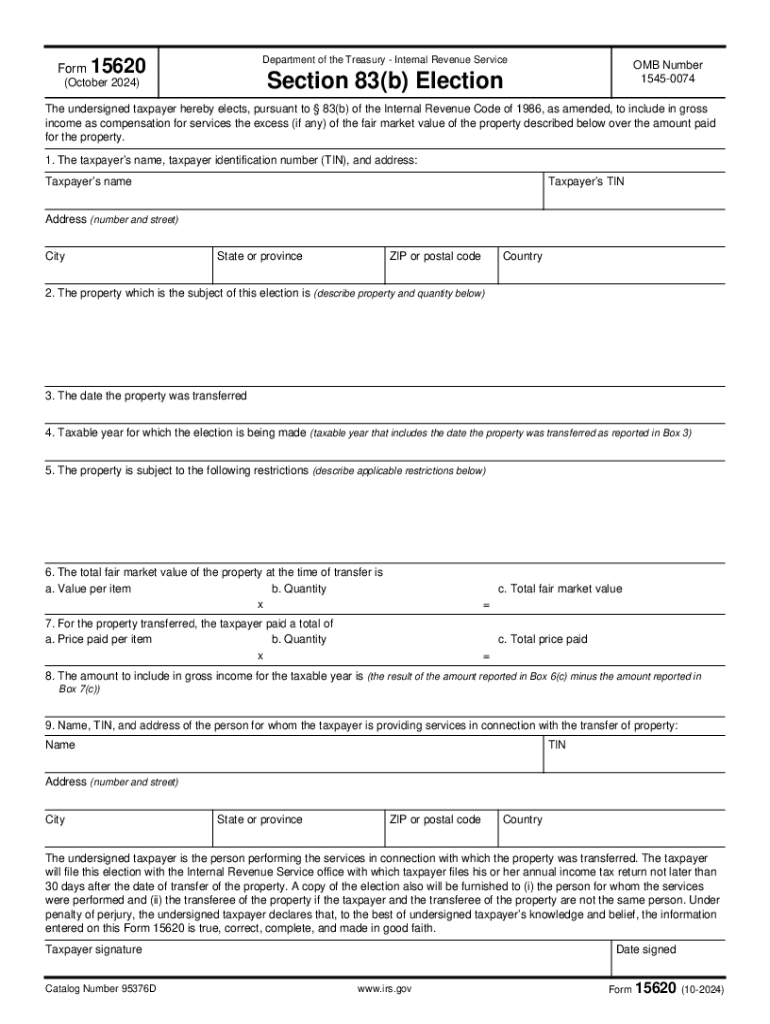

FormDepartment of the Treasury Internal Revenue Service15620OMB Number 15450074Section 83(b) Election(October 2024)The undersigned taxpayer hereby elects, pursuant to 83(b) of the Internal Revenue

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign section 83b election official

Edit your section 83b election official form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your section 83b election official form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing section 83b election official online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit section 83b election official. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out section 83b election official

How to fill out section 83b election official

01

Obtain the Section 83(b) election form from the IRS or your company's equity plan.

02

Fill out your name, address, and taxpayer identification number (TIN) at the top of the form.

03

Provide the description of the property (e.g., number of shares of stock) you are electing.

04

Include the date of the property transfer and the vesting schedule, if applicable.

05

State the fair market value of the property at the time of transfer and any amount you paid for the property.

06

Sign and date the form to certify that the information is true and correct.

07

Mail the completed Section 83(b) election form to the IRS office where you file your tax return.

08

Keep a copy of the form for your records.

Who needs section 83b election official?

01

Individuals receiving restricted stock or other forms of equity compensation.

02

Employees who want to recognize income earlier for tax purposes.

03

Founders and key employees who are granted stock options or shares subject to vesting.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get section 83b election official?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific section 83b election official and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit section 83b election official online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your section 83b election official to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for the section 83b election official in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your section 83b election official in seconds.

What is section 83b election official?

Section 83(b) election is a provision in the Internal Revenue Code that allows taxpayers to elect to include in their income the value of property received in connection with the performance of services, such as stock options, at the time of transfer rather than when the property becomes vested.

Who is required to file section 83b election official?

Individuals who receive property in connection with the performance of services, such as employees who are granted stock options or restricted stock, may choose to file a Section 83(b) election if they wish to recognize the income immediately.

How to fill out section 83b election official?

To fill out a Section 83(b) election, the taxpayer must complete a written statement that includes their name, address, taxpayer identification number, the description of the property, the date of transfer, and the amount paid for the property, and then file it with the IRS.

What is the purpose of section 83b election official?

The purpose of the Section 83(b) election is to allow taxpayers to accelerate the recognition of income related to the transfer of property, potentially benefiting them by locking in a lower tax rate and starting the holding period for long-term capital gains.

What information must be reported on section 83b election official?

The information that must be reported includes the taxpayer's name, address, taxpayer ID number, a description of the property, the date of transfer, the amount paid for the property, and a statement that the election is being made under Section 83(b).

Fill out your section 83b election official online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Section 83b Election Official is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.