Get the free Gifts by Will or Living TrustPlanned Parenthood

Show details

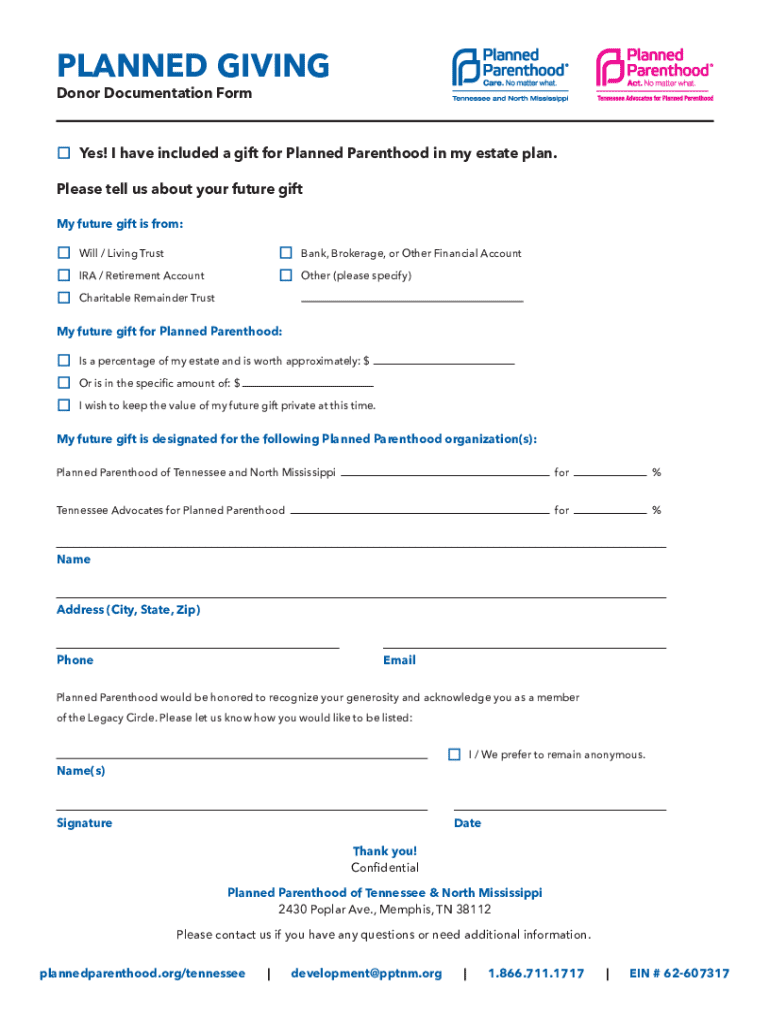

PLANNED GIVING Donor Documentation FormYes! I have included a gift for Planned Parenthood in my estate plan. Please tell us about your future gift My future gift is from: Will / Living TrustBank,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gifts by will or

Edit your gifts by will or form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gifts by will or form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gifts by will or online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit gifts by will or. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gifts by will or

How to fill out gifts by will or

01

Begin by clearly identifying the testator (the person making the will).

02

List all the gifts or bequests you intend to include in the will, specifying the items and their respective recipients.

03

Determine the value of each gift and consider any potential taxes or liabilities associated with it.

04

Use clear and unambiguous language to describe each gift to avoid any confusion later.

05

Ensure that the gifts comply with local laws regarding wills and inheritance.

06

Sign the will in the presence of witnesses who will also sign it, ensuring their signatures are included.

07

Store the will in a safe place and inform your executor of its location.

Who needs gifts by will or?

01

Individuals wanting to leave specific gifts to others after their death.

02

People who wish to ensure their assets are distributed according to their wishes.

03

Those with dependents or loved ones who require financial support.

04

Anyone who wants to minimize disputes among heirs regarding asset distribution.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my gifts by will or directly from Gmail?

gifts by will or and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I create an electronic signature for the gifts by will or in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your gifts by will or in seconds.

Can I edit gifts by will or on an iOS device?

Create, edit, and share gifts by will or from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is gifts by will or?

Gifts by will, also known as bequests, are transfers of property or assets that a person specifies in their will to be given to beneficiaries upon their death.

Who is required to file gifts by will or?

The executor or administrator of the estate is typically required to file gifts by will or, as part of the estate's probate process, to ensure that gifts are executed according to the deceased's wishes.

How to fill out gifts by will or?

To fill out gifts by will or, one must accurately complete the will document, specifying each gift clearly, including descriptions of the property, the names of the beneficiaries, and any conditions related to the gifts.

What is the purpose of gifts by will or?

The purpose of gifts by will is to allow an individual to decide how their assets and property will be distributed after their death, ensuring that their wishes are honored and providing for their loved ones.

What information must be reported on gifts by will or?

Information that must be reported includes the details of the assets being gifted, the names and addresses of beneficiaries, and any specific conditions or instructions related to the gifts.

Fill out your gifts by will or online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gifts By Will Or is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.