Get the free Economic Development Micro Loan Fund Policy & Guidelines And ...

Show details

The Light Industrial Hub of the Northwest Metro Economic Development Micro Loan Fund Policy & Guidelines And Application Amended: May 2011 City of Elk River Economic Development Division 13065 Front

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign economic development micro loan

Edit your economic development micro loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your economic development micro loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing economic development micro loan online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit economic development micro loan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out economic development micro loan

How to fill out an economic development micro loan:

01

Research and find an eligible lender or financial institution that offers economic development micro loans. They may have specific criteria or requirements, so make sure to review their guidelines.

02

Gather all necessary documentation and information. This may include personal identification, proof of residency, financial statements, business plans, and any other supporting documents required by the lender.

03

Review and complete the loan application form provided by the lender. Make sure to fill out all sections accurately and completely. Double-check for any errors or missing information before submitting the application.

04

Prepare a detailed business plan that outlines your goals, objectives, and how the loan will be utilized. Include financial projections, market analysis, and any other relevant information that demonstrates the viability and potential success of your business.

05

Consider seeking assistance from business consultants or financial advisors who specialize in small business loans. They can help review your application, provide guidance, and ensure that you are presenting your case in the best possible way.

06

Submit your completed application along with any required documentation. Be sure to keep copies of all submitted documents for future reference.

Who needs economic development micro loans?

01

Small business owners or entrepreneurs looking to start or expand their business but lack the necessary capital.

02

Individuals or communities in low-income areas seeking to stimulate economic growth and create job opportunities.

03

Minority-owned businesses or those from disadvantaged backgrounds that face challenges in accessing traditional financing options.

In summary, filling out an economic development micro loan involves finding an eligible lender, gathering required documentation, completing the application accurately, preparing a comprehensive business plan, and seeking professional advice if needed. These loans are targeted towards small businesses, entrepreneurs, individuals in low-income areas, and minority-owned businesses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find economic development micro loan?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the economic development micro loan in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for signing my economic development micro loan in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your economic development micro loan right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit economic development micro loan on an iOS device?

Create, edit, and share economic development micro loan from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

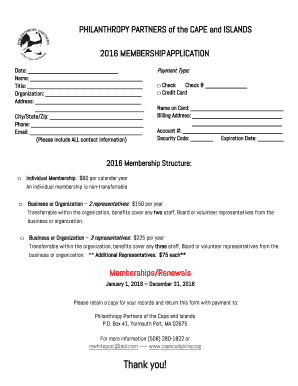

What is economic development micro loan?

A micro loan for economic development is a small loan provided to individuals or small businesses in order to promote economic growth and development in a particular area.

Who is required to file economic development micro loan?

Individuals or small businesses seeking financial assistance for economic development projects are required to file for an economic development micro loan.

How to fill out economic development micro loan?

To fill out an economic development micro loan, applicants must provide detailed information about their project, financial situation, and expected outcomes.

What is the purpose of economic development micro loan?

The purpose of an economic development micro loan is to stimulate economic growth, create job opportunities, and improve overall quality of life in a specific community.

What information must be reported on economic development micro loan?

Applicants must report information such as project details, financial projections, expected impact on the community, and repayment plan.

Fill out your economic development micro loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Economic Development Micro Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.