Get the free SECTION 5: ACCOUNTS PAYABLE

Show details

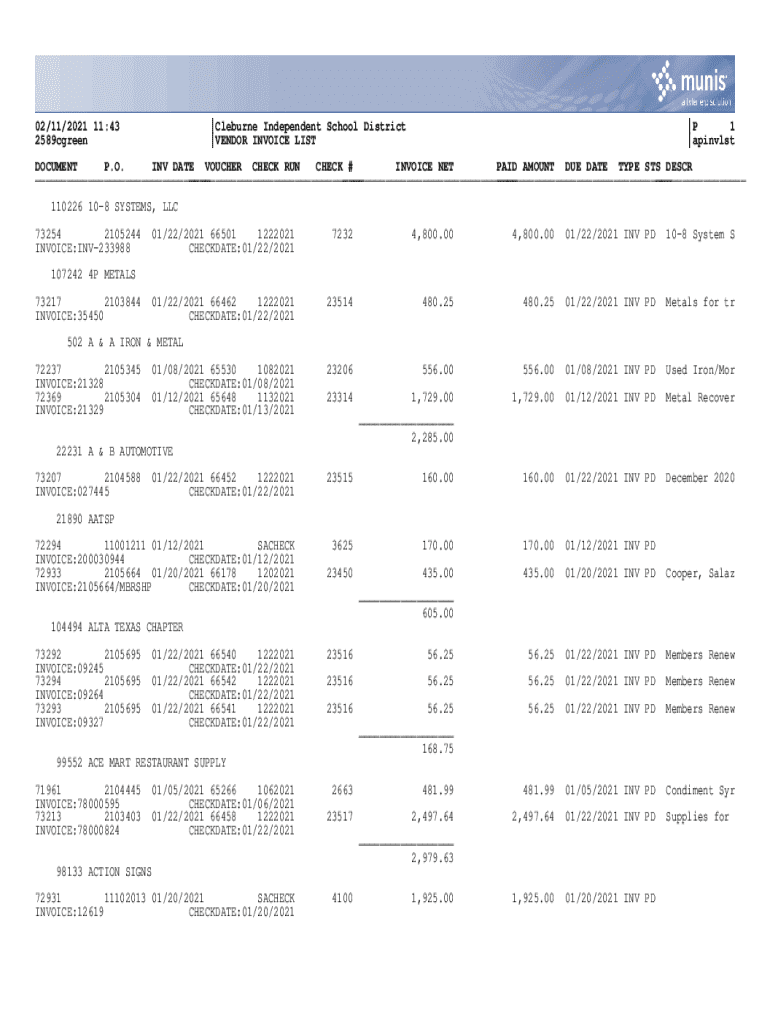

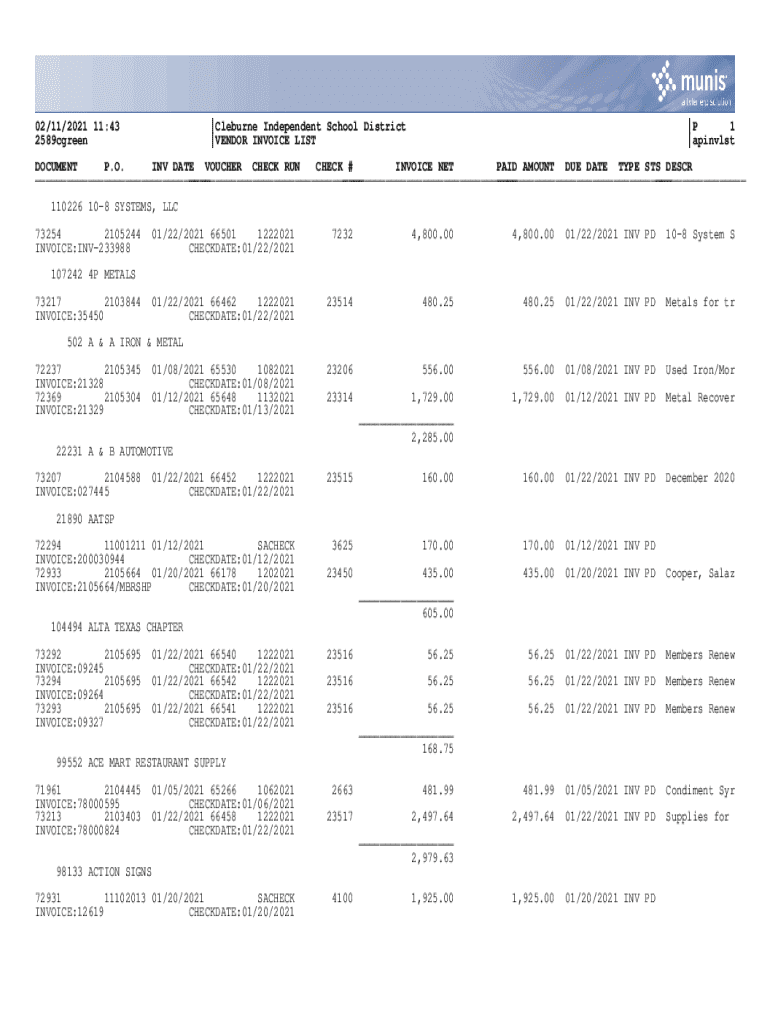

02/11/2021 11:43 2589cgreen|Cleburne Independent School District |VENDOR INVOICE LIST|P 1 |apinvlstDOCUMENT P.O. INV DATE VOUCHER CHECK RUN CHECK # INVOICE NET PAID AMOUNT DUE DATE TYPE STS DESCR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign section 5 accounts payable

Edit your section 5 accounts payable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your section 5 accounts payable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing section 5 accounts payable online

Follow the steps below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit section 5 accounts payable. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out section 5 accounts payable

How to fill out section 5 accounts payable

01

Gather all invoices and payment requests from vendors.

02

Review each invoice for accuracy, checking amounts and due dates.

03

Input the vendor information into the accounts payable system.

04

Enter the invoice details including the invoice number, date, and amount.

05

Assign appropriate expense accounts to each invoice entry.

06

Set payment terms based on vendor agreements (e.g., net 30 days).

07

Schedule payments based on invoice due dates to ensure timely disbursement.

08

Maintain documentation for each transaction in case of audits.

Who needs section 5 accounts payable?

01

Accounts Payable Department employees who manage outgoing payments.

02

Finance personnel responsible for budgeting and financial reports.

03

Management requiring oversight of cash flow and expenses.

04

Auditors reviewing financial records for compliance and accuracy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute section 5 accounts payable online?

Completing and signing section 5 accounts payable online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make changes in section 5 accounts payable?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your section 5 accounts payable and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I make edits in section 5 accounts payable without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing section 5 accounts payable and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

What is section 5 accounts payable?

Section 5 accounts payable refers to a specific segment of financial reporting that details the amounts a company owes to its suppliers and creditors for goods and services received but not yet paid.

Who is required to file section 5 accounts payable?

Entities that maintain accounts payable as part of their financial operations, typically businesses and organizations that engage in credit transactions, are required to file section 5 accounts payable.

How to fill out section 5 accounts payable?

To fill out section 5 accounts payable, collect all relevant invoices and supplier data, categorize the amounts owed by due dates, and input the total liabilities accurately into the accounts payable section of financial filings.

What is the purpose of section 5 accounts payable?

The purpose of section 5 accounts payable is to provide transparency regarding a company's short-term liabilities, helping stakeholders understand the financial obligations that are due in the near term.

What information must be reported on section 5 accounts payable?

Information to be reported on section 5 accounts payable includes the names of creditors, amounts owed, due dates, and any notes on payment terms or disputes.

Fill out your section 5 accounts payable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Section 5 Accounts Payable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.