Get the free Small Business Debtor’s Plan of Reorganization

Show details

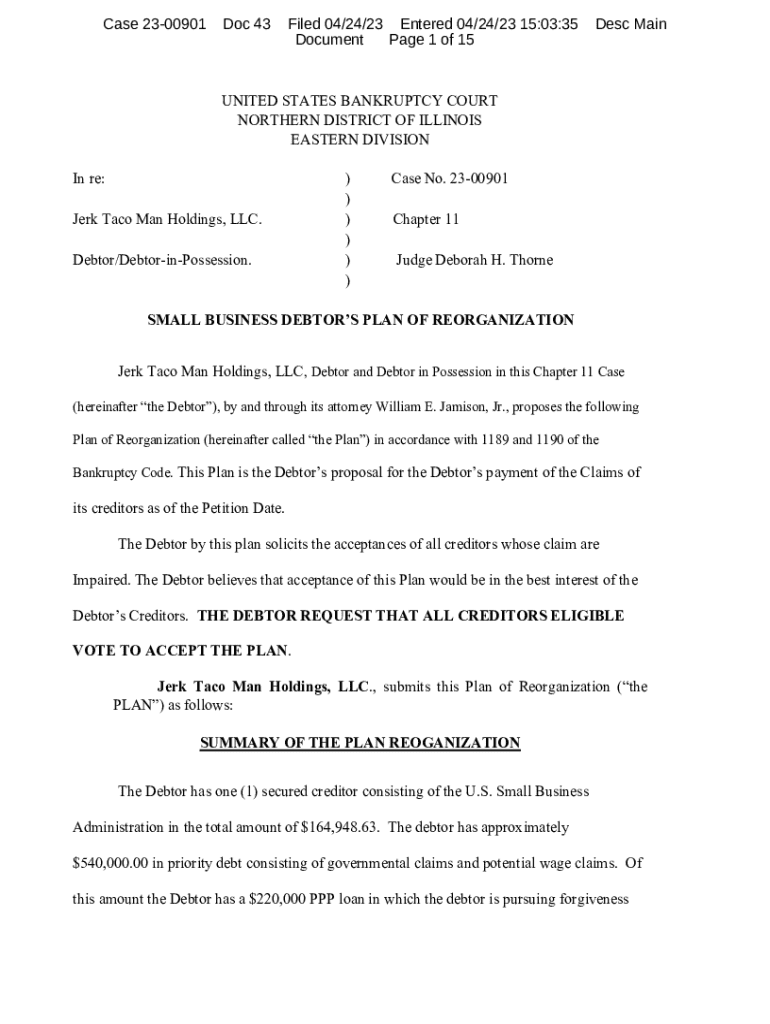

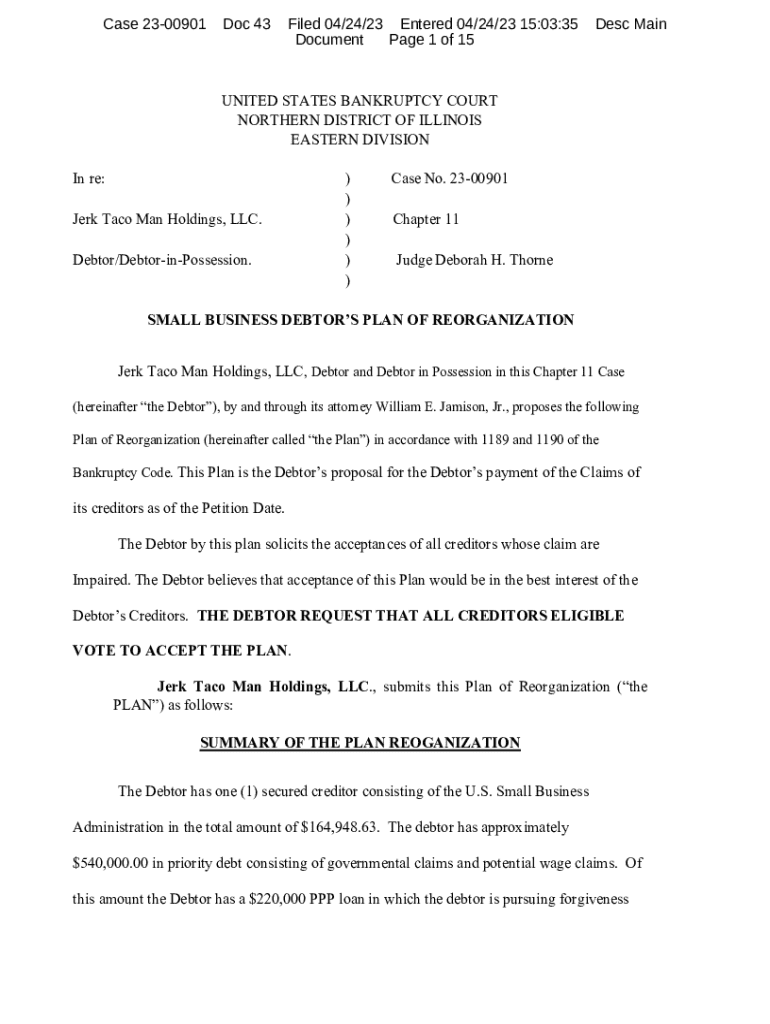

This document presents the proposed Plan of Reorganization for Jerk Taco Man Holdings, LLC, as part of its Chapter 11 bankruptcy proceedings. It outlines the debtor\'s payment structure to its creditors, classification of claims, and the historical context of the debtor\'s business. The plan seeks to address both secured and unsecured debts while aiming to maintain business operations post-bankruptcy.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign small business debtors plan

Edit your small business debtors plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business debtors plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing small business debtors plan online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit small business debtors plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out small business debtors plan

How to fill out small business debtors plan

01

Gather all financial statements, including balance sheets, income statements, and cash flow statements.

02

List all outstanding debts, including the amount owed, interest rates, and payment schedules.

03

Identify the source of each debt and categorize them (e.g., loans, credit lines, suppliers).

04

Analyze current cash flow to determine how much can be allocated to debt repayment.

05

Develop a repayment strategy, prioritizing high-interest debts first if possible.

06

Create a detailed timeline for repayments, indicating when each payment will occur.

07

Consider negotiation options with creditors for lower rates or extended terms.

08

Document all agreements and maintain clear communication with creditors.

09

Review and adjust the plan as needed based on changing financial circumstances.

Who needs small business debtors plan?

01

Small business owners facing financial challenges or cash flow issues.

02

Businesses with multiple creditors requiring a structured repayment approach.

03

Entrepreneurs looking to consolidate debt into a single manageable plan.

04

Startups that have accumulated debt and need a strategy for repayment.

05

Companies aiming to improve their credit rating by addressing outstanding debts.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit small business debtors plan from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including small business debtors plan. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit small business debtors plan straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing small business debtors plan, you can start right away.

How can I fill out small business debtors plan on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your small business debtors plan, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

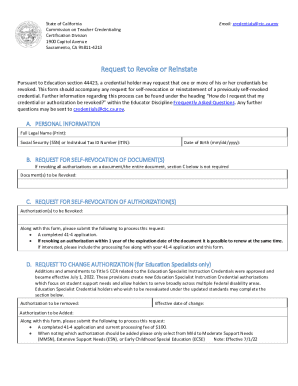

What is small business debtors plan?

A small business debtors plan is a proposal that outlines how a small business will reorganize its debts and manage its finances to ensure continued operations while satisfying creditor obligations.

Who is required to file small business debtors plan?

Small businesses that meet specific criteria established by bankruptcy law, typically those with secured and unsecured debts that fall below certain thresholds, are required to file a small business debtors plan.

How to fill out small business debtors plan?

To fill out a small business debtors plan, the debtor must provide detailed information about the business's financial status, debt structure, projected income, and a step-by-step strategy for repaying creditors, often using standardized forms provided by the bankruptcy court.

What is the purpose of small business debtors plan?

The purpose of a small business debtors plan is to provide a structured approach for the business to reorganize its debts, offering a way to pay off creditors while maintaining operations and avoiding liquidation.

What information must be reported on small business debtors plan?

The small business debtors plan must include information about the business's income, expenses, assets, liabilities, special circumstances affecting the business, and a proposed plan for handling debts.

Fill out your small business debtors plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Small Business Debtors Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.